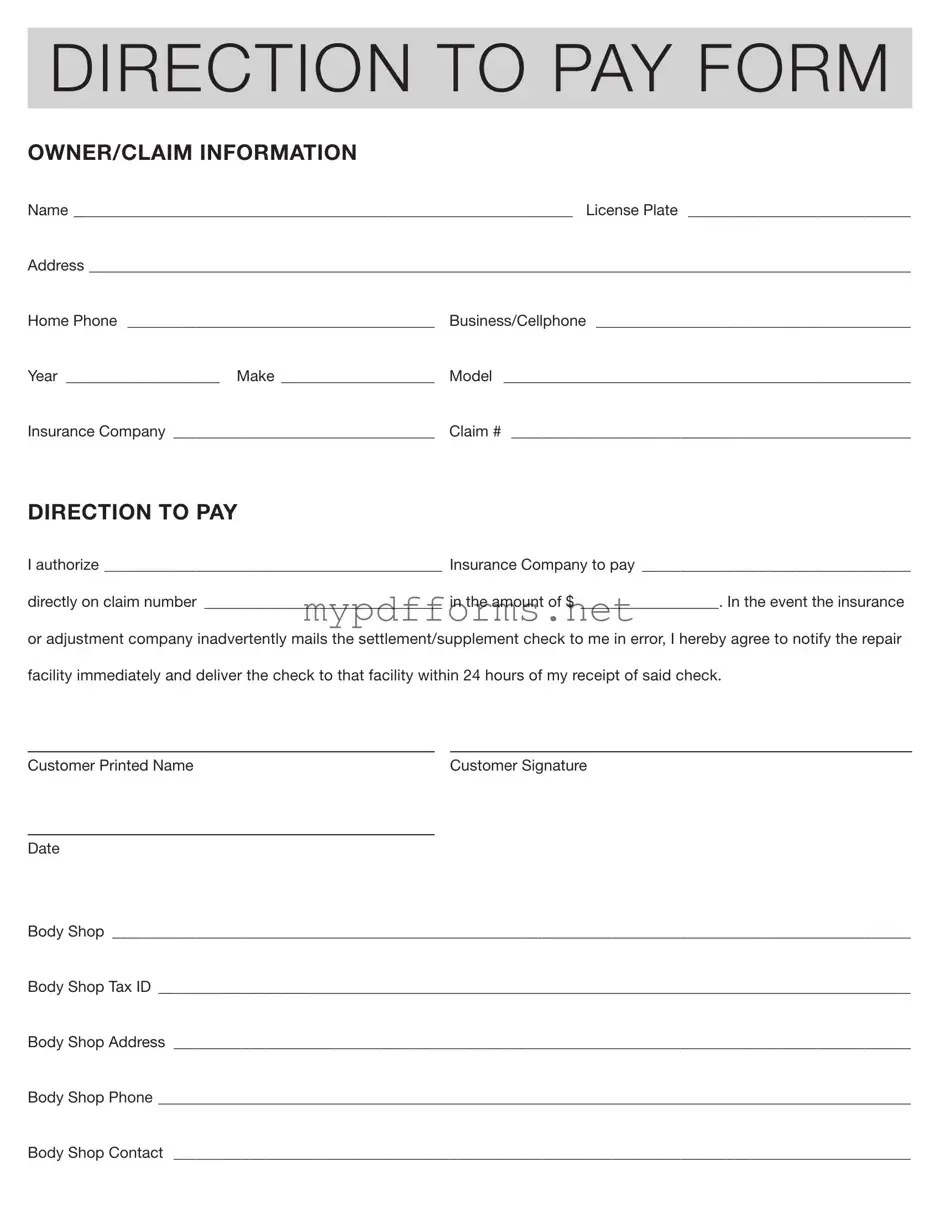

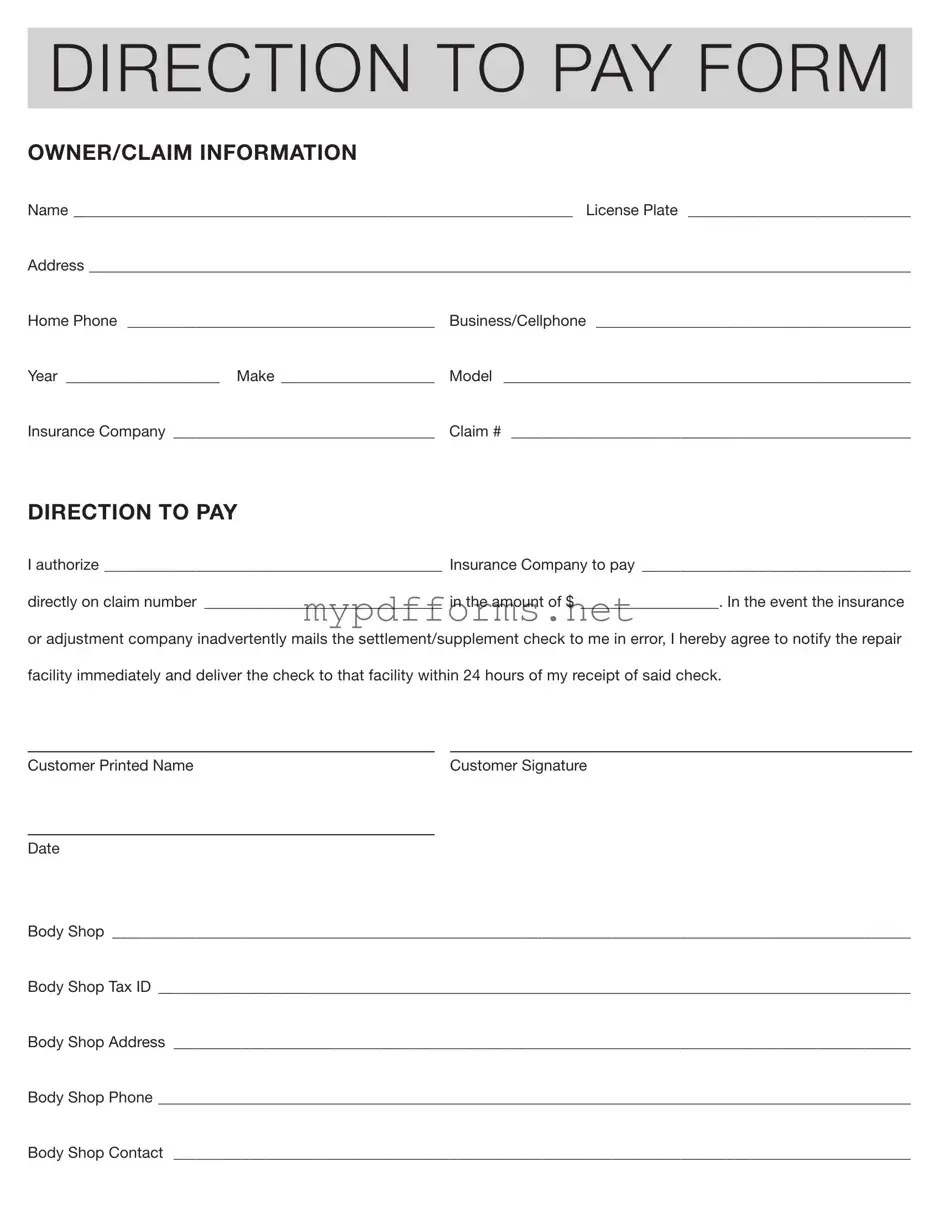

The Assignment of Benefits form is similar to the Authorization and Direction to Pay form in that both documents allow a policyholder to transfer their rights to receive payment directly to a third party. In the case of the Assignment of Benefits, the policyholder assigns their benefits to a service provider, such as a healthcare provider or repair shop. This means that the service provider can directly bill the insurance company for the services rendered. Both forms aim to streamline the payment process and ensure that the service provider receives payment without requiring the policyholder to act as an intermediary.

The Release of Liability form shares similarities with the Authorization and Direction to Pay form, particularly in the context of claims and payments. This document is often used to protect one party from legal claims by another. When a policyholder signs a Release of Liability, they may also be agreeing to settle a claim for a specified amount. This is akin to directing payment to a service provider, as both documents facilitate the resolution of a claim and ensure that all parties are clear on the terms of payment and liability.

The Minnesota Motorcycle Bill of Sale form is essential not only for confirming the transfer of ownership between a buyer and a seller but also for ensuring that both parties retain clear documentation of the transaction. For anyone looking to streamline the buying or selling process, it's advisable to have a copy of the necessary paperwork ready, which can be found for the document. This form acts as protection for both parties, alleviating any concerns regarding the legitimacy and details of the sale.

The Direct Deposit Authorization form also mirrors the Authorization and Direction to Pay form in its focus on facilitating payments. This document allows an individual or business to authorize the direct deposit of funds into their bank account. While the Authorization and Direction to Pay form directs payment to a specific service provider, the Direct Deposit Authorization ensures that funds are deposited directly into the individual’s account, streamlining the payment process and reducing the need for physical checks.

The Power of Attorney form is another document that bears resemblance to the Authorization and Direction to Pay form. This legal document grants one person the authority to act on behalf of another in legal or financial matters. In the context of insurance claims, a Power of Attorney may allow an agent to negotiate settlements and direct payments on behalf of the policyholder. Both forms empower a designated individual to manage financial transactions and ensure that payments are made efficiently.

Lastly, the Insurance Claim Form is closely related to the Authorization and Direction to Pay form as it initiates the claims process with an insurance company. This form collects essential information about the claim, including details about the incident and the parties involved. Once the claim is approved, the Authorization and Direction to Pay form can then be used to specify where the payment should be sent, creating a seamless transition from filing a claim to receiving payment.