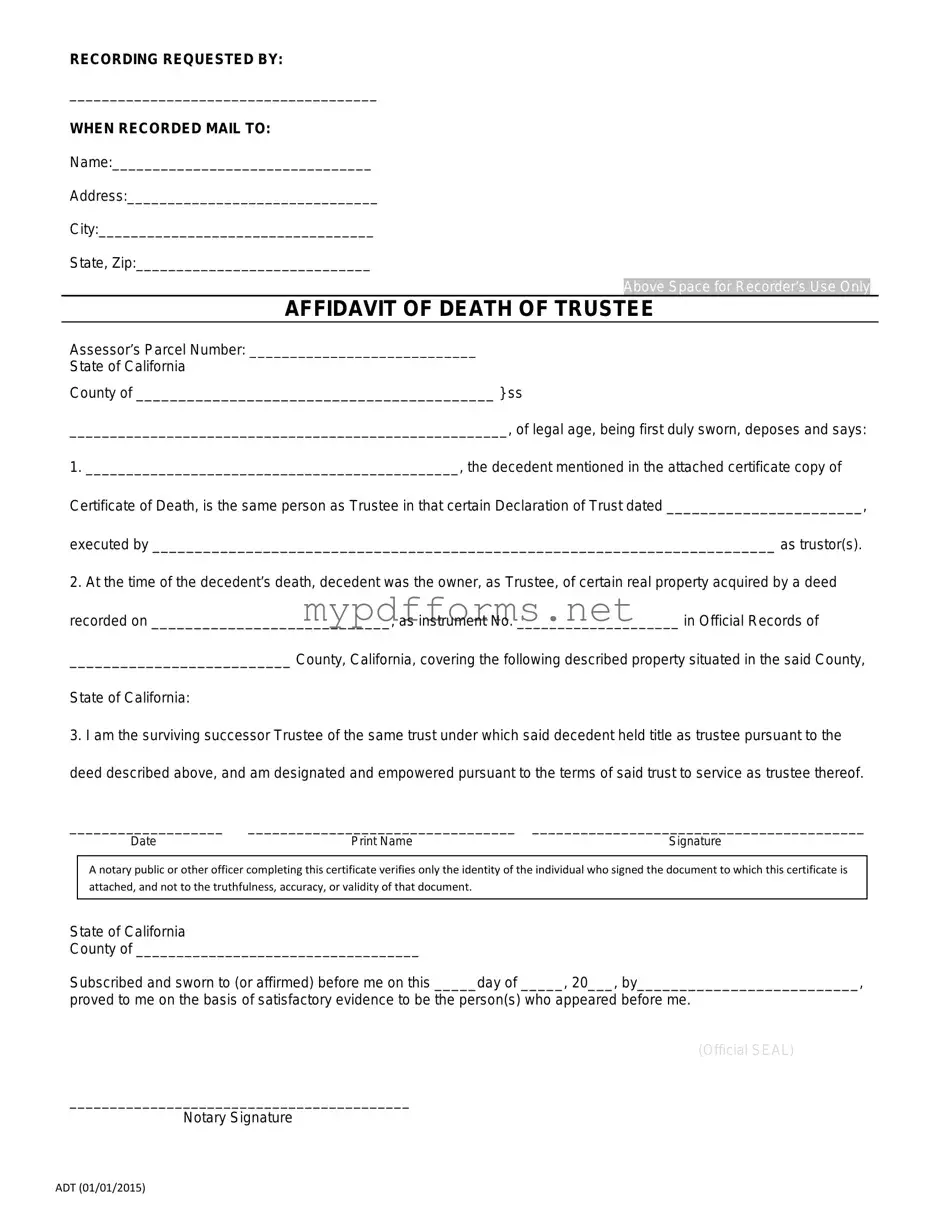

The California Affidavit of Death of a Trustee form is similar to the Affidavit of Death of a Joint Tenant. Both documents serve the purpose of confirming the death of an individual who held a significant interest in property. When a joint tenant passes away, the surviving joint tenant can use this affidavit to establish their sole ownership of the property, similar to how a trustee's death affects the management of a trust.

Another related document is the Affidavit of Heirship. This affidavit is used to establish the heirs of a deceased person when there is no will. Like the Affidavit of Death of a Trustee, it provides legal recognition of the death and helps clarify the distribution of assets. Both documents aim to simplify the transfer of property rights and ensure that the deceased's wishes are honored.

The Declaration of Trust is also akin to the California Affidavit of Death of a Trustee. A Declaration of Trust outlines the terms and conditions of a trust, including who the trustees are. When a trustee passes away, the Affidavit of Death serves as a necessary step to update the trust's records and ensure that the trust continues to operate smoothly under the remaining trustees or new appointees.

When navigating the complexities of estate planning, it's essential to have access to comprehensive resources that clarify your rights and responsibilities. The Illinois Employee Handbook form serves as a fundamental tool for establishing workplace expectations, much like the various legal documents discussed in the context of trust and estate management. For additional guidance on employee rights, we recommend reviewing the Illinois Forms, which provide valuable insights for both employees and employers.

The Last Will and Testament shares similarities as well. A will outlines how a person's assets will be distributed upon their death. When a trustee dies, their will may also need to be referenced to understand their wishes regarding the trust. Both documents play crucial roles in estate planning and asset distribution after death.

Additionally, the Certificate of Death is relevant. This document officially records the death of an individual and is often required when filing the Affidavit of Death of a Trustee. Both documents serve as formal proof of death, allowing the necessary legal processes to move forward, whether for trusts or other estate matters.

The Power of Attorney document is also worth mentioning. While it primarily grants authority to another person to act on someone’s behalf, it can become relevant if the trustee becomes incapacitated before their death. In such cases, a successor trustee may need to step in. The Affidavit of Death of a Trustee can later clarify the transition of responsibilities after the trustee has passed away.

The Probate Petition is another similar document. This legal filing is necessary when someone passes away, and their estate needs to be administered. If a trustee dies, the trust may need to go through probate, depending on its structure. Both the Affidavit of Death of a Trustee and the Probate Petition help facilitate the legal processes surrounding the deceased's estate.

Lastly, the Living Trust document is relevant. A living trust is created during a person's lifetime to manage their assets. When a trustee passes away, the Affidavit of Death of a Trustee is essential to ensure that the trust can be properly administered according to its terms. Both documents are integral in managing and transferring assets smoothly after a trustee's death.