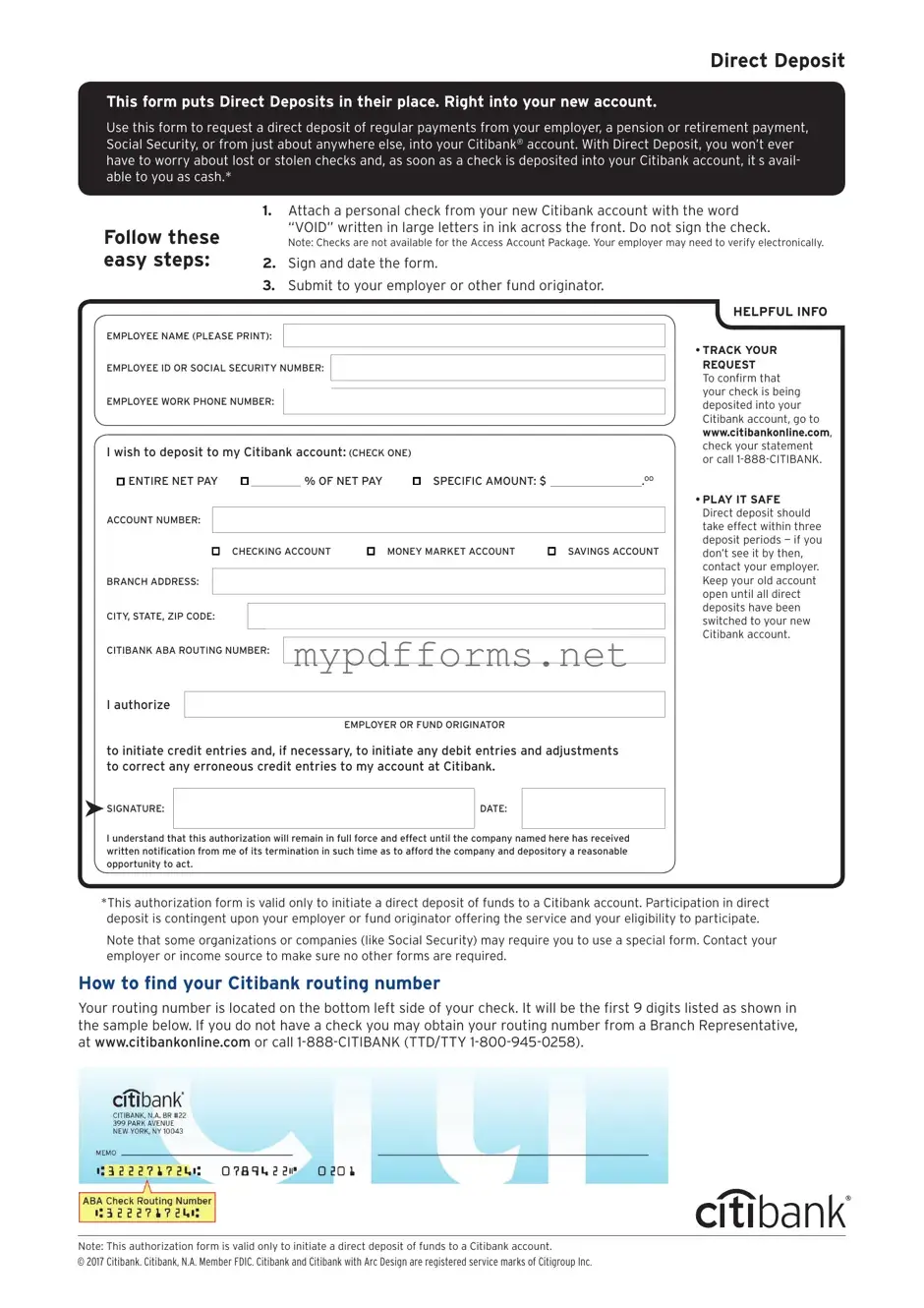

The Citibank Direct Deposit form shares similarities with a Payroll Authorization form. Both documents are designed to facilitate the automatic transfer of funds from an employer to an employee's bank account. In essence, they serve to streamline the payment process, ensuring that employees receive their wages directly into their bank accounts without the need for physical checks. The Payroll Authorization form typically includes details such as the employee's banking information and authorization for the employer to initiate these transfers, much like the Citibank form.

For anyone involved in motorcycling transactions, the proper documentation is crucial, and understanding the significance of the Illinois Forms can greatly aid in ensuring a smooth ownership transfer process. This legal document solidifies the sale agreement between the parties and helps to avoid any disputes in the future.

Another document that resembles the Citibank Direct Deposit form is the Automatic Payment Authorization form. This form is used to set up recurring payments, such as utility bills or loan payments, directly from a bank account. Similar to the direct deposit form, it requires the account holder's banking details and consent to withdraw funds on a specified schedule. Both forms aim to simplify financial transactions and ensure timely payments without manual intervention.

The Bank Account Verification form also bears a resemblance to the Citibank Direct Deposit form. This document is often used by employers to confirm an employee's banking information before setting up direct deposits. While the Citibank form is focused on initiating deposits, the Bank Account Verification form ensures accuracy and security by validating the account details provided. Both forms help prevent errors in transactions, promoting a smooth payment process.

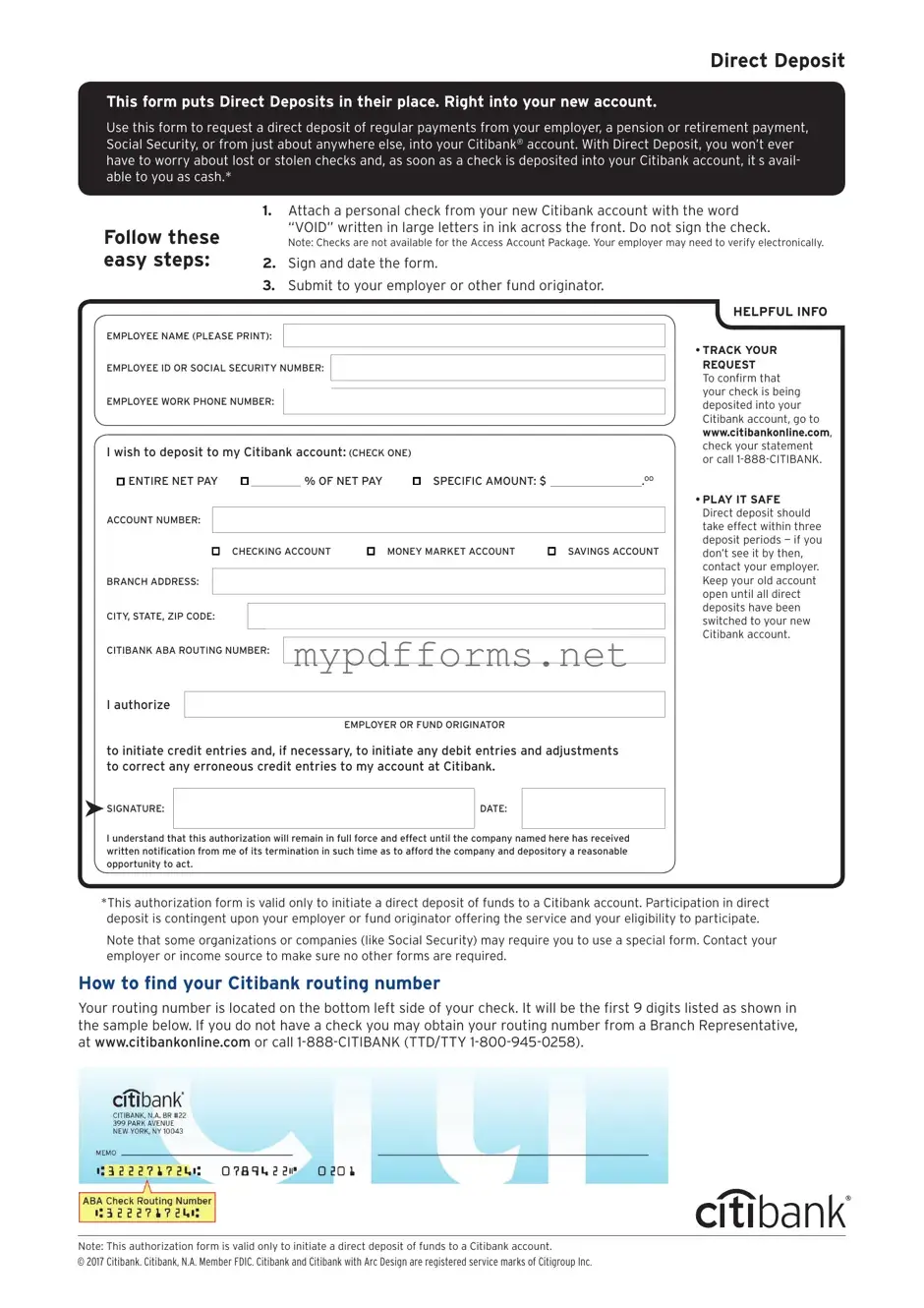

Additionally, the Direct Deposit Enrollment form is closely related to the Citibank Direct Deposit form. This enrollment form is specifically designed for employees to register their bank accounts for direct deposit. It collects similar information, such as account numbers and routing numbers, and requires the employee’s signature to authorize the direct deposit. The primary purpose of both forms is to ensure that funds are deposited correctly and efficiently into the designated accounts.

Lastly, the W-4 form, while primarily a tax document, is similar in that it requires personal and financial information from the employee. The W-4 form is used to determine the amount of federal income tax withholding from an employee's paycheck. Like the Citibank Direct Deposit form, it is essential for accurate payroll processing. Both documents require careful attention to detail to ensure that financial transactions, whether deposits or tax withholdings, are handled correctly and in compliance with regulations.