The ACORD 125 form serves a similar purpose to the ACORD 130 by providing a comprehensive application for commercial insurance. This form gathers essential information about the applicant's business, including their operations, coverage needs, and loss history. Just like the ACORD 130, the ACORD 125 is designed to streamline the underwriting process by ensuring that all necessary details are presented in a clear and organized manner. Both forms facilitate communication between the applicant and the insurance provider, helping to ensure that the coverage accurately reflects the risks associated with the business.

For individuals navigating the complexities of health-related absences, understanding the role of documents like the Medical Excuse Note can be invaluable. These forms not only substantiate one's medical condition but also simplify the process of communicating absence to employers or educational institutions, ensuring that individuals receive the necessary accommodations during their recovery period.

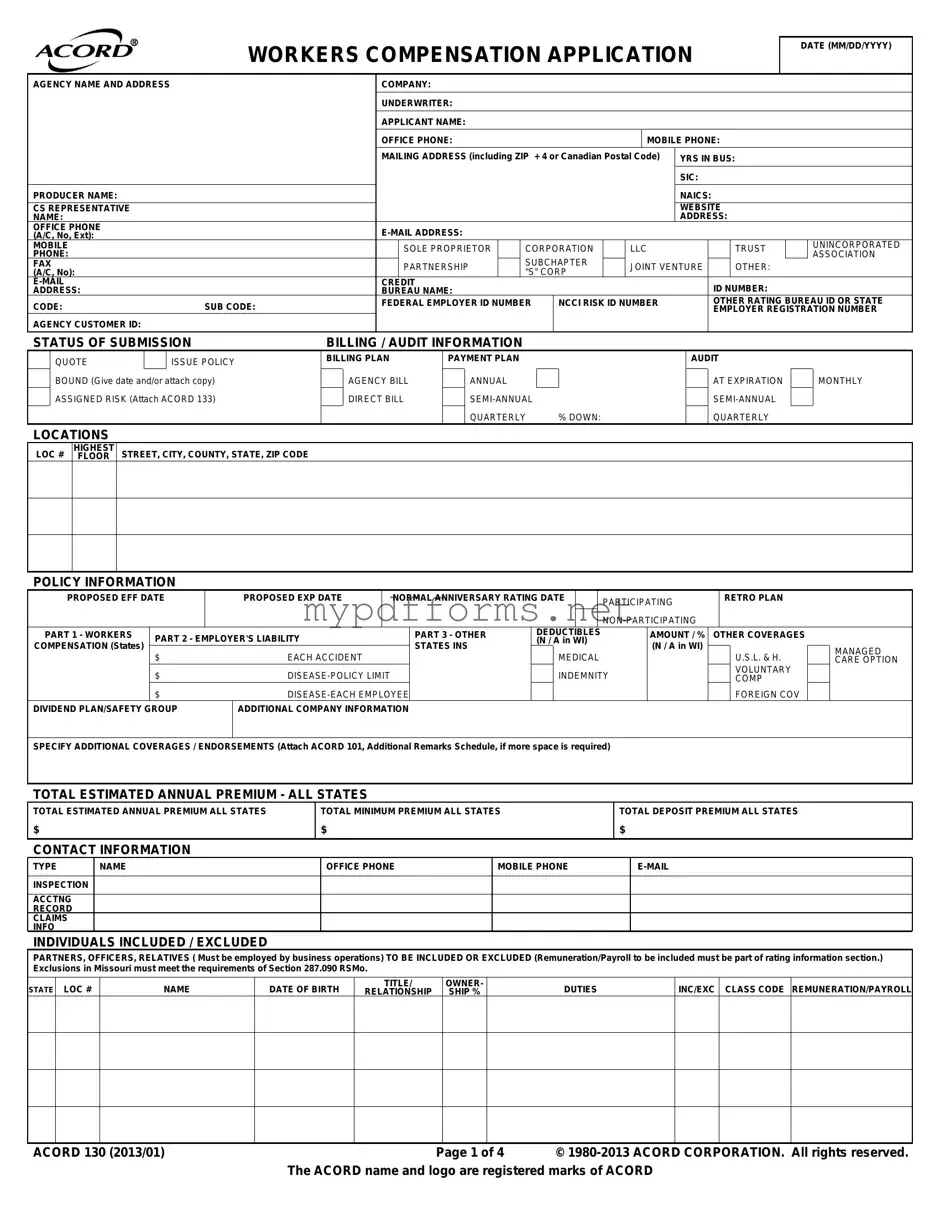

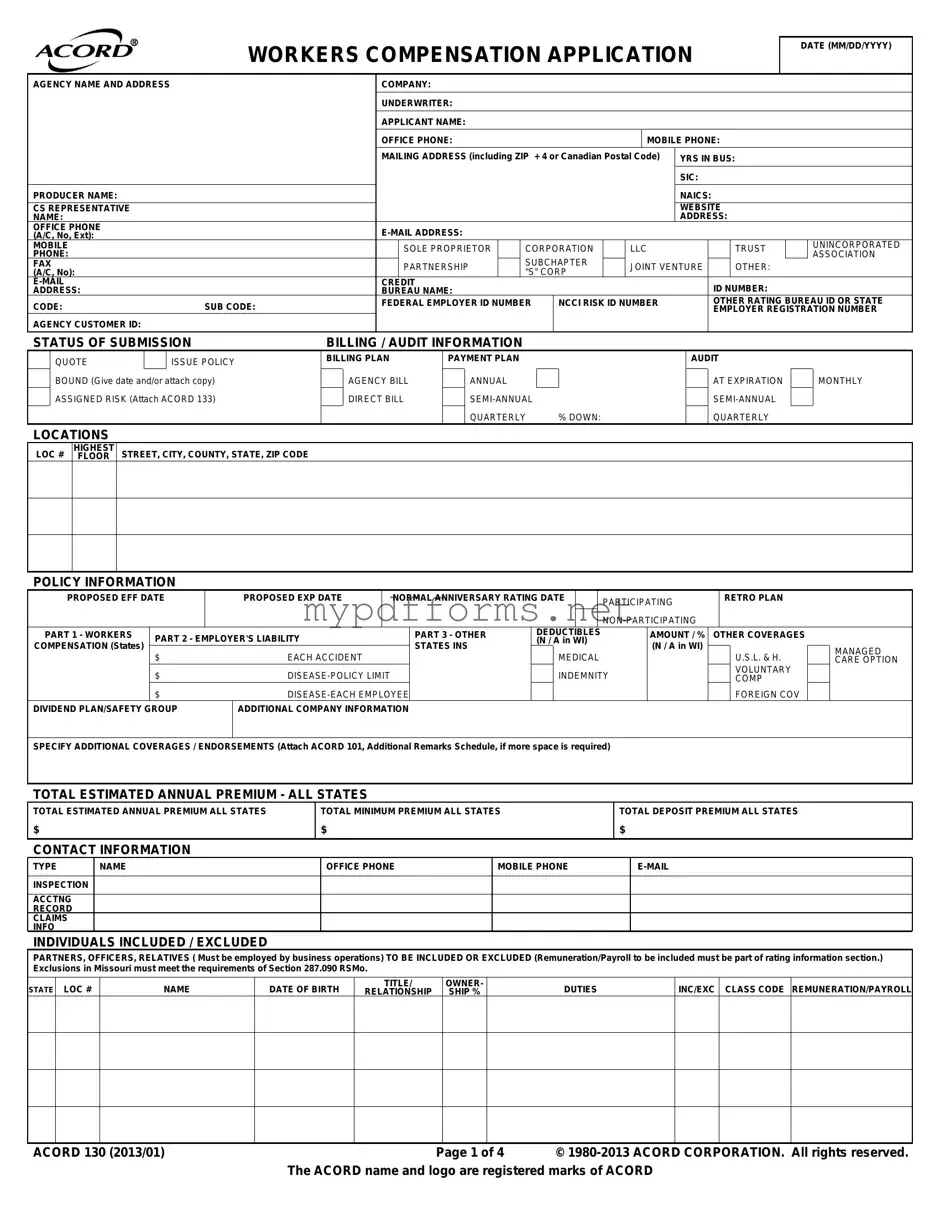

Another document that aligns closely with the ACORD 130 is the ACORD 133 form. This form is specifically used for assigned risk workers' compensation insurance applications. Like the ACORD 130, the ACORD 133 collects vital information about the applicant's business and its employees. The primary distinction lies in its focus on those businesses that may not qualify for standard coverage due to their risk profile. Therefore, while both forms aim to provide the necessary information for underwriting, the ACORD 133 is tailored for a specific subset of applicants facing unique challenges in obtaining insurance.

The ACORD 101 form is also comparable to the ACORD 130, as it serves as an additional remarks schedule that can be attached to various ACORD applications. This document allows applicants to provide further details or clarifications that may not fit within the constraints of the primary application forms. In this way, it complements the ACORD 130 by enabling a more thorough explanation of the business's operations, coverage needs, or any other relevant information that could influence underwriting decisions.

Lastly, the ACORD 140 form is another document that shares similarities with the ACORD 130. This form is utilized for property insurance applications and collects information about the property to be insured, including its location, value, and any existing hazards. While the ACORD 130 focuses on workers' compensation, both forms require detailed information to assess risk and determine appropriate coverage. They serve as crucial tools for insurance providers to evaluate the applicant's needs and establish premiums based on the specific risks involved.