The Home Inspection Report shares similarities with the 4-Point Inspection Form in its purpose of assessing the condition of a property. Both documents aim to provide a comprehensive evaluation of the home’s systems, including plumbing, electrical, roofing, and HVAC. A licensed inspector typically completes the Home Inspection Report, ensuring that potential issues are documented. This report is crucial for buyers and sellers alike, as it helps inform decisions regarding repairs and negotiations. Just like the 4-Point Inspection, the Home Inspection Report includes photographs and detailed descriptions of any deficiencies noted during the inspection.

For anyone considering purchasing a home, having a thorough understanding of the various inspection reports, including the Home Inspection Report, Roof Inspection Report, and others is essential. These reports, which provide insights into the condition of key systems, help buyers make informed decisions. Furthermore, as part of preparing necessary documentation, it's beneficial to refer to Illinois Forms to ensure compliance with local regulations and standards, thus safeguarding your investment.

The Roof Inspection Report is another document closely related to the 4-Point Inspection Form, focusing specifically on the roofing system. This report evaluates the roof's condition, age, and remaining useful life, much like the roof section of the 4-Point Inspection. Inspectors assess for visible damage, leaks, and overall integrity. Both documents require photographic evidence to support findings. The Roof Inspection Report is essential for homeowners and insurers to determine the need for repairs or replacements, ensuring the roof meets safety and insurance standards.

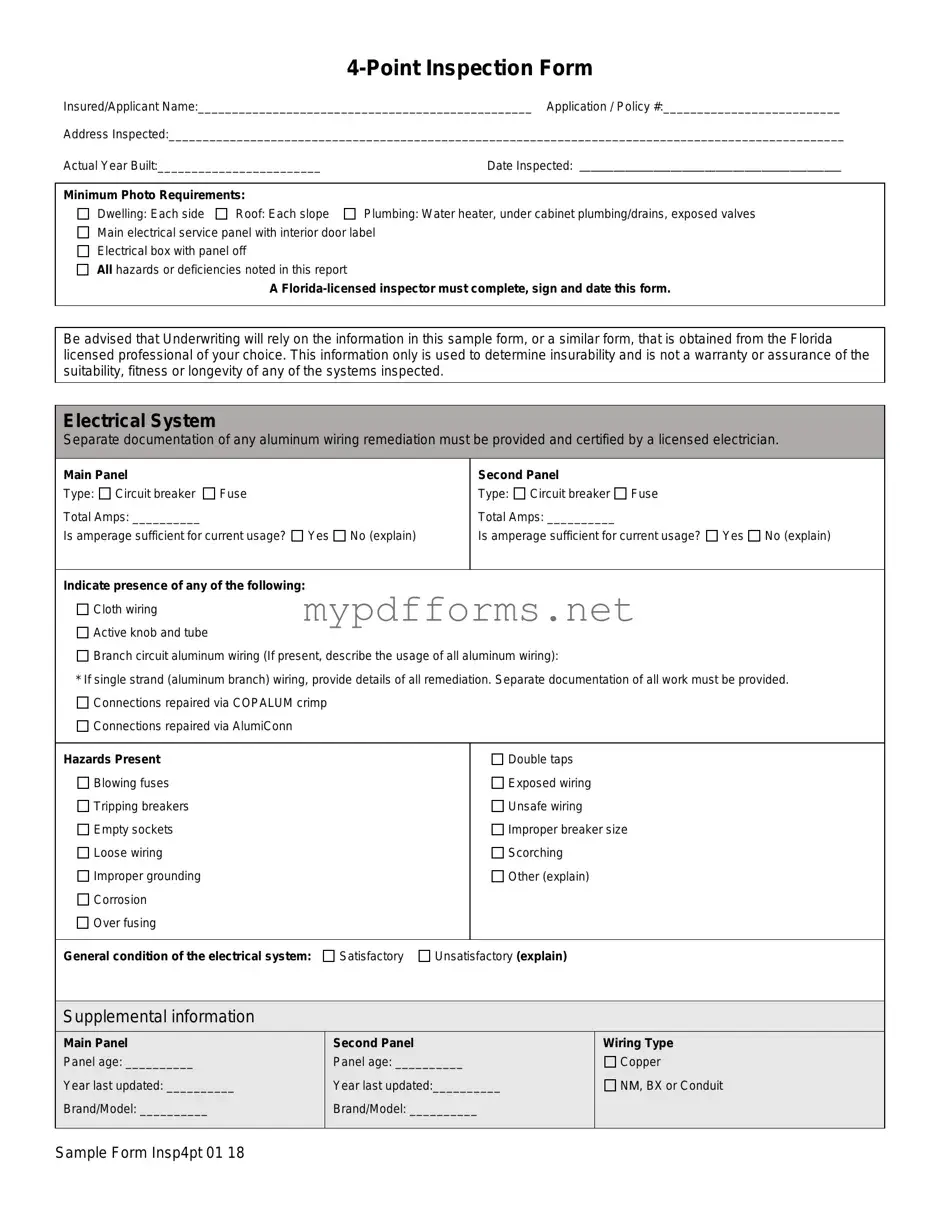

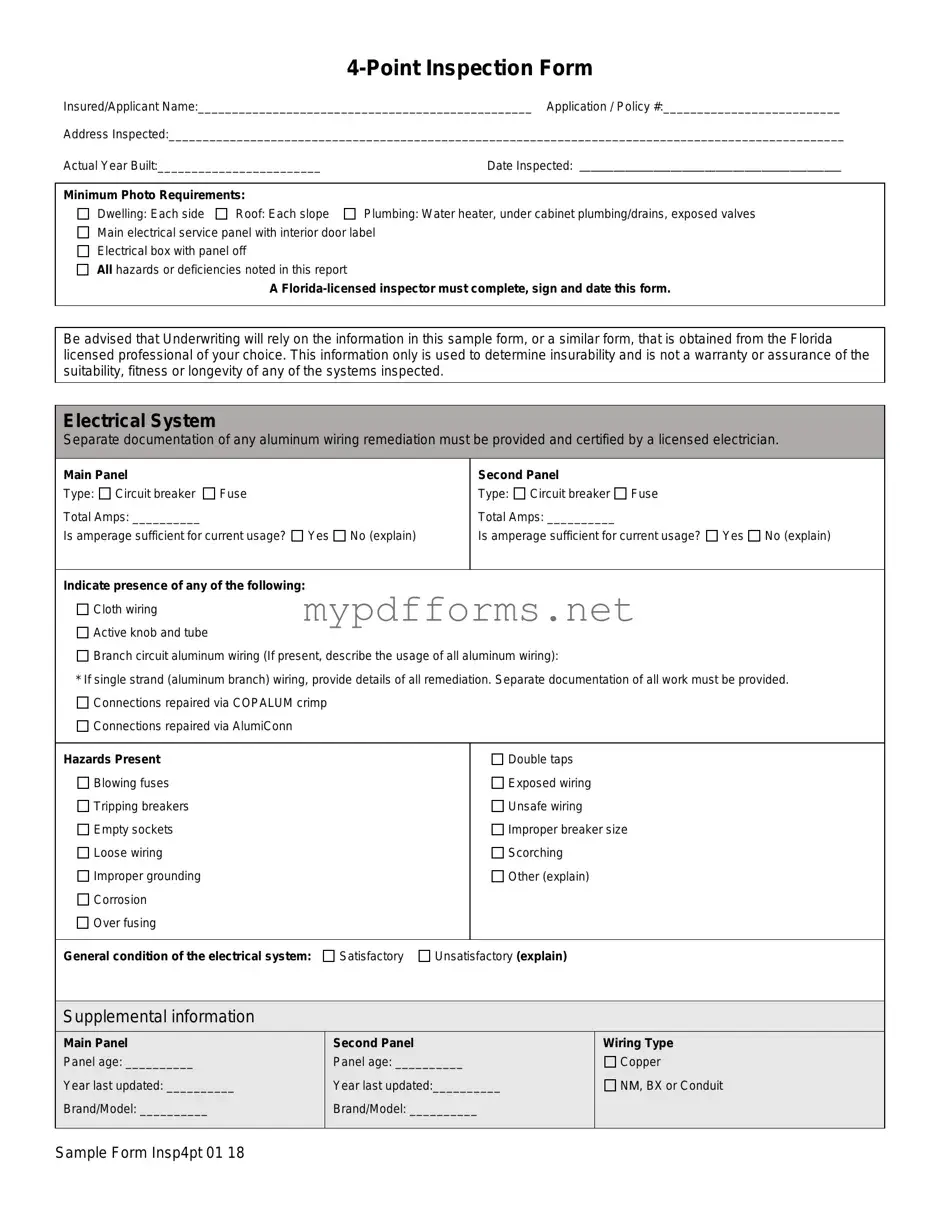

The Electrical Inspection Report parallels the 4-Point Inspection Form by concentrating on the electrical systems within a property. This report details the condition of wiring, panels, and any hazards present. Like the 4-Point Inspection, it requires a licensed electrician to complete it, ensuring that all findings are credible and accurate. Both reports document any necessary remediation for issues like aluminum wiring or faulty connections. This thorough evaluation helps homeowners and insurers understand the safety and functionality of the electrical system.

The HVAC Inspection Report is similar to the 4-Point Inspection Form in its focus on heating, ventilation, and air conditioning systems. This report assesses the operational status of HVAC units, their age, and any potential issues. Like the HVAC section of the 4-Point Inspection, it requires a qualified technician to perform the evaluation. Both documents highlight the importance of proper maintenance and servicing, providing critical information for homeowners and insurers regarding the efficiency and safety of the HVAC systems.

The Plumbing Inspection Report aligns with the 4-Point Inspection Form by examining the plumbing systems within a property. This report identifies issues such as leaks, pipe materials, and the condition of fixtures. Like the plumbing section of the 4-Point Inspection, it requires a licensed plumber to ensure accurate assessments. Both documents serve as vital tools for homeowners and insurers, as they help reveal potential problems that could lead to costly repairs or safety hazards in the future.

The Insurance Underwriting Report is another document that shares commonalities with the 4-Point Inspection Form. This report is used by insurance companies to evaluate the risk associated with insuring a property. It includes information about the property's systems, similar to what is found in the 4-Point Inspection. Both documents provide a thorough overview of the property's condition, helping insurers make informed decisions about coverage and premiums. The accuracy and detail in both reports are crucial for ensuring that homeowners receive appropriate insurance based on their property's specific needs.