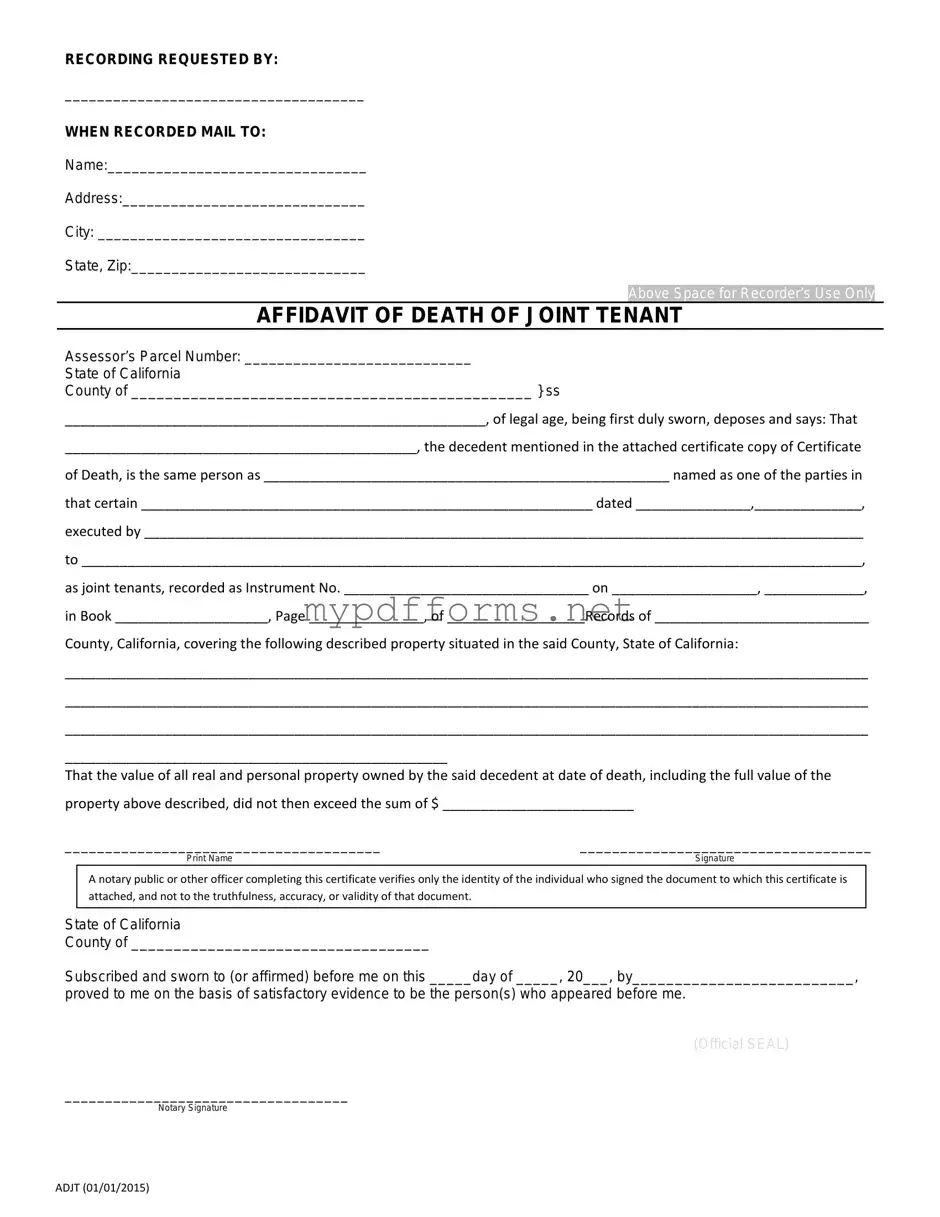

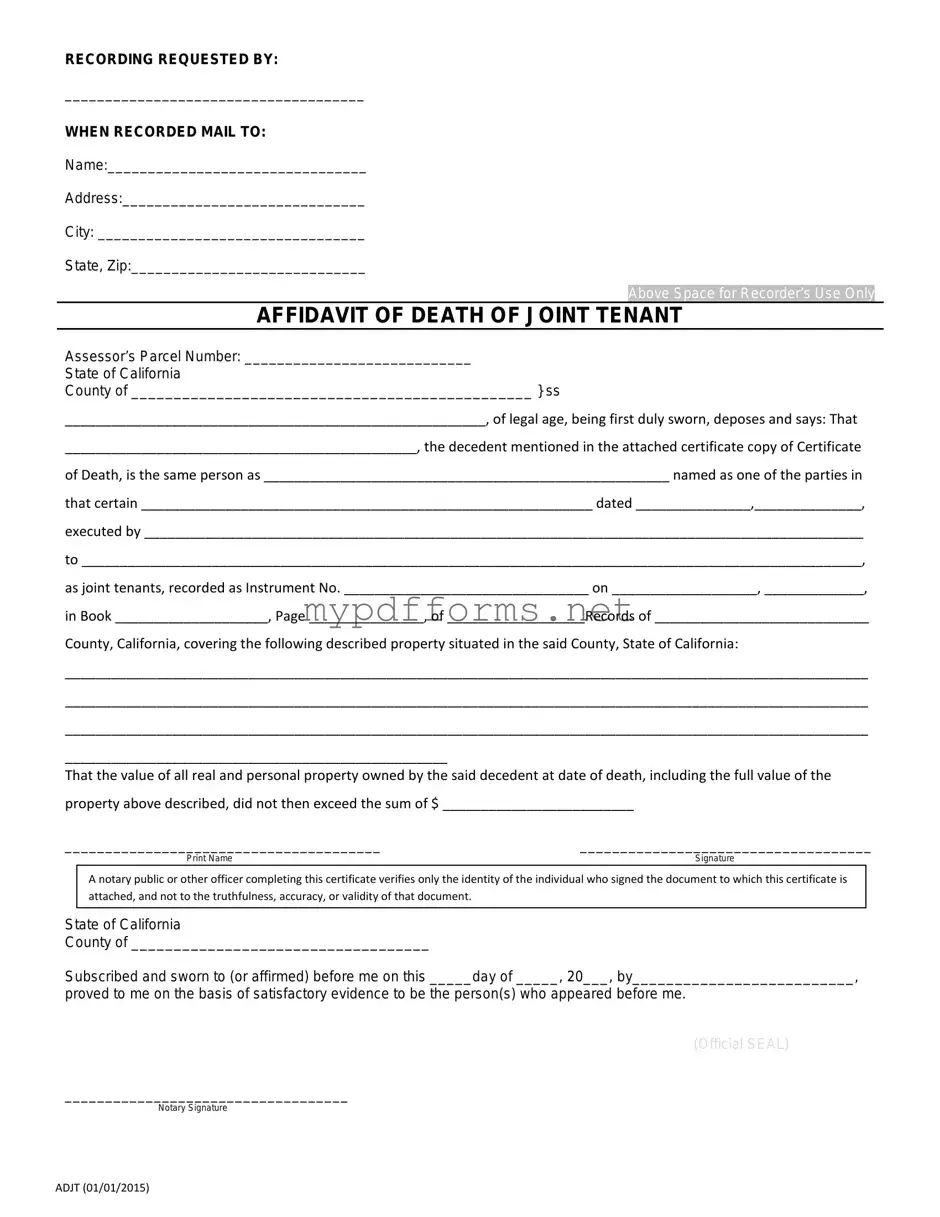

The California Death of a Joint Tenant Affidavit form is similar to the Affidavit of Heirship. Both documents serve to clarify the transfer of property ownership after the death of an individual. When someone passes away, their assets need to be distributed according to their wishes or state laws. The Affidavit of Heirship helps establish who the rightful heirs are, ensuring that the deceased's property is passed on correctly. This document is often used in situations where there is no will, making it crucial for determining how assets will be divided among surviving family members.

Another document that shares similarities is the Grant Deed. A Grant Deed is a legal document used to transfer ownership of real property from one person to another. When a joint tenant dies, the surviving tenant can use a Grant Deed to formally record their ownership of the property. This is particularly important for clarifying title and ensuring that the property is recognized as belonging solely to the surviving tenant. Both forms facilitate the transfer of property but in different contexts—one focuses on the death of a joint tenant, while the other is a general tool for property transfer.

The Affidavit of Death is also closely related to the California Death of a Joint Tenant Affidavit. This document is used to confirm the death of an individual and is often required by financial institutions or other entities to release assets or accounts held in the deceased's name. Similar to the Death of a Joint Tenant Affidavit, it serves to establish a legal acknowledgment of death, but it is broader in scope, applying to various types of accounts and assets, not just real estate.

Moreover, if you are considering property transfers in Texas, utilizing a Quitclaim Deed can simplify the process considerably. This legal document allows property owners to relinquish their interests without the formalities of title guarantees. For those looking to fill out a Texas Quitclaim Deed form, resources are available online, including at https://quitclaimdocs.com/fillable-texas-quitclaim-deed, providing an accessible starting point for completing this essential paperwork.

Lastly, the Will is another document that bears resemblance to the California Death of a Joint Tenant Affidavit. While a Will outlines an individual's wishes regarding the distribution of their assets upon death, the Death of a Joint Tenant Affidavit specifically addresses the transfer of property held in joint tenancy. If a joint tenant passes away, the surviving tenant may not need to reference the Will if the property automatically transfers. However, if the deceased had a Will, it may still play a role in the overall distribution of their estate, especially if other assets are involved.