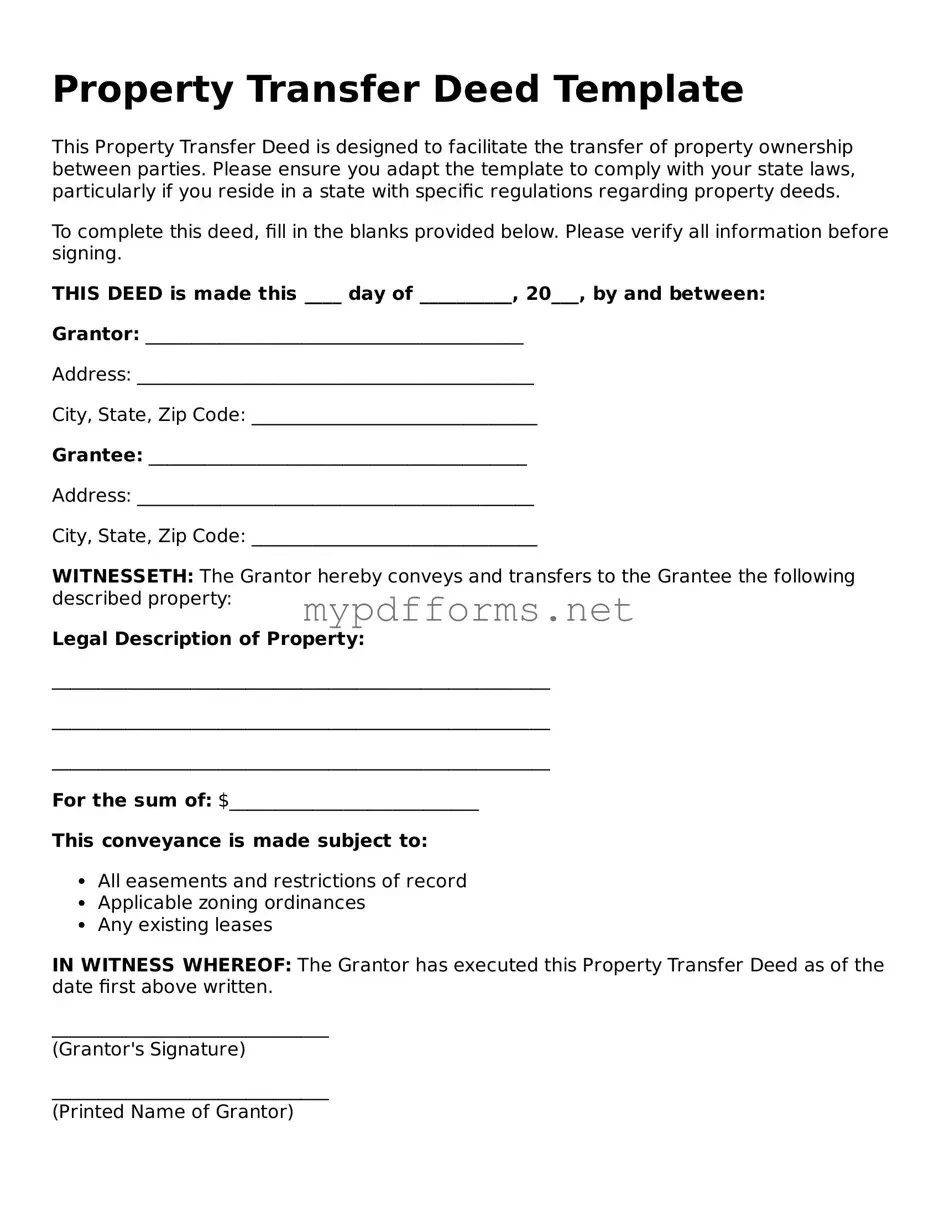

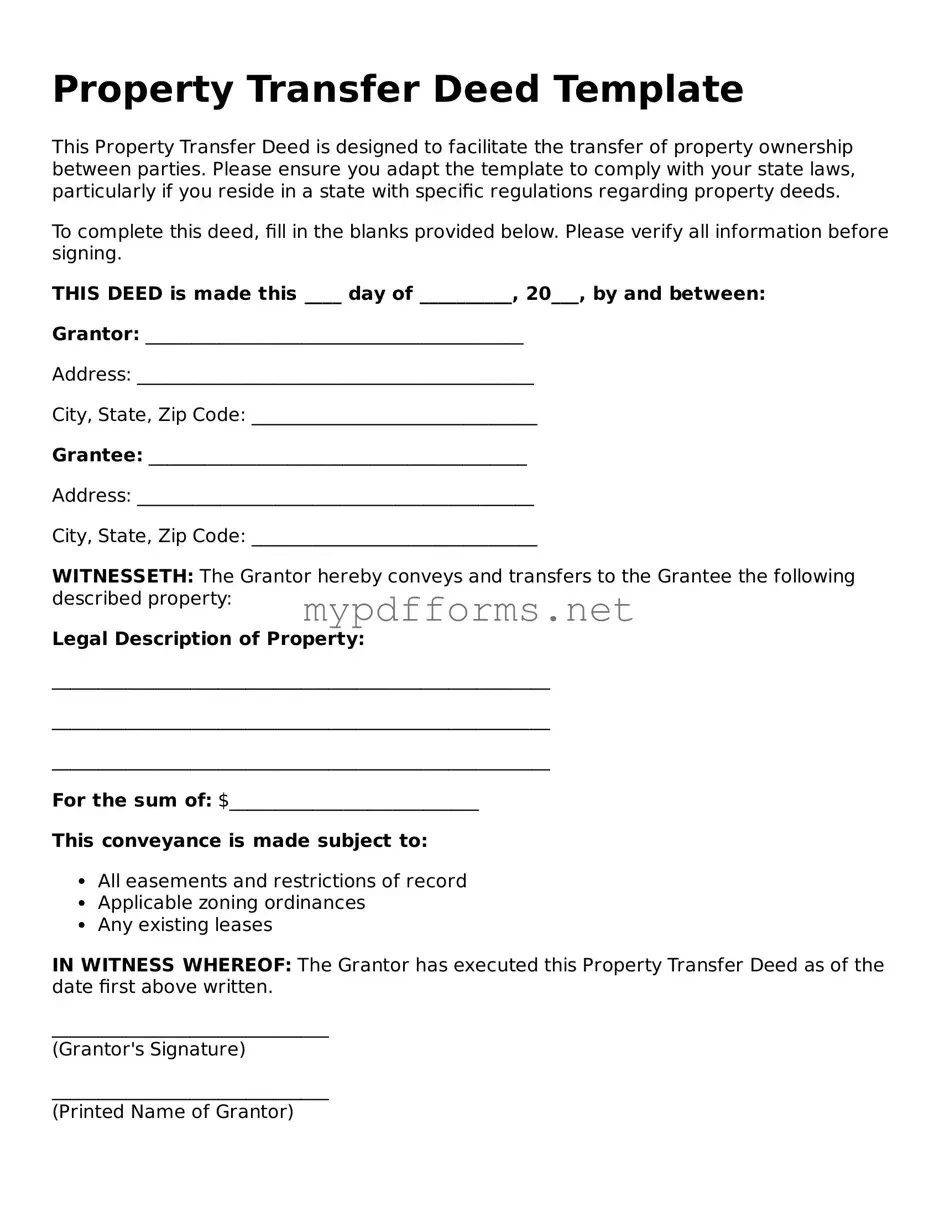

Deed Template

A deed form is a legal document that serves to transfer ownership of property from one party to another. This essential tool ensures that the transaction is recorded and recognized by law, providing clarity and security for both the buyer and the seller. If you're ready to take the next step in your property transaction, fill out the form by clicking the button below.

Modify Document Here

Deed Template

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Deed online in just a few steps.