The California Deed form shares similarities with the Quitclaim Deed. Both documents are used to transfer property ownership. However, a Quitclaim Deed does not guarantee that the person transferring the property has clear title. It simply conveys whatever interest the grantor has, if any. This makes it a quick way to transfer property, but it offers less protection to the buyer than a warranty deed would.

Another document that resembles the California Deed is the Warranty Deed. Unlike the Quitclaim Deed, a Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. If any issues arise regarding the title, the seller is responsible for resolving them. This added security makes Warranty Deeds more favorable for buyers.

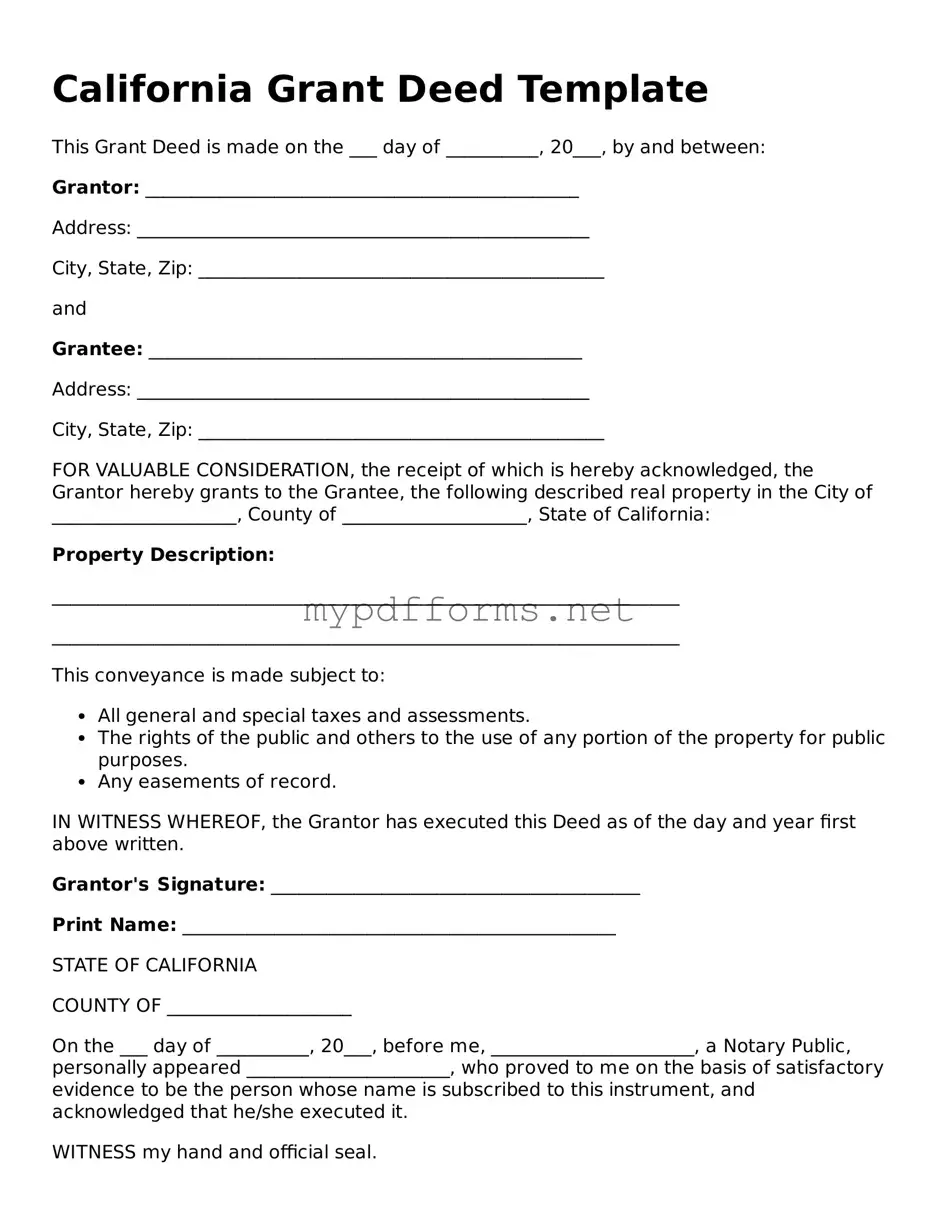

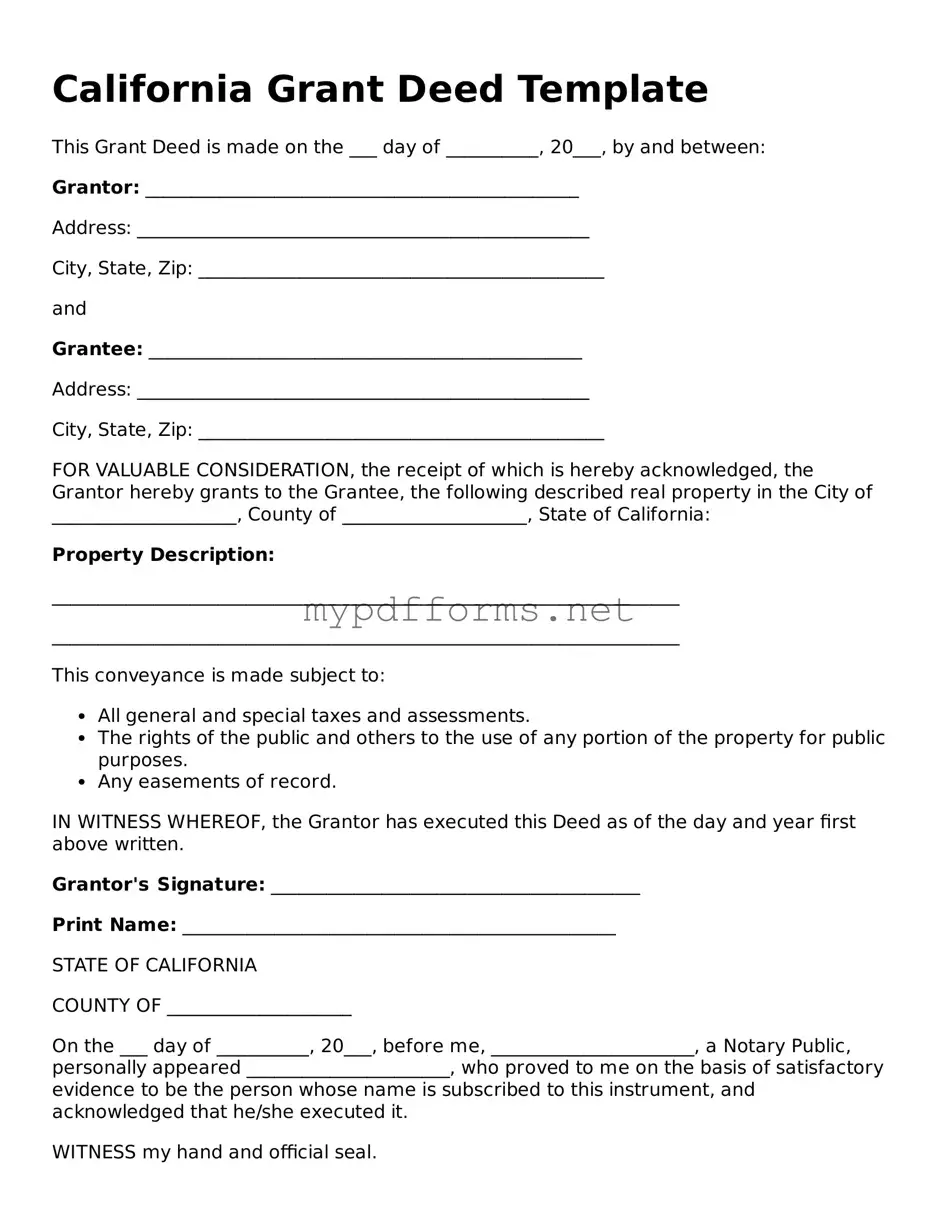

The Grant Deed is also similar to the California Deed. It transfers property ownership and includes certain warranties, but it is more limited than a Warranty Deed. A Grant Deed assures that the property has not been sold to anyone else and that there are no undisclosed encumbrances. It provides some level of protection, but not as comprehensive as a Warranty Deed.

The Bargain and Sale Deed is another document that shares characteristics with the California Deed. This type of deed implies that the seller has ownership of the property and the right to sell it, but it does not provide any warranties about the title. Buyers should be cautious, as they take on the risk of any title issues that may arise after the sale.

A Special Purpose Deed, such as a Trustee's Deed, is also similar. This deed is often used in situations like foreclosures or estate sales. It allows a trustee to transfer property on behalf of the owner, but it may not provide the same protections as a standard California Deed. Buyers should carefully review the terms to understand what they are getting.

The Reconveyance Deed is relevant in the context of mortgage transactions. It is used to transfer property back to the owner once a loan is paid off. While it serves a different purpose than a California Deed, it is still a legal document that signifies a change in property ownership, albeit in a more specific context.

For those looking to document the sale of a vehicle in North Carolina, it is essential to have a proper bill of sale. This ensures that both parties are clear about the terms of the transaction and protects their interests. To facilitate this process, you can download and fill out the form that meets the state's requirements.

The Affidavit of Death is another document that can be related to property transfers. When a property owner passes away, this affidavit can help facilitate the transfer of property to heirs without going through probate. While not a deed in the traditional sense, it plays a crucial role in the ownership transition process.

Lastly, the Bill of Sale is somewhat similar, but it is primarily used for personal property rather than real estate. It serves as proof of the transfer of ownership and includes details about the items being sold. While it does not deal with land or buildings, it shares the fundamental purpose of documenting a change in ownership.