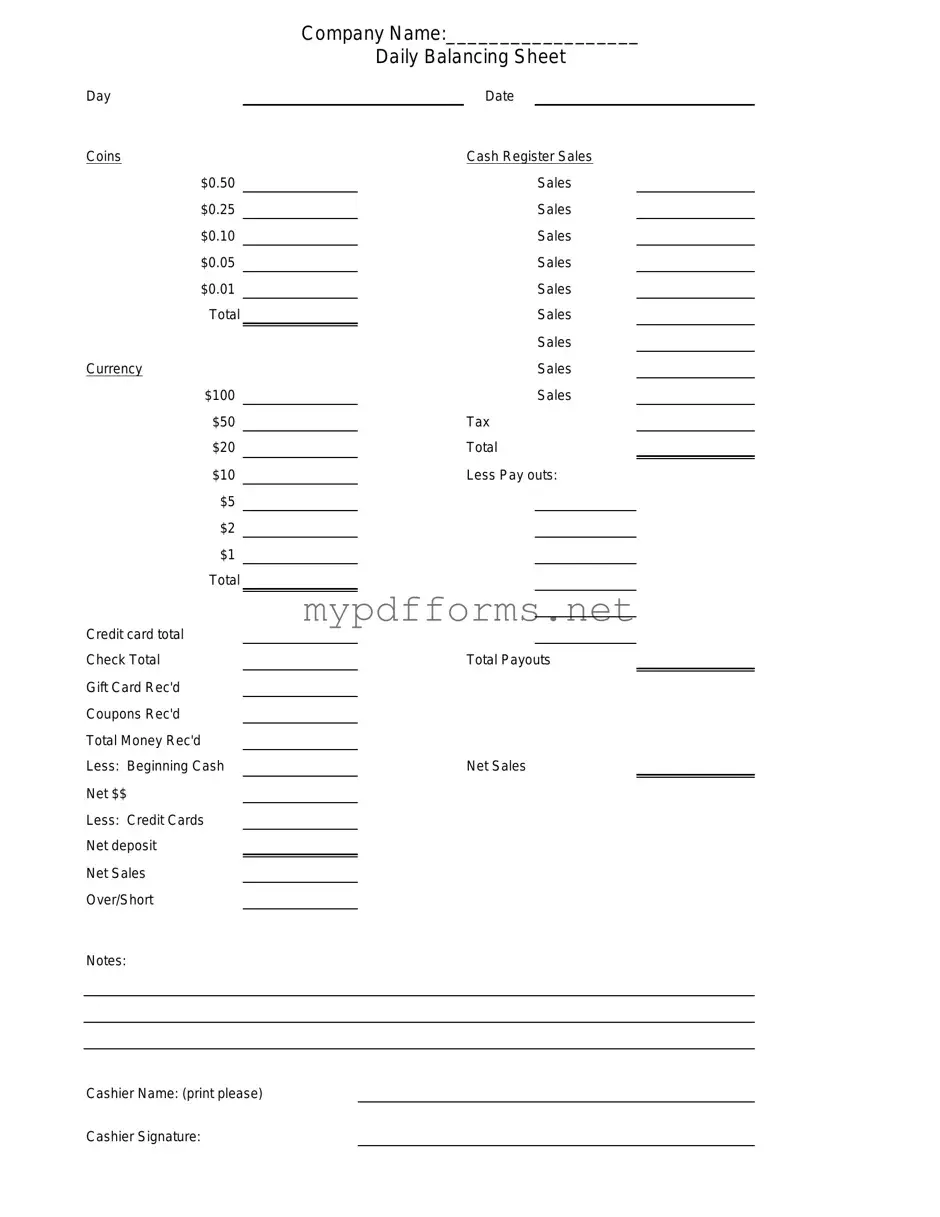

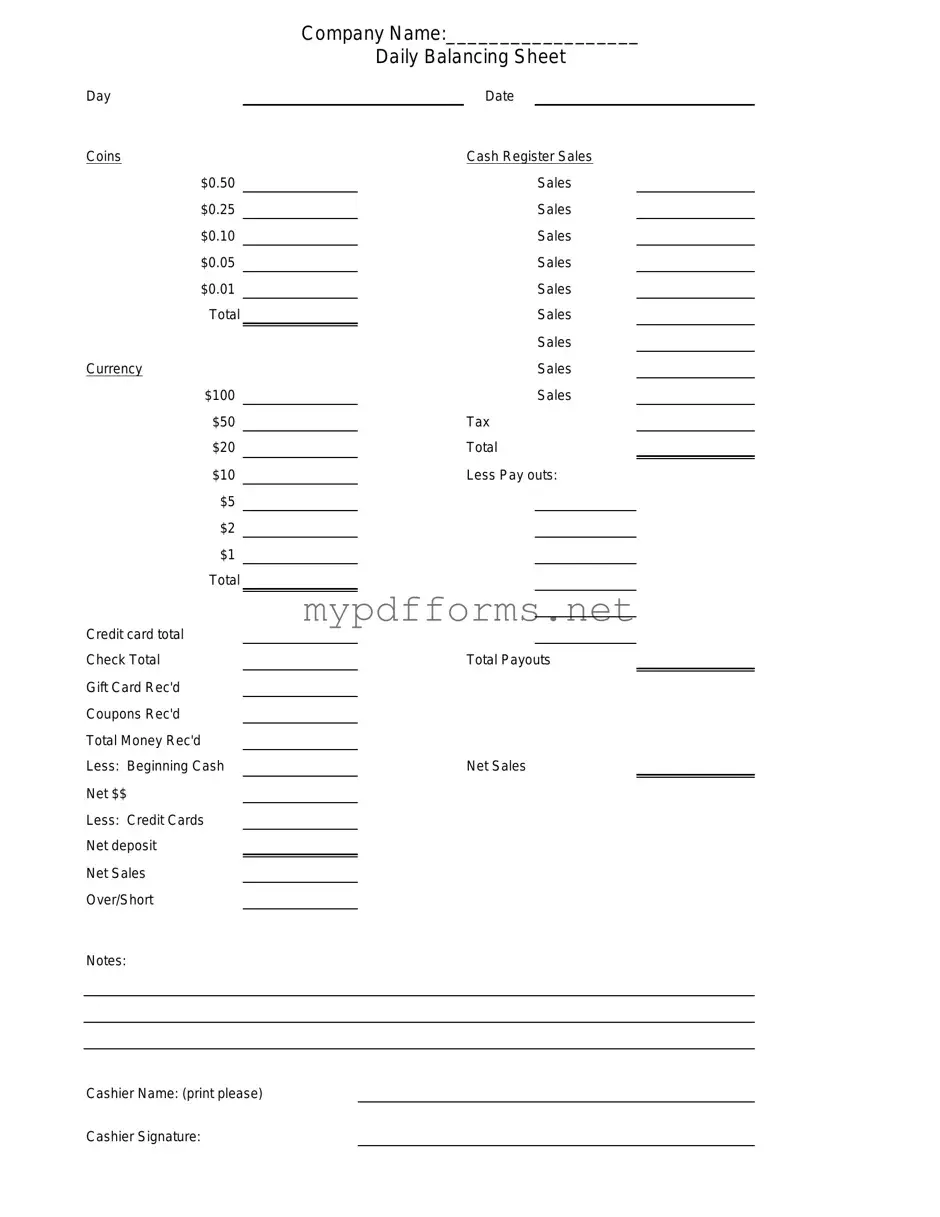

The Cash Register Reconciliation Report serves a similar purpose to the Cash Drawer Count Sheet. This document is used at the end of a business day to compare the cash collected against sales records. It helps to identify any discrepancies and ensures that all transactions are accounted for. Like the Cash Drawer Count Sheet, it requires meticulous attention to detail and accurate record-keeping to maintain financial integrity.

The Daily Sales Report is another document that aligns closely with the Cash Drawer Count Sheet. It summarizes the total sales made during a specific period, typically a day. This report provides an overview of revenue generated and can be cross-referenced with the cash drawer count to confirm that sales and cash on hand match. Both documents are essential for maintaining accurate financial records and tracking business performance.

The Petty Cash Log is also similar in function, as it tracks small cash transactions for minor expenses. This log records each withdrawal and replenishment, ensuring that petty cash is properly managed. Just like the Cash Drawer Count Sheet, it emphasizes the importance of accountability and transparency in financial dealings.

The Bank Deposit Slip is another related document. It is used when cash from the cash drawer is deposited into the bank. This slip provides a record of the amount being deposited and is often accompanied by the Cash Drawer Count Sheet to verify that the cash being deposited matches the cash on hand. Both documents are vital for reconciling cash flow and maintaining accurate financial records.

The Inventory Count Sheet shares similarities as well. While it focuses on physical inventory rather than cash, it requires a systematic approach to counting and recording. Just like the Cash Drawer Count Sheet, it aims to ensure accuracy and accountability, helping businesses keep track of their assets and manage losses effectively.

The Expense Report also bears resemblance to the Cash Drawer Count Sheet. This document records business expenses incurred over a specific period. It requires careful documentation and justification of each expense, similar to how cash transactions are documented in the Cash Drawer Count Sheet. Both documents play a crucial role in financial reporting and budgeting.

The Sales Receipt serves a functional purpose akin to the Cash Drawer Count Sheet. Each sales receipt provides a detailed account of individual transactions, including the amount paid and method of payment. This documentation supports the figures reported on the Cash Drawer Count Sheet, reinforcing the accuracy of financial records and enhancing customer transparency.

To protect your financial interests, it is advisable to review the Maryland Durable Power of Attorney guidelines as you prepare for unforeseen circumstances. This document empowers chosen representatives to act on your behalf, and you can find more information by visiting this comprehensive Durable Power of Attorney resource.

Lastly, the Cash Flow Statement is similar in that it provides an overview of cash inflows and outflows over a specific period. This document helps businesses understand their liquidity and financial health. While the Cash Drawer Count Sheet focuses on immediate cash on hand, the Cash Flow Statement offers a broader perspective on cash management, making both essential for effective financial oversight.