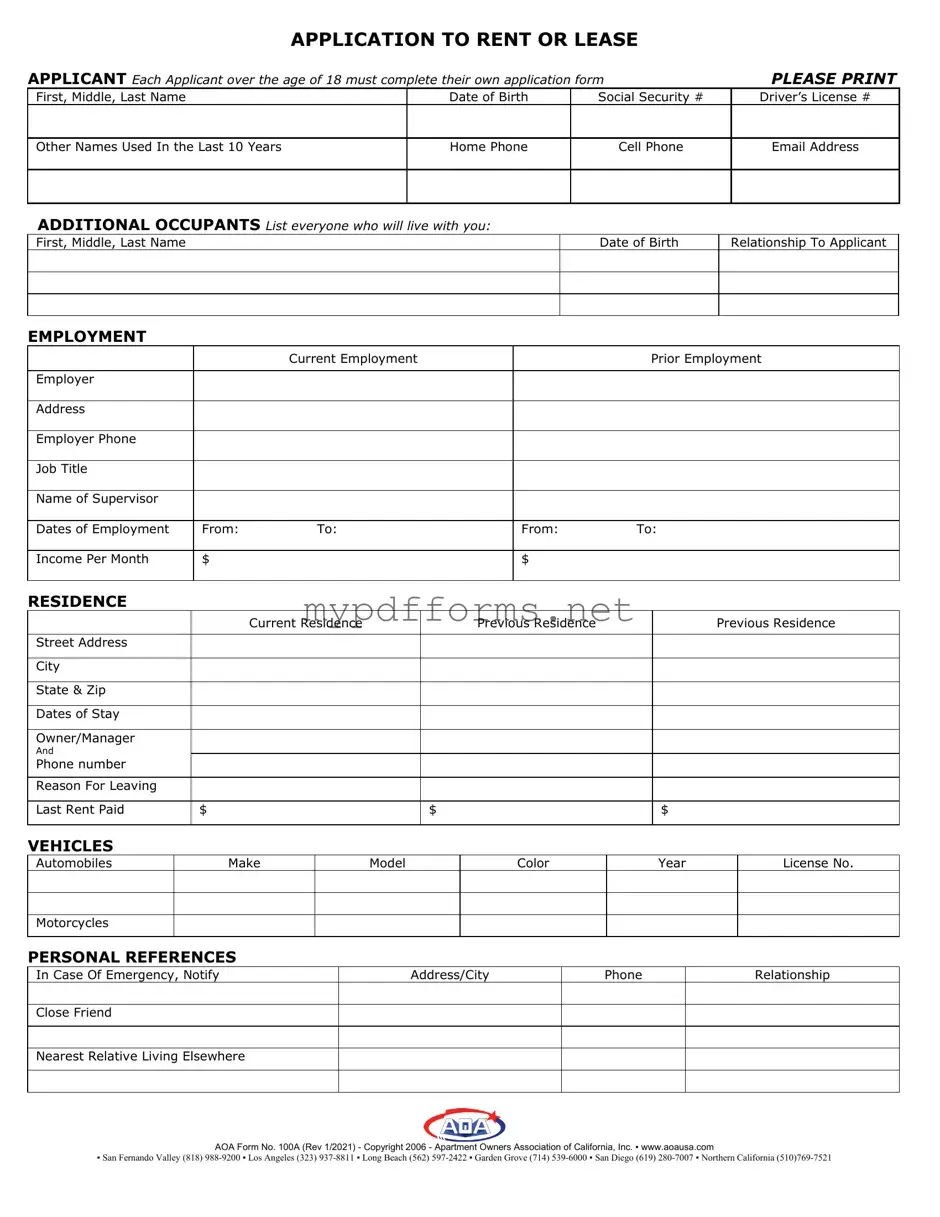

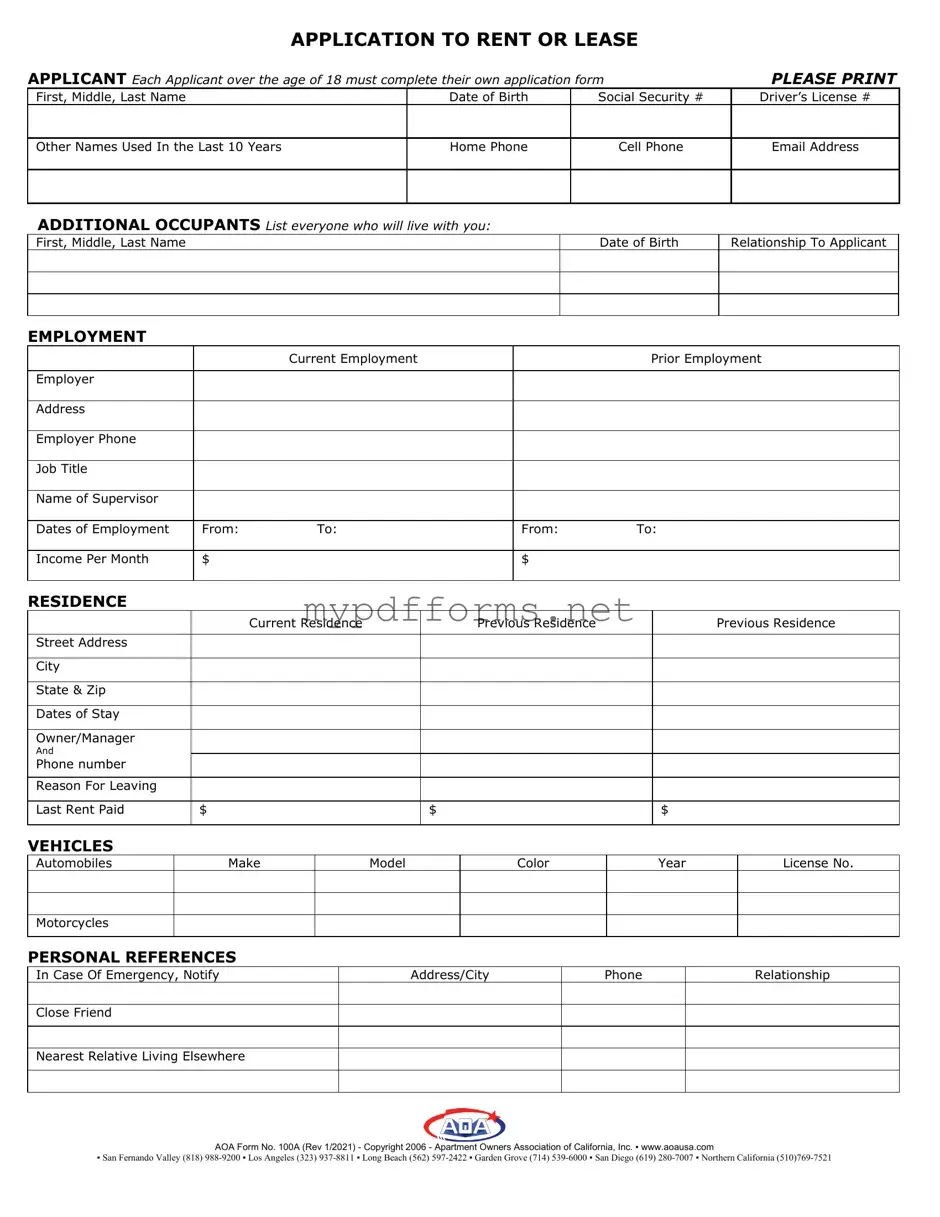

The Aoa 100A form shares similarities with the Rental Application form often used by landlords and property management companies. Like the Aoa 100A, this document collects essential information about the applicant, including personal details, employment history, and references. Both forms aim to assess the applicant's suitability as a tenant, ensuring that landlords have a comprehensive understanding of their potential renters. Furthermore, the Rental Application often includes sections for credit history and background checks, mirroring the verification processes outlined in the Aoa 100A.

Another document akin to the Aoa 100A is the Lease Agreement. While the Aoa 100A serves as an application to rent, the Lease Agreement formalizes the rental relationship once an applicant is approved. Both documents require information about the tenant, such as names and contact details, and they outline the responsibilities of both parties. The Lease Agreement typically includes terms regarding rent payment, duration of tenancy, and conditions for termination, which are essential for establishing clear expectations between the landlord and tenant.

The Employment Verification form is also similar to the Aoa 100A, as both seek to confirm the applicant's employment status and income. The Aoa 100A requires applicants to provide details about their current and previous employment, which helps landlords assess financial stability. Similarly, the Employment Verification form is often submitted to employers to validate the information provided by the applicant. Both documents serve to ensure that the applicant can meet their financial obligations under the lease.

Additionally, the Credit Report Authorization form parallels the Aoa 100A in its focus on financial assessment. While the Aoa 100A allows landlords to obtain credit reports as part of the application process, the Credit Report Authorization form explicitly grants permission for this inquiry. Both documents emphasize the importance of understanding an applicant's creditworthiness, which is a crucial factor in determining whether they will be a reliable tenant.

The Background Check Authorization form is another document that shares similarities with the Aoa 100A. Both forms facilitate the process of verifying an applicant's history, including any criminal records or previous evictions. The Aoa 100A includes a section where applicants authorize landlords to conduct background checks, while the Background Check Authorization form specifically outlines the applicant's consent for such investigations. This ensures that landlords can make informed decisions based on the applicant's past behaviors.

For a well-rounded approach, utilizing the comprehensive Employee Handbook guidelines can significantly enhance communication between employers and their workforce. This document encapsulates vital company policies and expectations, ensuring clarity and consistency for all employees.

Lastly, the Personal Reference form bears resemblance to the Aoa 100A in that both documents collect information about individuals who can vouch for the applicant's character and reliability. The Aoa 100A includes a section for personal references, allowing landlords to contact these individuals for further insights. Similarly, the Personal Reference form is often used to gather contact information and relationships of individuals who can provide testimonials about the applicant's suitability as a tenant. Both forms aim to add an additional layer of assurance for landlords in their selection process.