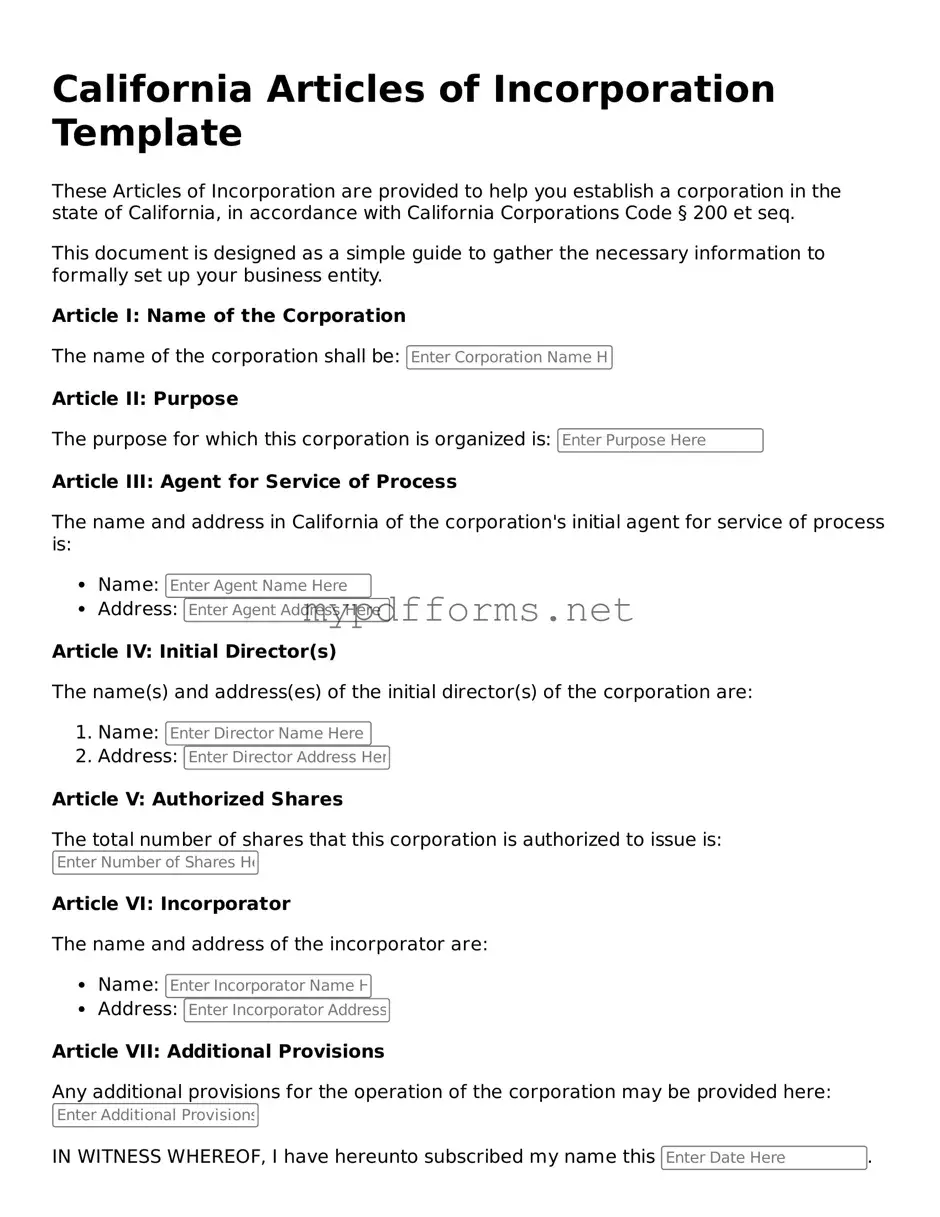

The California Articles of Incorporation is similar to the Certificate of Formation used in other states. Both documents serve as the foundational legal paperwork required to establish a corporation. They outline essential details such as the corporation's name, purpose, and registered agent. While the terminology may differ slightly from state to state, the core function remains the same: to formally create a legal entity recognized by the state government.

Another comparable document is the Bylaws. While the Articles of Incorporation establish the existence of the corporation, Bylaws provide the internal rules for governance. They dictate how the corporation will operate, including the roles and responsibilities of directors and officers, meeting protocols, and voting procedures. Together, these documents create a comprehensive framework for both external recognition and internal management.

The Operating Agreement is similar for limited liability companies (LLCs). Like the Articles of Incorporation, it is essential for legal recognition but tailored for LLCs. This document outlines the ownership structure, management responsibilities, and operational procedures of the LLC. While the Articles focus on the formation of the entity, the Operating Agreement details how it will function on a day-to-day basis.

In the context of establishing a business entity, it is critical to also consider documentation such as the Employment Verification form, which serves as a vital tool for verifying the employment history of individuals. This form not only helps in confirming job details but also ensures that employers can maintain accurate records that align with state requirements.

The Statement of Information is another document that complements the Articles of Incorporation. This form is required to provide updated information about the corporation after its formation. It includes details such as the names and addresses of officers and directors. Filing this document ensures that the state has current information about the corporation, which is crucial for legal compliance and transparency.

Lastly, the Application for Employer Identification Number (EIN) is essential for tax purposes. While the Articles of Incorporation establish the corporation, the EIN is necessary for tax identification and reporting. This document is used to open bank accounts, hire employees, and file tax returns. It is a critical step in the operational setup of the corporation, ensuring it can conduct business legally and efficiently.