The Vehicle Registration Document serves as proof that a vehicle is legally registered with the state. It includes important details such as the vehicle identification number (VIN), make and model, and the owner's information. Like the Auto Insurance Card, it must be kept in the vehicle and presented when requested by law enforcement. Both documents are essential for operating a vehicle legally and ensuring compliance with state regulations.

The Driver’s License is another crucial document that establishes a person's legal right to operate a vehicle. It contains the driver's name, address, and photograph, along with the license number and expiration date. Similar to the Auto Insurance Card, it must be presented upon request during traffic stops or accidents. Both documents verify identity and ensure that the driver is authorized to be on the road.

When entering into a commercial property rental agreement, understanding the associated documentation is crucial for both landlords and tenants. For instance, a New Jersey Commercial Lease Agreement serves as a vital legal contract that outlines specific terms and conditions to protect the interests of both parties. Just like a rental car agreement, it is crucial to refer to resources such as NJ PDF Forms to ensure compliance and clarity in these agreements.

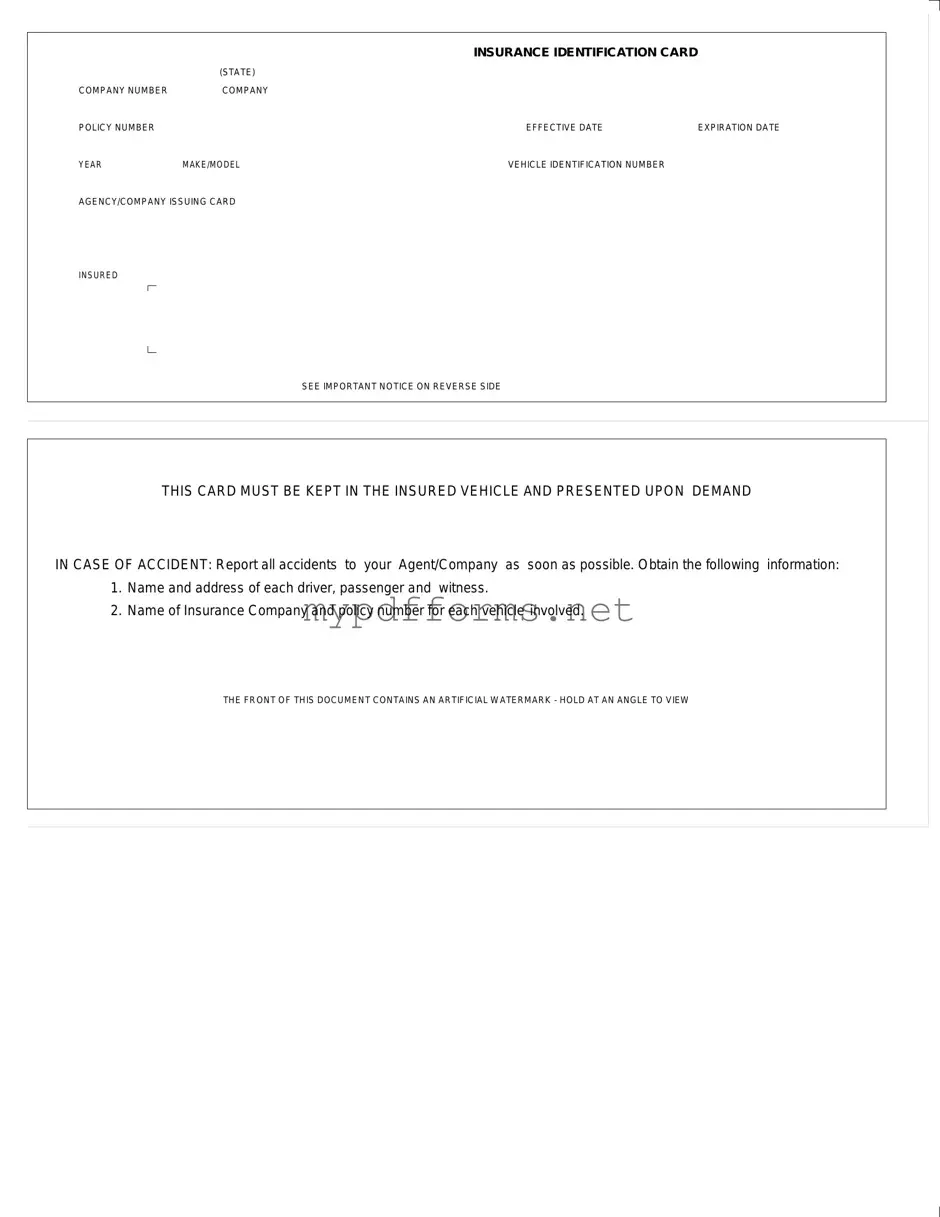

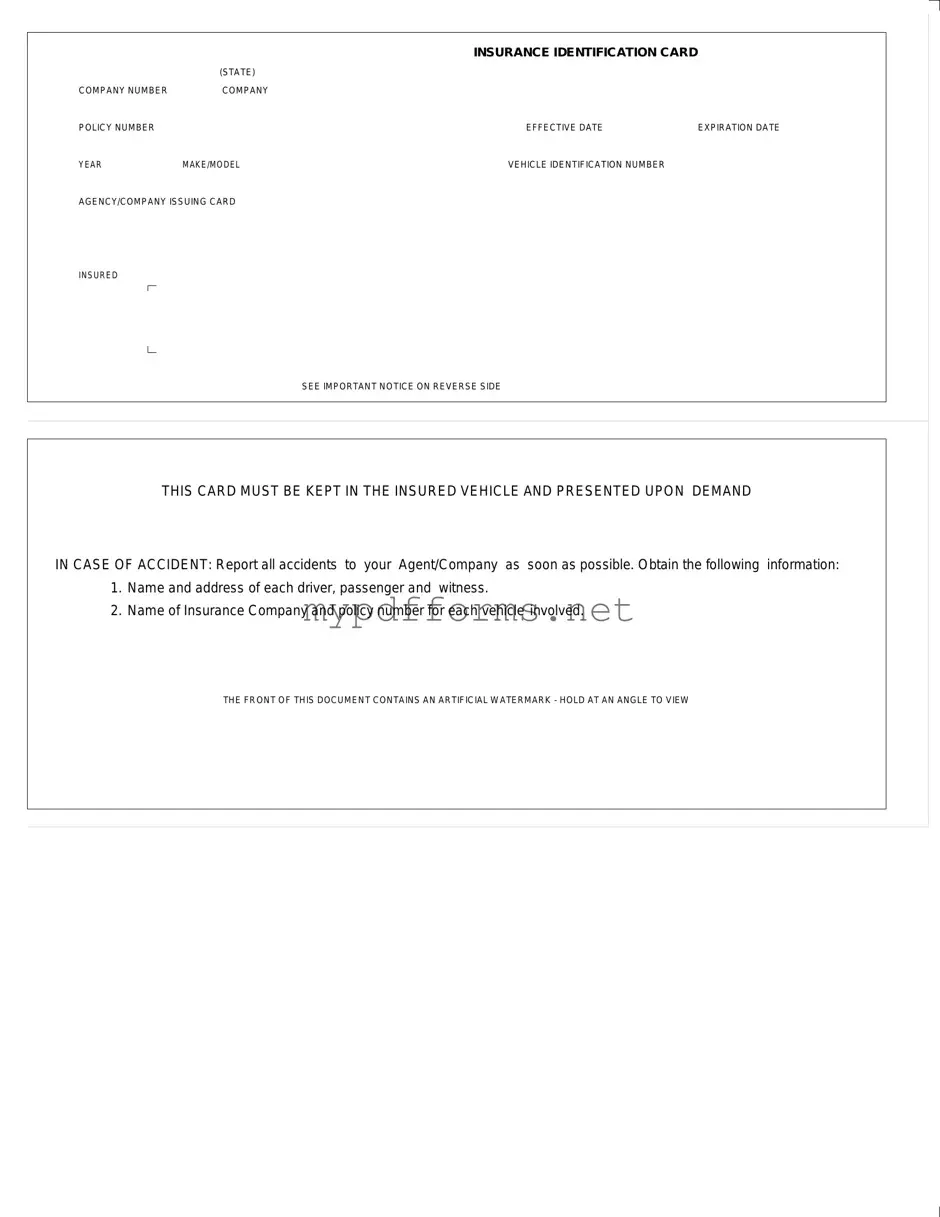

The Proof of Insurance Certificate is a document that confirms a driver has active insurance coverage. It typically includes the insurance company’s name, policy number, and effective dates. This document, like the Auto Insurance Card, is often required to be shown during traffic stops or after an accident. Both serve as evidence of financial responsibility in case of vehicle-related incidents.

The Title Document is a legal document that proves ownership of a vehicle. It includes information such as the owner's name, the vehicle’s VIN, and any liens against the vehicle. While it differs from the Auto Insurance Card in purpose, both documents are essential for vehicle ownership and must be kept accessible. The title may be required when selling or transferring ownership of the vehicle.

The Bill of Sale is a document that records the transaction between a buyer and seller when a vehicle is purchased. It includes details such as the purchase price, vehicle description, and the signatures of both parties. While it serves a different function than the Auto Insurance Card, both documents can be important during the sale of a vehicle. They provide proof of ownership transfer and can be necessary for registration and insurance purposes.