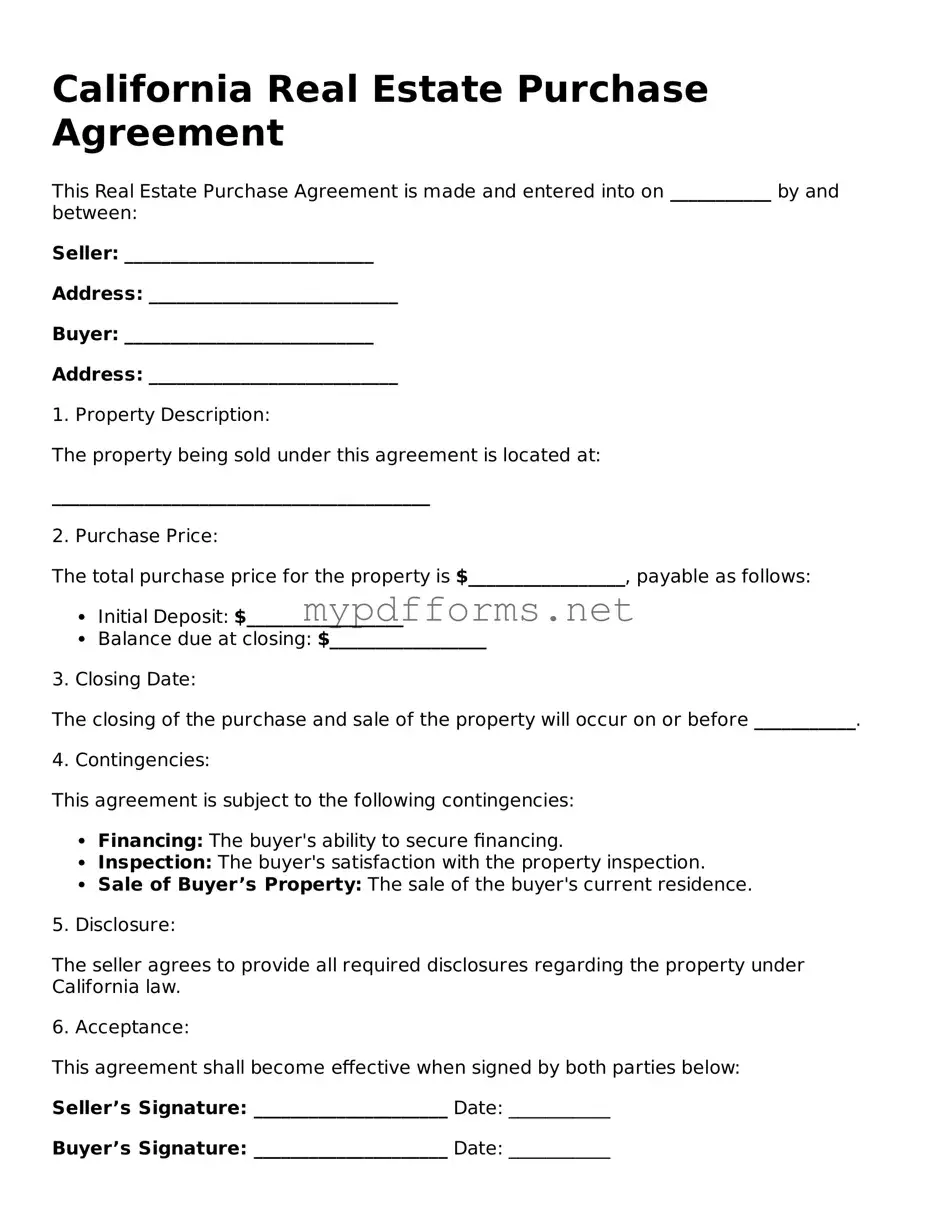

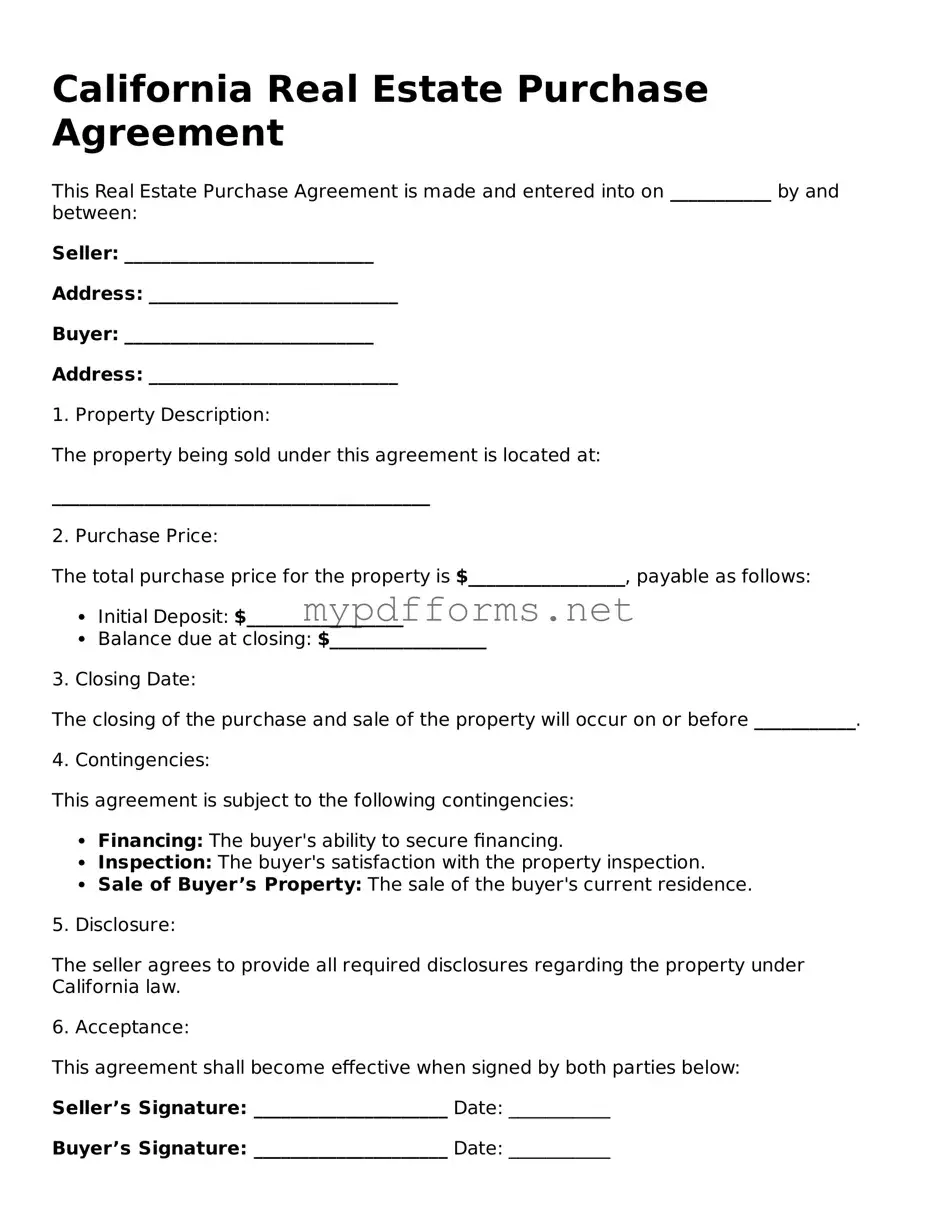

The California Real Estate Purchase Agreement (REPA) shares similarities with the Residential Purchase Agreement (RPA). Both documents serve as binding contracts between a buyer and a seller in real estate transactions. The RPA is specifically tailored for residential properties, outlining the terms of the sale, including purchase price, contingencies, and closing dates. Like the REPA, it aims to protect the interests of both parties while ensuring that all necessary disclosures and conditions are met prior to finalizing the sale.

Another document akin to the REPA is the Commercial Purchase Agreement. This agreement is designed for commercial real estate transactions, addressing unique aspects such as zoning laws and business operations. While the REPA focuses on residential properties, the Commercial Purchase Agreement includes provisions that cater to the complexities of commercial real estate, such as lease agreements and tenant rights. Both documents establish the framework for negotiations and detail the obligations of each party involved.

In addition to these essential documents, prospective buyers of motorcycles in Illinois should also be aware of the importance of having a proper legal record of the sale. The Illinois Motorcycle Bill of Sale provides a necessary framework to ensure a smooth transaction, encompassing vital details about both the buyer and seller. For more information and to access a template, visit motorcyclebillofsale.com/free-illinois-motorcycle-bill-of-sale.

The California Counteroffer form also bears resemblance to the REPA. A counteroffer is made when one party responds to an offer with modified terms. Similar to the REPA, it contains critical information such as price adjustments and changes to contingencies. The counteroffer allows for negotiation while keeping the original offer in play. Both documents play a crucial role in the negotiation process, ensuring that all parties have a clear understanding of the terms being discussed.

Lastly, the Listing Agreement is another document comparable to the REPA. This agreement is between a property owner and a real estate agent, authorizing the agent to represent the owner in selling the property. Like the REPA, it outlines the terms of the transaction, including the commission structure and duration of the agreement. While the REPA focuses on the sale between buyer and seller, the Listing Agreement is centered on the relationship between the seller and their agent, establishing expectations for the sale process.