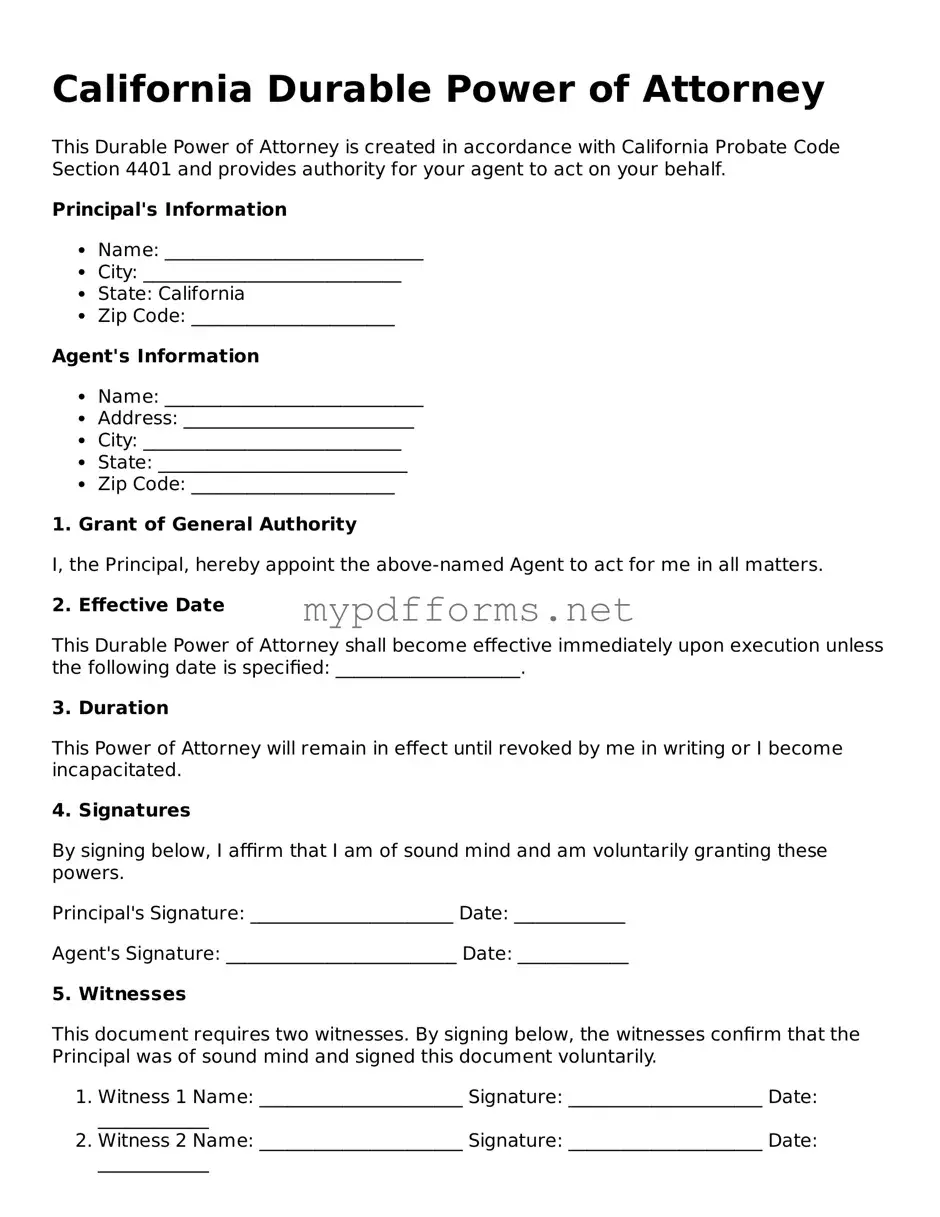

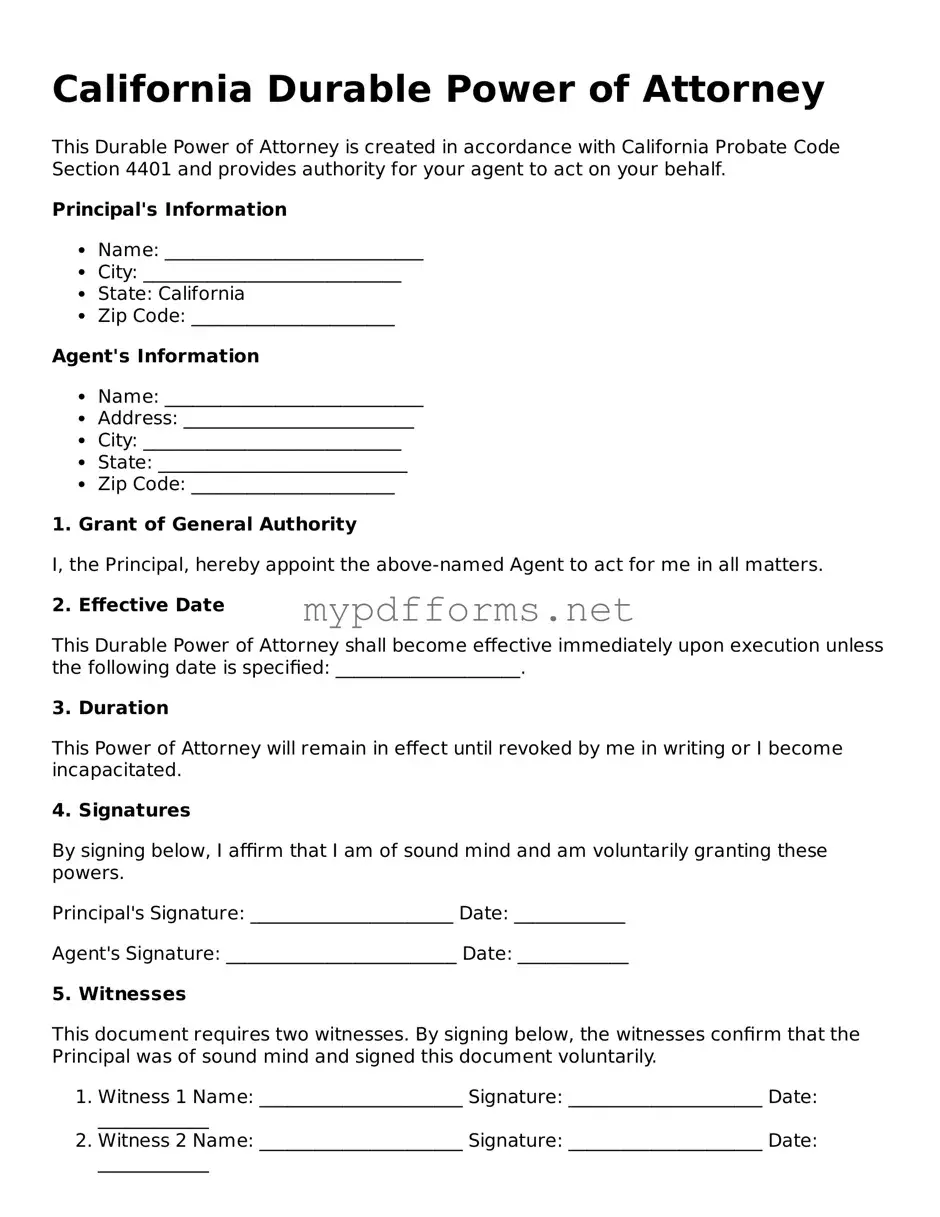

Attorney-Verified Durable Power of Attorney Document for California

A California Durable Power of Attorney form is a legal document that allows an individual to appoint someone else to make decisions on their behalf, particularly regarding financial and legal matters, even if they become incapacitated. This form ensures that your wishes are respected and that your affairs are managed by a trusted person during challenging times. Understanding how to properly fill out this form is essential for safeguarding your interests.

Take control of your future today! Fill out the Durable Power of Attorney form by clicking the button below.

Modify Document Here

Attorney-Verified Durable Power of Attorney Document for California

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Durable Power of Attorney online in just a few steps.