The Business Bill of Sale is similar to a Personal Bill of Sale. Both documents serve as a formal record of the transfer of ownership from one party to another. A Personal Bill of Sale is typically used for individual transactions involving personal property, such as vehicles or equipment. Like the Business Bill of Sale, it includes details about the item being sold, the purchase price, and the identities of the buyer and seller. Both documents aim to protect the interests of both parties and provide proof of the transaction.

Another document comparable to the Business Bill of Sale is the Asset Purchase Agreement. This agreement is often used in business transactions to outline the terms under which one party purchases specific assets from another. While the Business Bill of Sale focuses on the transfer of ownership, the Asset Purchase Agreement provides a more detailed framework, including representations and warranties, liabilities, and conditions for the sale. Both documents facilitate the legal transfer of assets, but the Asset Purchase Agreement usually covers more complex transactions.

The Equipment Bill of Sale is also similar to the Business Bill of Sale. This document specifically pertains to the sale of equipment, such as machinery or tools. It includes essential details about the equipment, such as its condition, model, and serial number, along with the purchase price and buyer-seller information. Like the Business Bill of Sale, it serves to confirm the transfer of ownership and can be used for record-keeping purposes. Both documents help clarify the terms of the sale and protect the rights of both parties involved.

A Vehicle Bill of Sale shares similarities with the Business Bill of Sale as well. This document is specifically designed for the sale of motor vehicles. It includes information such as the vehicle identification number (VIN), make, model, year, and odometer reading, along with the sale price and buyer-seller details. Both documents provide a legal record of the transaction and can be used for title transfer and registration purposes. They help ensure that both parties are protected and that the transaction is conducted fairly.

The Real Estate Purchase Agreement is another document that bears resemblance to the Business Bill of Sale. This agreement is used when transferring ownership of real property, such as land or buildings. It outlines the terms of the sale, including the purchase price, contingencies, and closing date. While the Business Bill of Sale is typically simpler and more straightforward, both documents serve the same fundamental purpose of formalizing the transfer of ownership and protecting the rights of the involved parties.

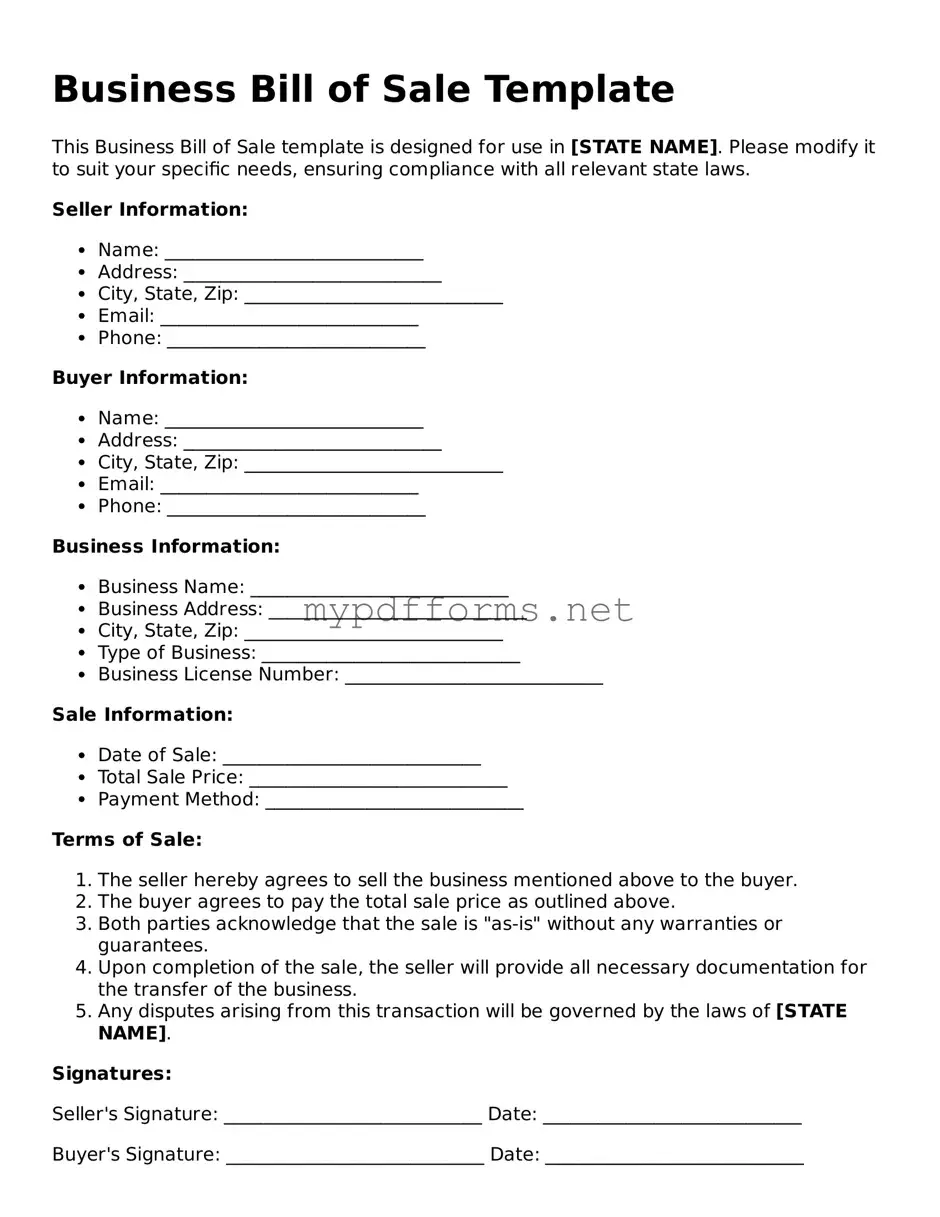

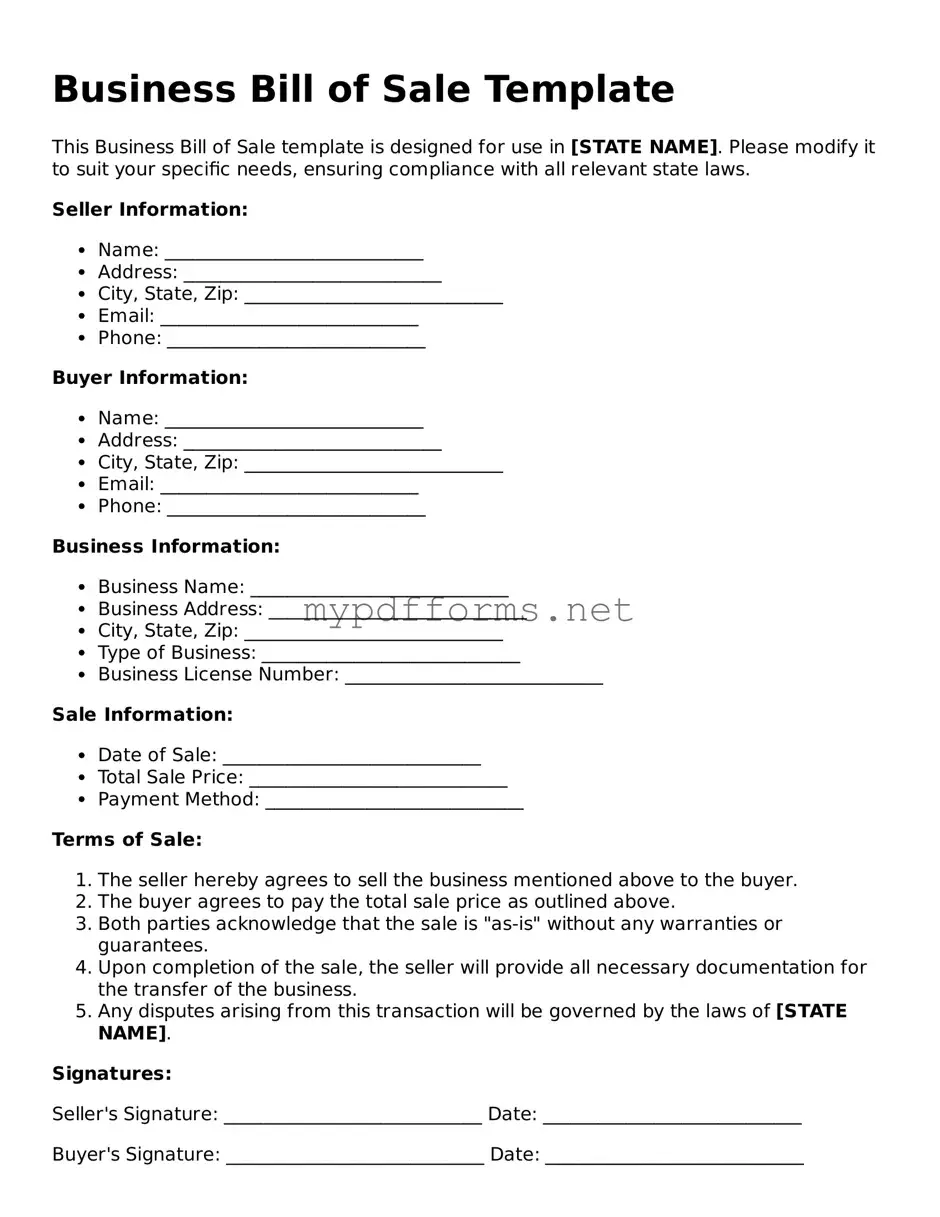

In New Jersey, having the right documentation is paramount when engaging in various sales transactions, as these documents not only provide clarity but also protect the interests of all parties involved. For those looking to simplify the process, resources such as NJ PDF Forms can be invaluable in ensuring that the required paperwork is readily accessible and compliant with state laws.

Lastly, the Lease Agreement can be compared to the Business Bill of Sale in certain contexts. While a Lease Agreement does not transfer ownership, it establishes the terms under which one party rents property from another. Both documents require clear identification of the parties involved, the property in question, and the terms of the agreement. They serve to protect the rights and responsibilities of both parties, ensuring that there is a mutual understanding of the terms involved, whether for a sale or a lease arrangement.