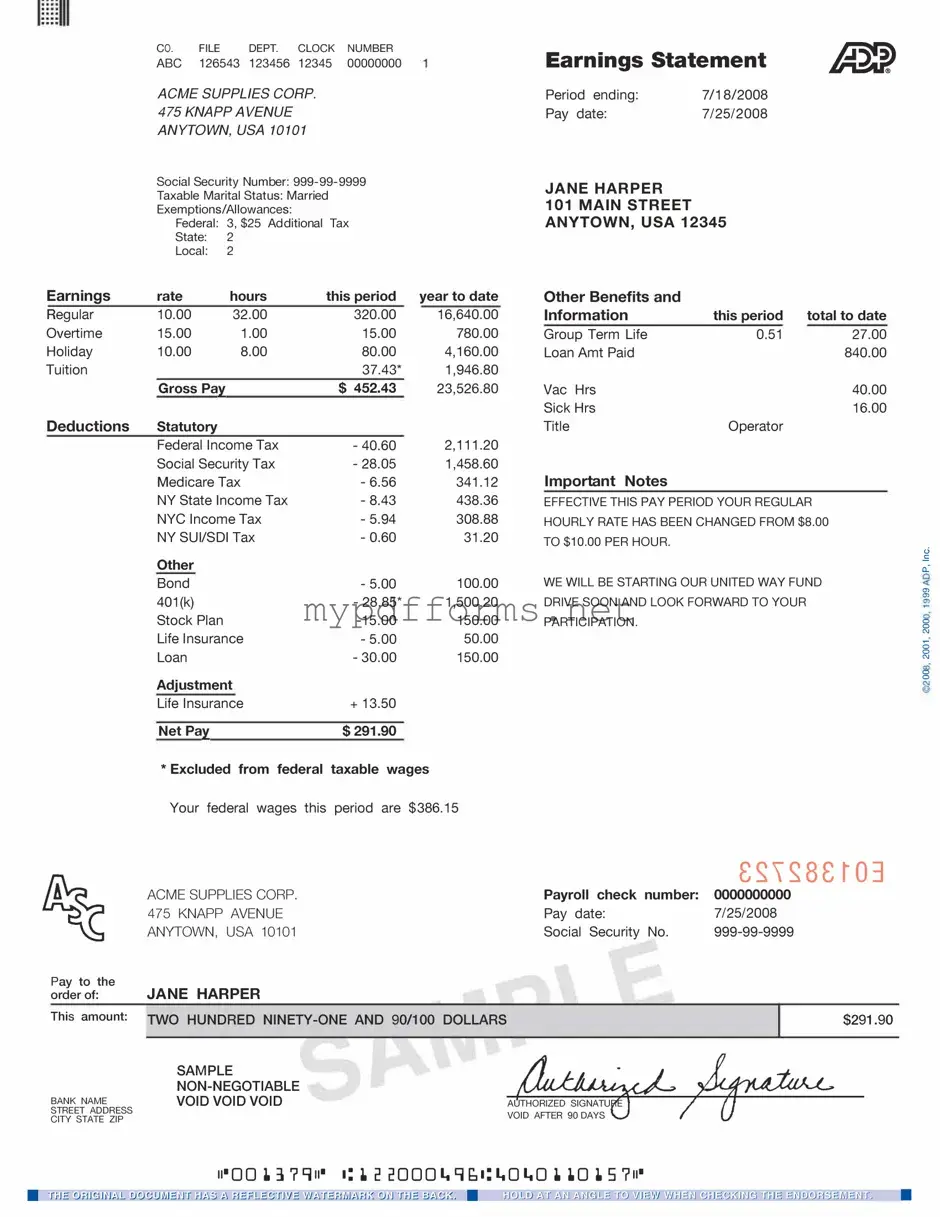

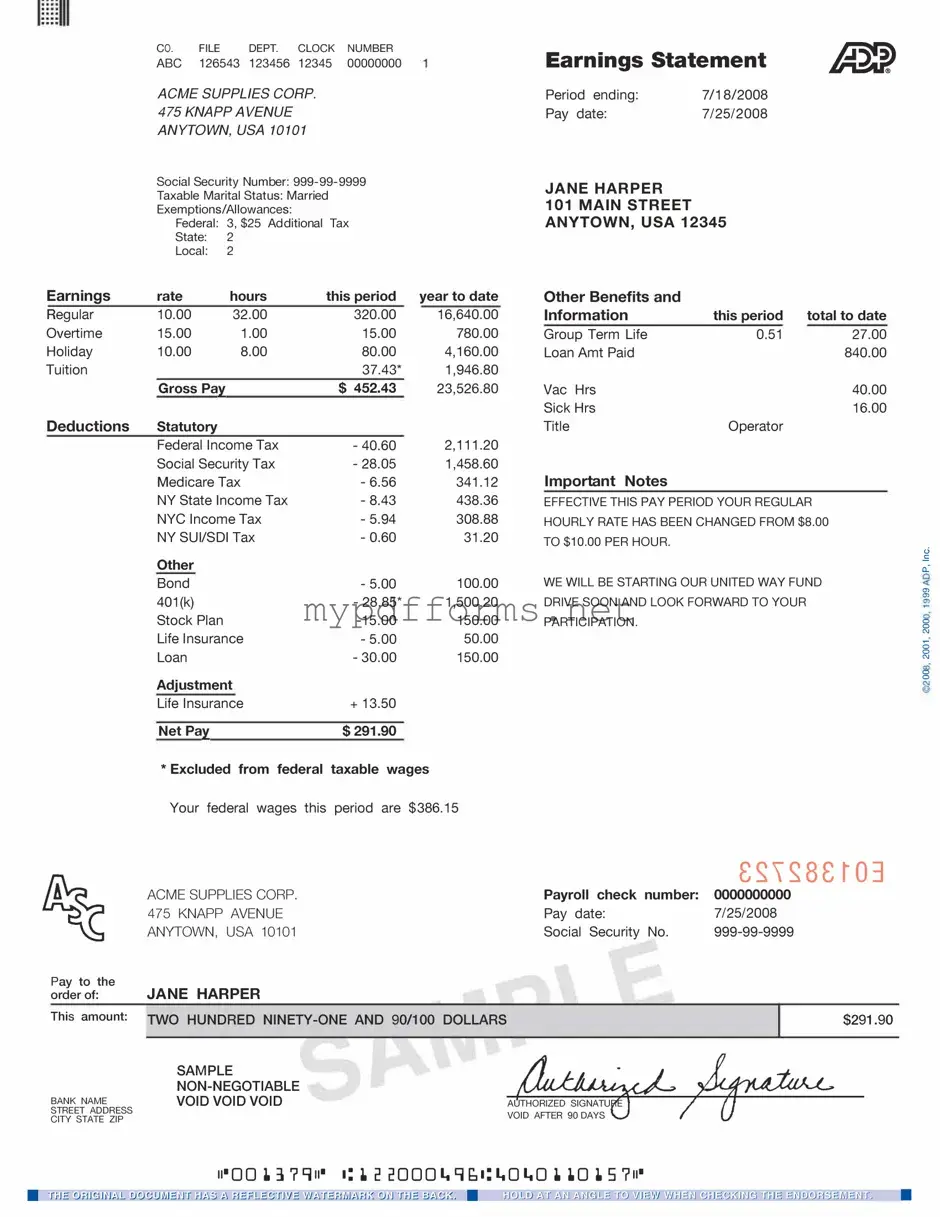

Get Adp Pay Stub Form in PDF

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings, deductions, and net pay for a specific pay period. This form is essential for understanding one's compensation and ensuring accurate record-keeping. To fill out the form, click the button below.

Modify Document Here

Get Adp Pay Stub Form in PDF

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Adp Pay Stub online in just a few steps.