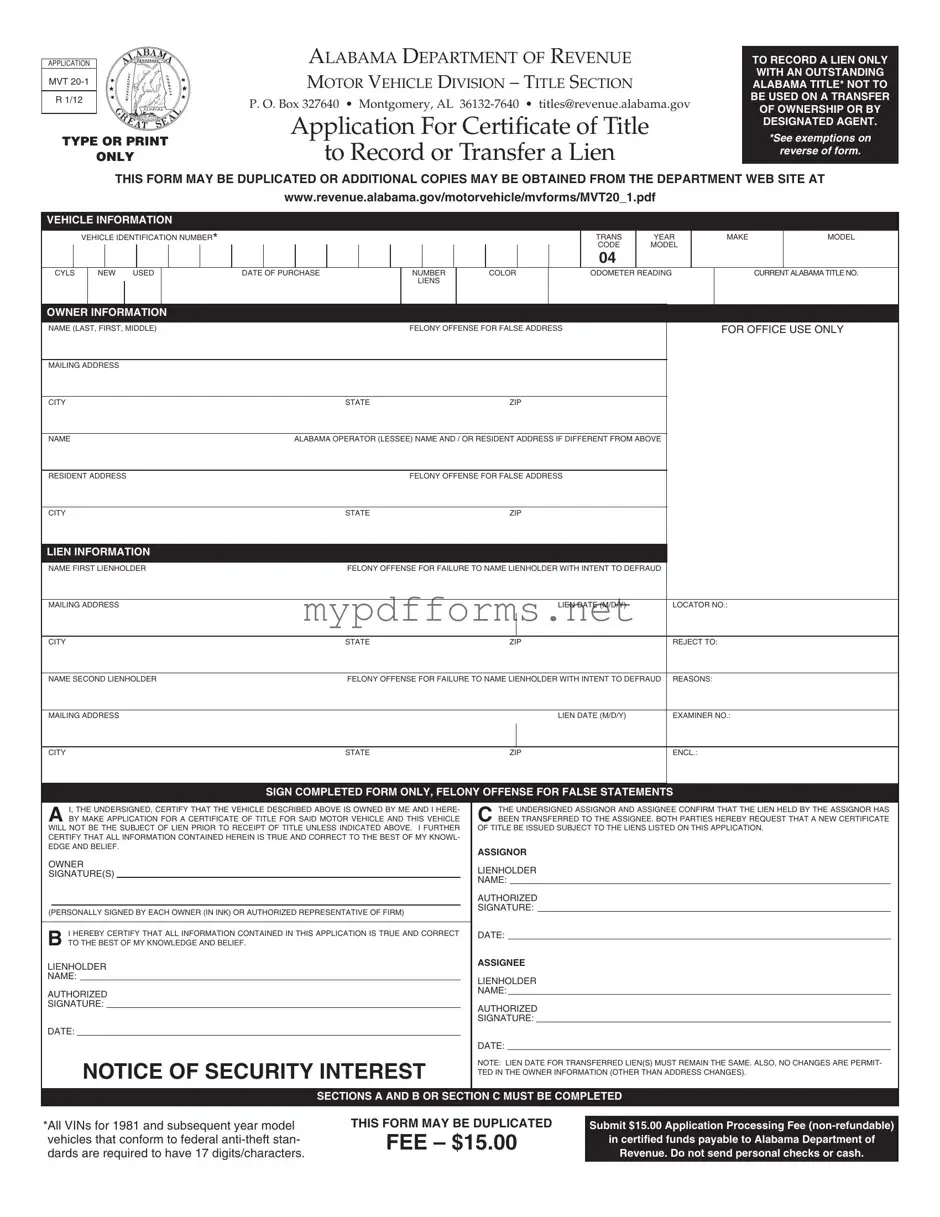

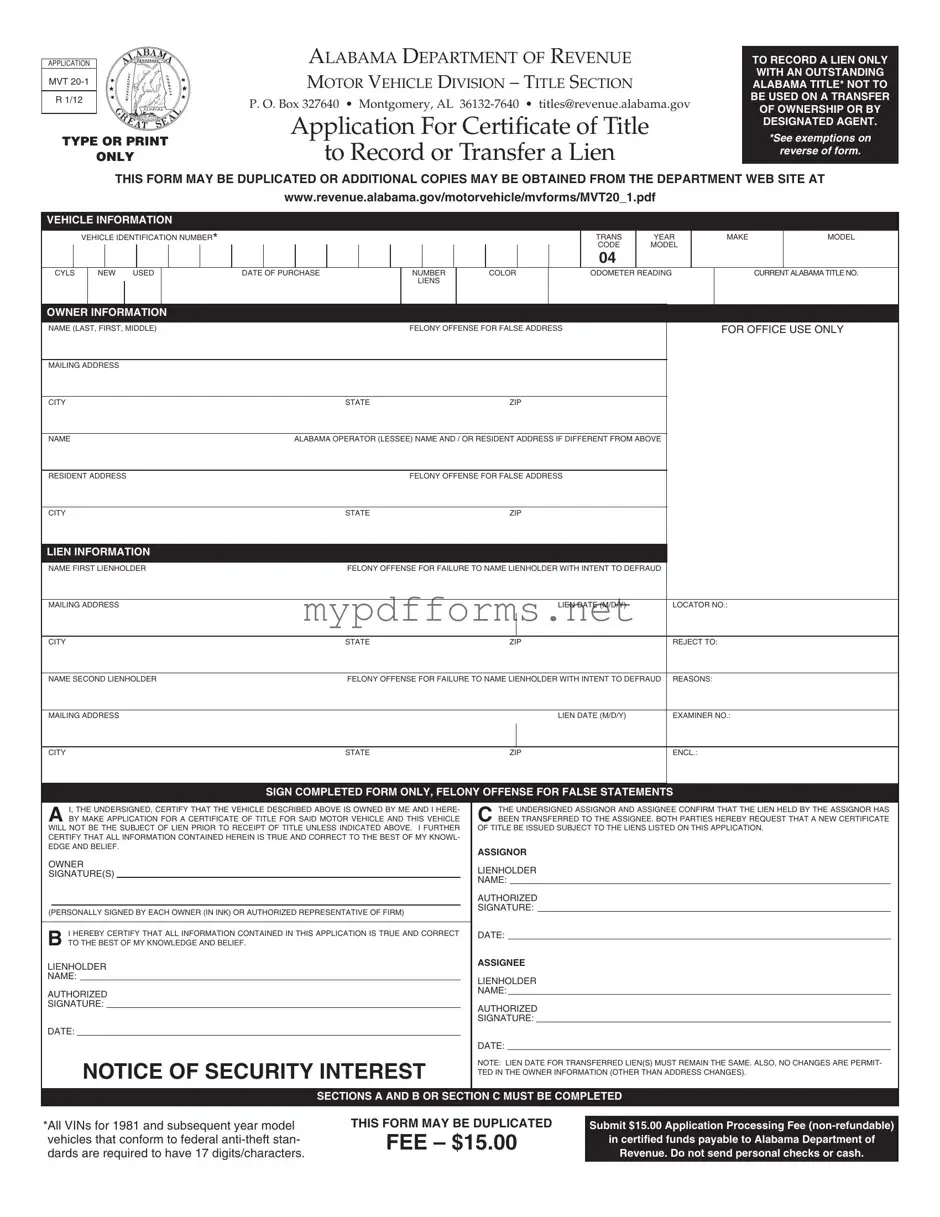

The Alabama MVT 20 1 form is similar to the MVT 5-1E form, which is utilized by designated agents to record liens. While the MVT 20 1 form is specifically for lienholders and requires the current Alabama title, the MVT 5-1E is designed for agents who are acting on behalf of the owner. Both forms serve the purpose of documenting a lien on a vehicle, but they differ in who is authorized to submit them. The MVT 5-1E allows agents to perform the same function as the MVT 20 1, ensuring that all parties involved in the transaction are properly represented and that the lien is recorded accurately.

Another document similar to the MVT 20 1 form is the MVT 2-1 form, which is the application for a certificate of title. The MVT 2-1 is used when an individual is seeking to obtain a new title for a vehicle, which may involve a transfer of ownership. Unlike the MVT 20 1, which focuses solely on lien recording, the MVT 2-1 includes information about the buyer, seller, and vehicle details. Both forms require accurate vehicle identification numbers and owner information, ensuring that the records are consistent and up-to-date.

Understanding the various forms related to vehicle transactions is crucial for ensuring proper documentation and compliance. For those interested in firearm licensing in Illinois, a similar sense of diligence is required when applying for the necessary permits. To expedite this process, it's beneficial to familiarize yourself with the Illinois Application Firearm Control Card, a mandatory document for professionals in the state. Make sure to check out the Illinois Forms to ensure you have the correct paperwork and guidelines to proceed with your application effectively.

The MVT 10 form is also relevant, as it is used for reporting a lost or stolen title. When a vehicle owner finds themselves in a situation where their title has been misplaced or taken unlawfully, the MVT 10 allows them to formally report this issue. While the MVT 20 1 is concerned with recording liens, the MVT 10 addresses the need for title security and ownership verification. Both documents serve to protect the interests of vehicle owners and lienholders, ensuring that ownership and financial interests are clearly documented.

Additionally, the MVT 7 form, which is used for the application for a duplicate title, shares similarities with the MVT 20 1 form. When a vehicle owner needs a replacement title due to damage or loss, the MVT 7 provides a means to obtain a new title. While the MVT 20 1 focuses on lien recording, both forms require detailed vehicle information and owner verification to ensure that the title accurately reflects the current status of the vehicle.

The MVT 8 form, which is used for the application to transfer a title upon the death of an owner, also bears resemblance to the MVT 20 1. This form allows heirs or representatives to transfer the title of a vehicle after the original owner has passed away. Similar to the MVT 20 1, the MVT 8 requires specific information about the vehicle and the deceased owner, ensuring that the transfer of ownership is handled legally and appropriately.

Moreover, the MVT 1 form, which is the application for a new vehicle title, is another document that relates to the MVT 20 1. The MVT 1 is typically used by individuals who have recently purchased a vehicle and need to establish their ownership formally. While the MVT 20 1 is focused on lien recording, both forms require the same level of detail regarding vehicle identification and owner information, ensuring that all records are accurate and up-to-date.

Lastly, the MVT 12 form, which is used for reporting the sale of a vehicle, is similar to the MVT 20 1 in that it involves the transfer of interests in a vehicle. The MVT 12 allows sellers to report the sale and provide necessary information about the buyer. While the MVT 20 1 specifically addresses lien recording, both forms play a crucial role in maintaining accurate vehicle ownership records and ensuring that all transactions are documented properly.