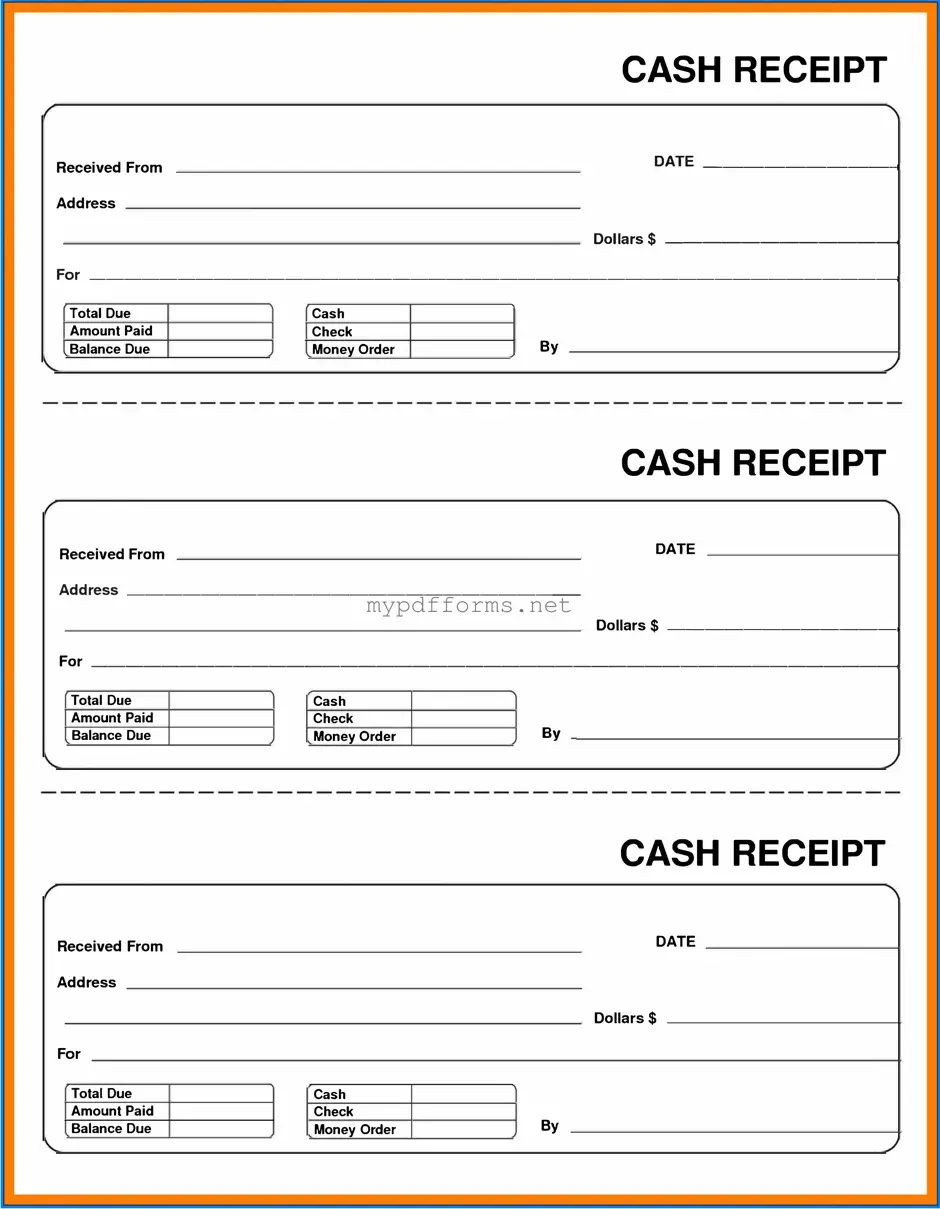

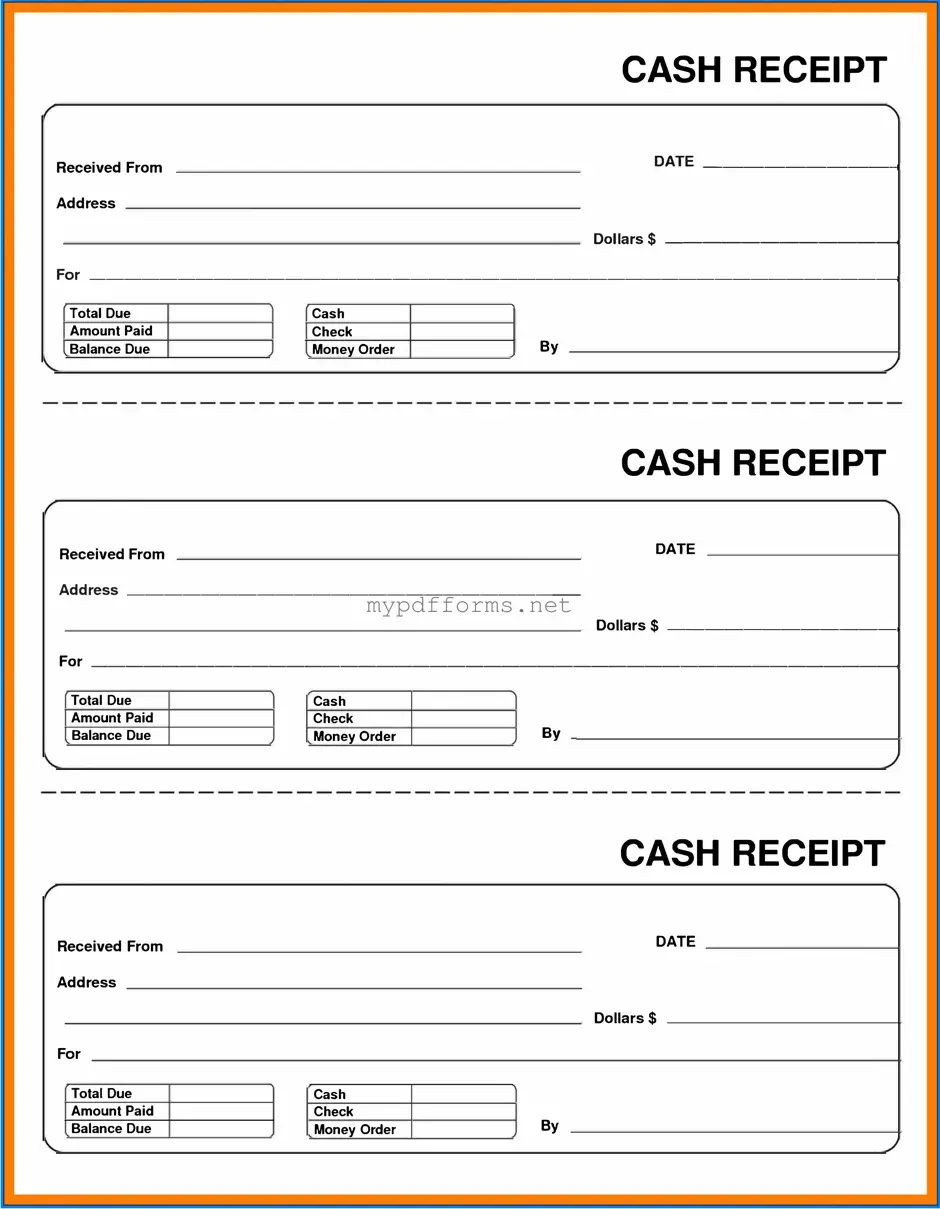

The Cash Receipt form is akin to an Invoice, which serves as a request for payment from a buyer to a seller. While an invoice outlines the goods or services provided, detailing the amounts due, a cash receipt confirms that payment has been received. Both documents play a crucial role in tracking financial transactions, but the cash receipt is primarily focused on the acknowledgment of payment, whereas the invoice is about the request for it.

Another document similar to the Cash Receipt form is the Sales Receipt. This document is issued at the point of sale and provides proof of purchase for the buyer. Like a cash receipt, a sales receipt confirms that a transaction has occurred and payment has been made. However, a sales receipt often includes additional information such as item descriptions and quantities, making it a comprehensive record of the sale.

A Payment Voucher is also comparable to the Cash Receipt form. This document serves as a record that a payment has been authorized and processed. While the cash receipt confirms receipt of funds, the payment voucher is more about the approval of the transaction, often used in business settings to manage outgoing payments. Both documents are essential for maintaining accurate financial records but serve different roles in the payment process.

The Deposit Slip is another document that shares similarities with the Cash Receipt form. When cash or checks are deposited into a bank account, a deposit slip is filled out to record the transaction. This document serves as proof that funds have been deposited, much like a cash receipt confirms that payment has been received. Both documents are vital for tracking cash flow and ensuring that financial records align with bank statements.

Understanding the importance of documentation in transactions, such as the Dirt Bike Bill of Sale form, is essential for both buyers and sellers. This form is not only a legal requirement but also serves as a reassurance of ownership transfer. Further insights and access to relevant forms can be found at newyorkpdfdocs.com, which provides resources for ensuring smooth and legitimate transactions in similar circumstances.

In addition, the Credit Note is closely related to the Cash Receipt form. A credit note is issued when a refund is processed, indicating that a customer has returned goods or services. While a cash receipt confirms the receipt of payment, a credit note acknowledges a reversal of that payment. Both documents are critical for managing customer accounts and ensuring accurate financial reporting.

The Receipt Acknowledgment form is another document that resembles the Cash Receipt form. This form is often used in transactions involving multiple parties, where one party acknowledges receipt of funds or goods from another. Like the cash receipt, it serves as proof of a transaction, but it may involve additional parties and can be more complex in nature. Both documents are vital for maintaining transparency in financial dealings.

The Expense Report can also be considered similar to the Cash Receipt form. This document is used to track expenditures made by employees on behalf of the company. While a cash receipt verifies that a specific payment has been received, an expense report details the amounts spent and often requires accompanying receipts. Both documents are important for financial accountability and budgeting within an organization.

Lastly, the Purchase Order can be likened to the Cash Receipt form. A purchase order is created before a transaction occurs, serving as a formal request to buy goods or services. It outlines the details of the order and is used to initiate the purchasing process. In contrast, the cash receipt confirms that the transaction has been completed. Both documents are integral to the purchasing process, ensuring that financial records are accurate and that both parties are in agreement about the terms of the transaction.