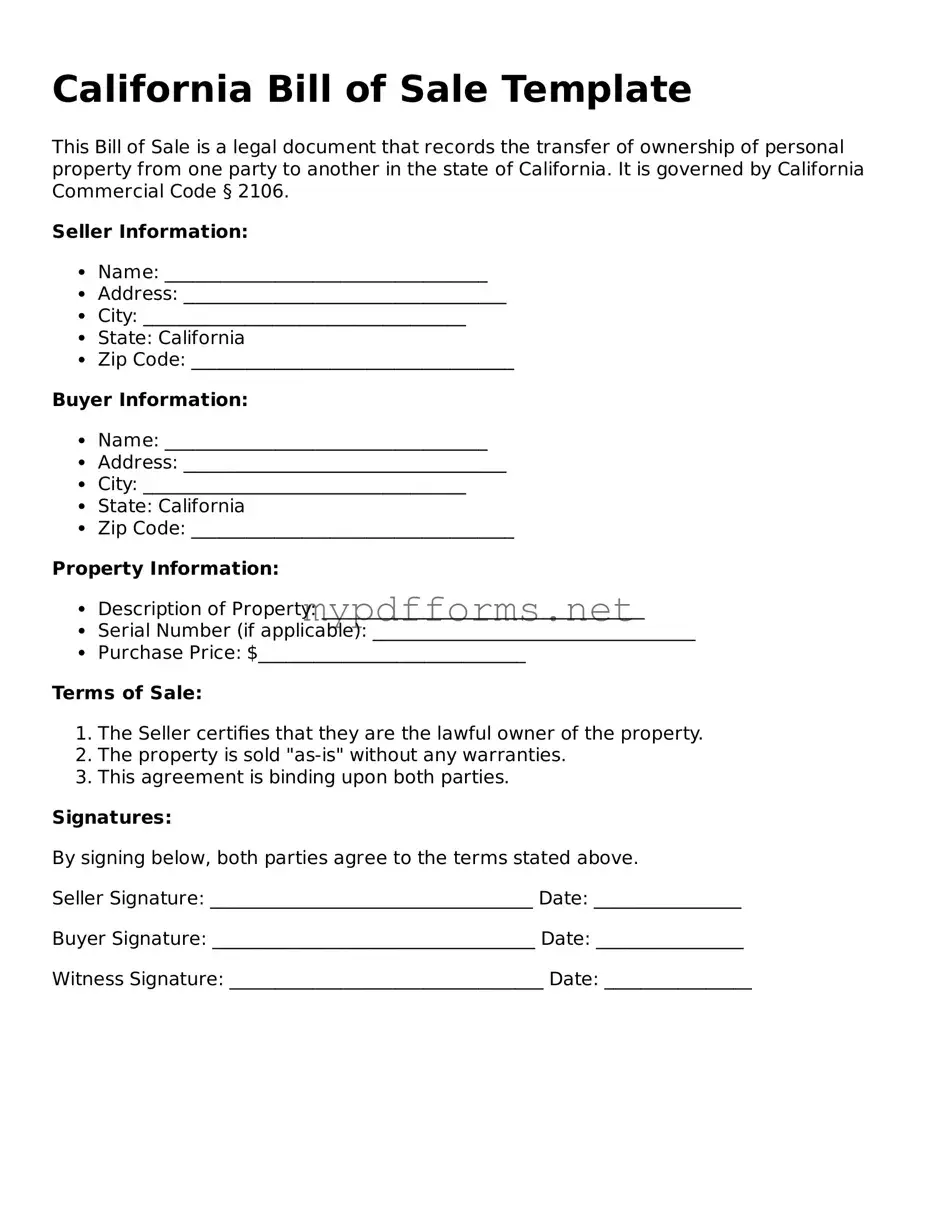

The California Bill of Sale form shares similarities with the Vehicle Title Transfer form. Both documents serve to transfer ownership of a vehicle from one party to another. While the Bill of Sale provides a record of the transaction, the Vehicle Title Transfer form is essential for updating the official ownership records with the Department of Motor Vehicles (DMV). Completing both forms ensures that the seller is no longer liable for the vehicle, and the buyer has proof of ownership for registration purposes.

For those looking to understand the complexities of the ownership transfer process, a comprehensive guide to the Motor Vehicle Bill of Sale can provide valuable insights and facilitate smoother transactions. For more information, please visit this resource on the Motor Vehicle Bill of Sale.

Another document akin to the California Bill of Sale is the Purchase Agreement. This agreement outlines the terms of the sale, including the price and conditions of the transaction. While the Bill of Sale acts as proof of the transfer, the Purchase Agreement details the obligations of both the buyer and seller before the sale is finalized. Together, these documents create a comprehensive record of the transaction, safeguarding both parties' interests.

The Receipt for Payment is another document that parallels the Bill of Sale. This receipt acknowledges that payment has been made for goods or services, similar to how a Bill of Sale confirms the transfer of ownership. While the Bill of Sale includes details about the item being sold, the Receipt for Payment focuses primarily on the financial transaction. Both documents can be used as evidence in case of disputes regarding the sale.

A Lease Agreement can also be compared to the California Bill of Sale, particularly when it comes to the rental or leasing of personal property. Both documents outline the terms of use and ownership rights. However, a Lease Agreement typically pertains to temporary arrangements, whereas a Bill of Sale signifies a permanent transfer of ownership. Despite their differences, both serve to protect the rights of the involved parties.

The Warranty Deed is similar in function to the Bill of Sale, particularly in real estate transactions. Both documents transfer ownership, but a Warranty Deed provides additional assurances regarding the title's validity and the seller's right to sell the property. While the Bill of Sale is often used for personal property, a Warranty Deed is specifically designed for real estate, ensuring that the buyer receives clear and marketable title.

Lastly, the Affidavit of Ownership can be likened to the California Bill of Sale in that it serves as a declaration of ownership. This document is often used when the original title is lost or unavailable. It allows the owner to assert their claim to the property, similar to how a Bill of Sale confirms the transfer of ownership. Both documents provide legal backing to ownership claims, helping to resolve potential disputes.