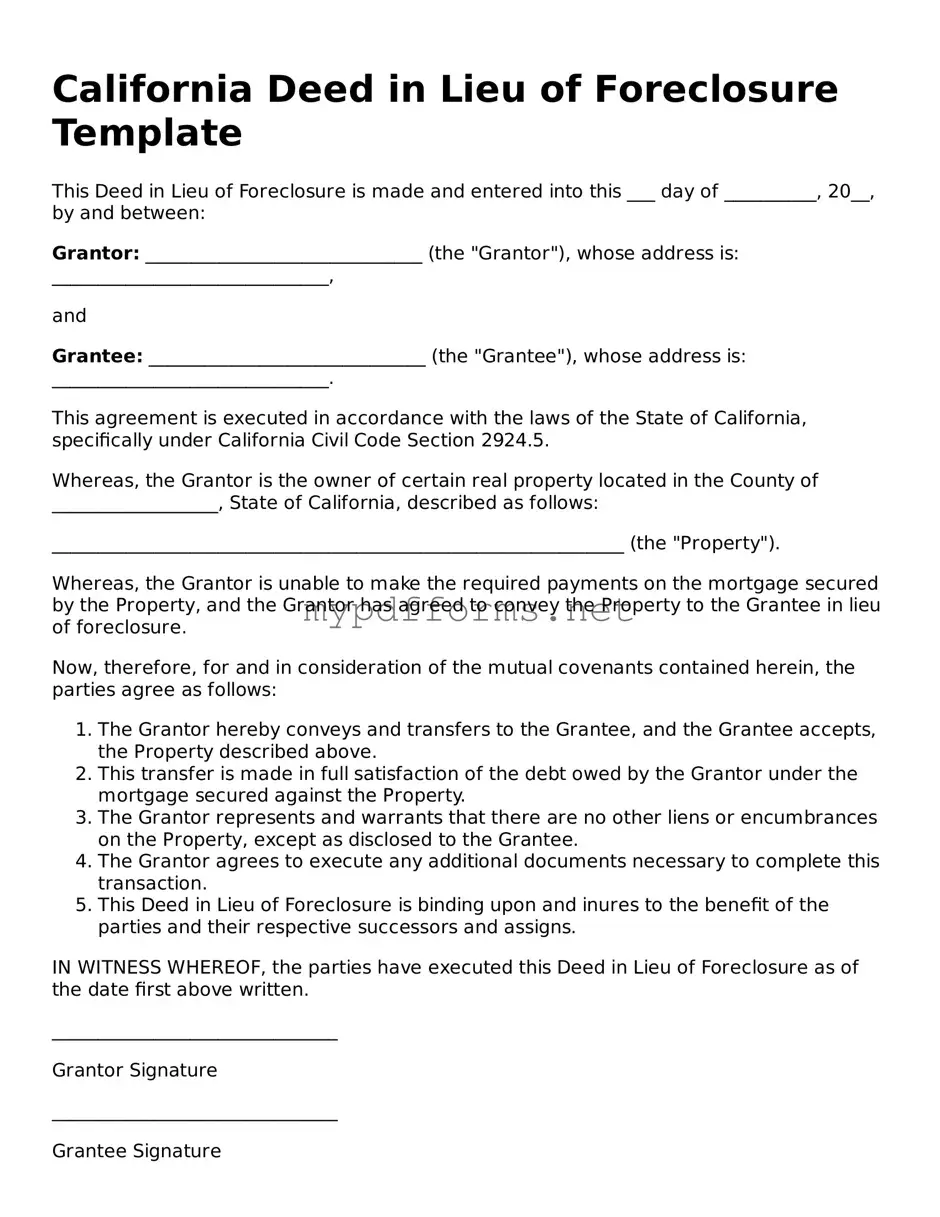

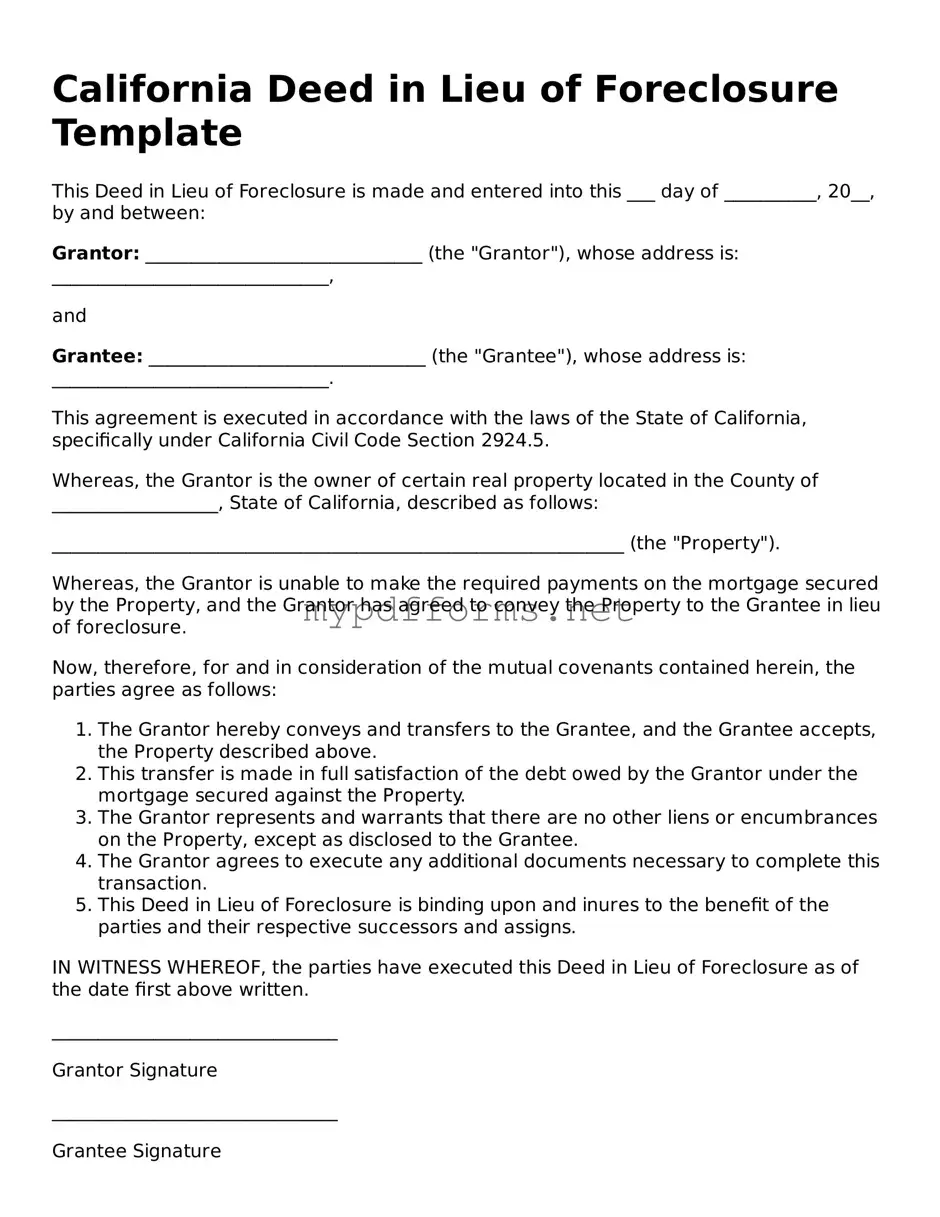

Attorney-Verified Deed in Lieu of Foreclosure Document for California

A California Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure. This option can provide a smoother resolution for both parties, potentially saving time and costs associated with the foreclosure process. If you're considering this option, take the first step by filling out the form below.

Click the button below to get started!

Modify Document Here

Attorney-Verified Deed in Lieu of Foreclosure Document for California

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Deed in Lieu of Foreclosure online in just a few steps.