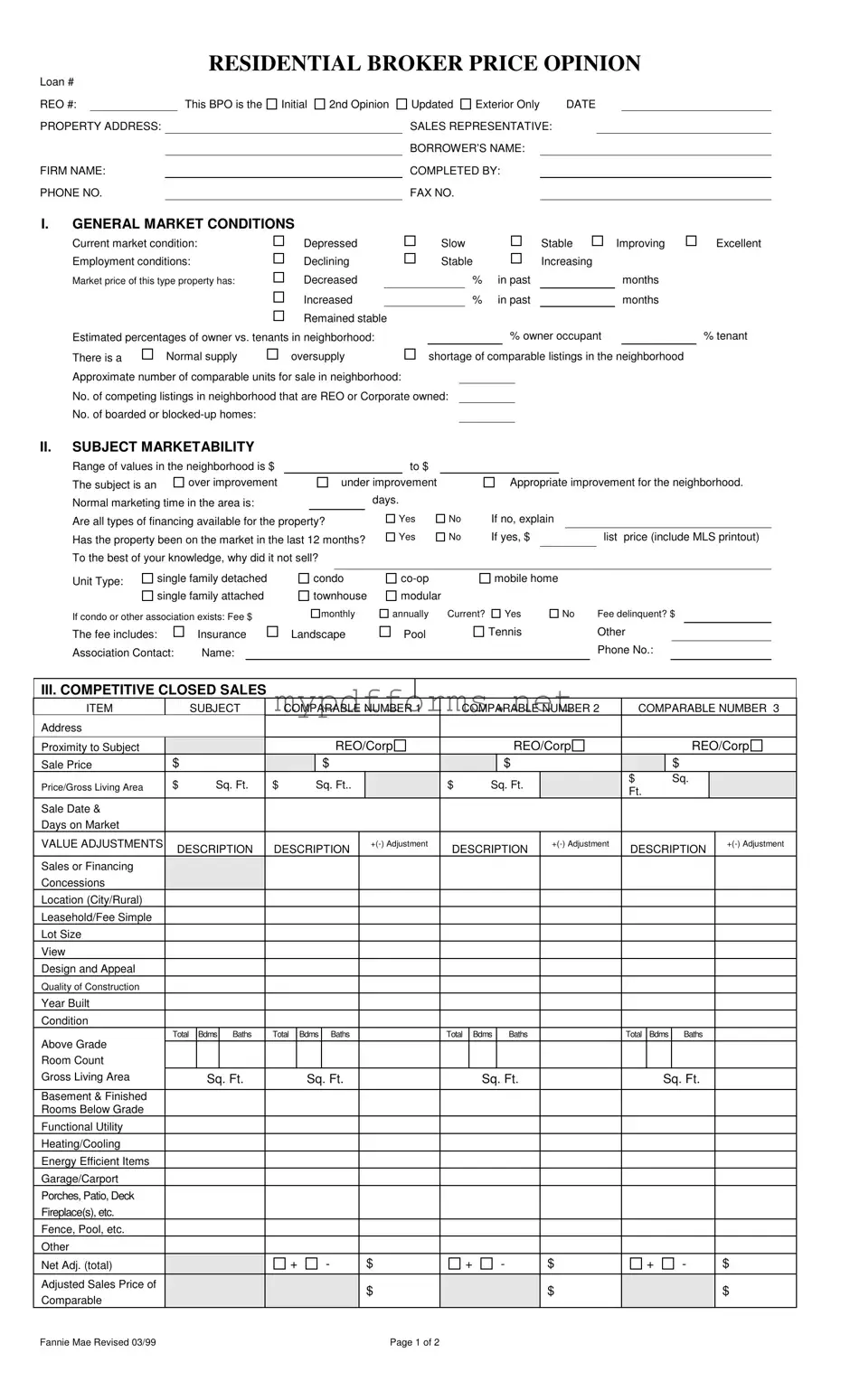

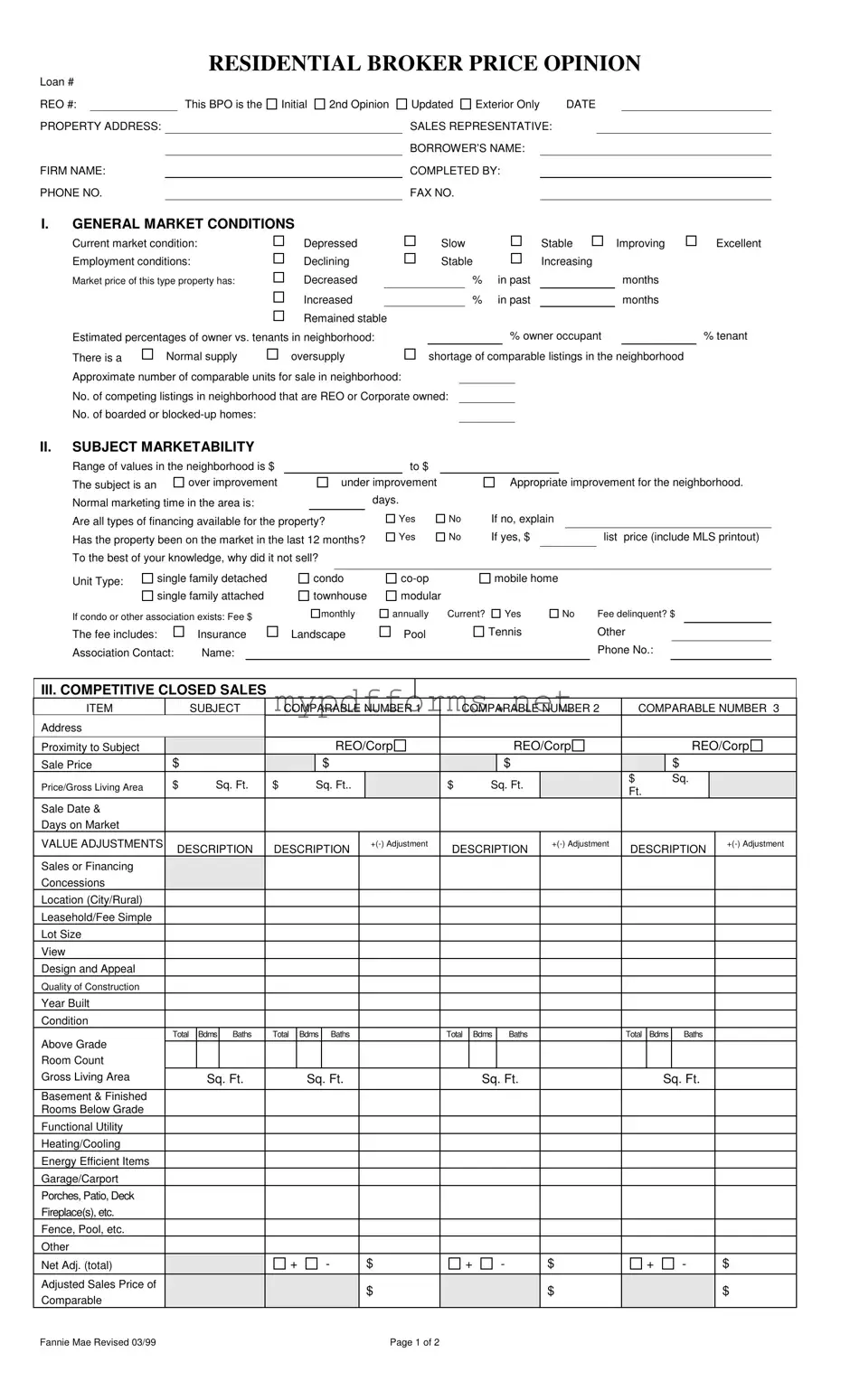

The Comparative Market Analysis (CMA) is a document often used in real estate to estimate a property's value based on similar properties that have recently sold in the area. Like the Broker Price Opinion (BPO), a CMA analyzes recent sales data, current listings, and market trends to provide a comprehensive view of the property's worth. While a BPO is typically completed by a licensed broker or agent for lenders or financial institutions, a CMA is usually prepared by real estate agents for sellers or buyers. Both documents aim to help stakeholders make informed decisions about pricing and selling properties.

In navigating the complexities of real estate transactions, it is crucial for individuals to be well-informed about the various legal documents required. One such document is the Illinois Forms, which can be instrumental for those who wish to empower an agent to make decisions on their behalf. Understanding the significance of these forms can greatly impact not only the buying and selling process but also ensure that one’s interests are protected throughout the transaction.

An Appraisal is another document similar to the Broker Price Opinion, but it is conducted by a licensed appraiser. Appraisers evaluate a property’s value based on various factors, including its condition, location, and comparable sales. While BPOs are often quicker and less formal, appraisals provide a more detailed analysis and are typically required for mortgage financing. Both documents serve the purpose of establishing a property's market value, but an appraisal is usually seen as more authoritative due to the appraiser's specialized training and credentials.

The Property Condition Report (PCR) focuses on the physical state of a property rather than its market value. While a BPO considers market conditions and comparable sales, a PCR provides a detailed assessment of the property's structural and functional aspects. This includes information on repairs needed, safety issues, and overall maintenance. Both documents are essential in the real estate process, but they serve different purposes—one for pricing and the other for assessing condition.

The Listing Agreement is a contract between a property owner and a real estate agent that outlines the terms of selling a property. Similar to the BPO, it includes information about the property and market analysis to help set a listing price. However, while a BPO is an opinion of value based on market data, a Listing Agreement formalizes the relationship and expectations between the seller and the agent. Both documents aim to facilitate the sale process, but they function in different capacities.

The Seller’s Disclosure Statement is a document that provides potential buyers with information about the condition of the property and any known issues. While the BPO focuses on estimating market value, the Seller’s Disclosure ensures that buyers are informed about the property's history and any potential problems. Both documents play a critical role in the buying and selling process, promoting transparency and informed decision-making.

The Lease Agreement is a legal document that outlines the terms under which a tenant can occupy a property. While it differs significantly in purpose from a BPO, both documents relate to real estate transactions. A BPO assesses property value, while a Lease Agreement establishes the terms of rental. However, both are essential in the real estate realm, as they help define the expectations and responsibilities of the involved parties, whether in a sale or rental situation.