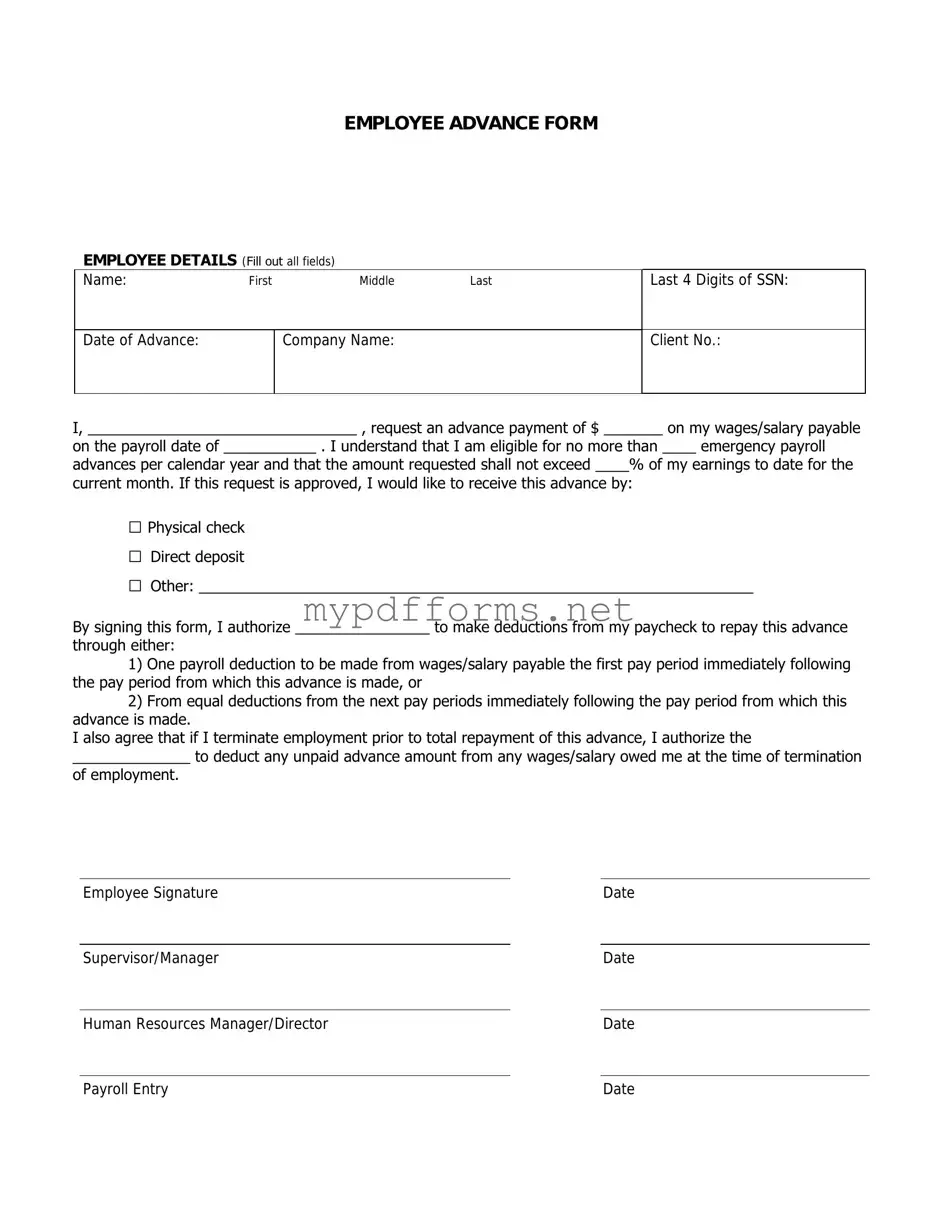

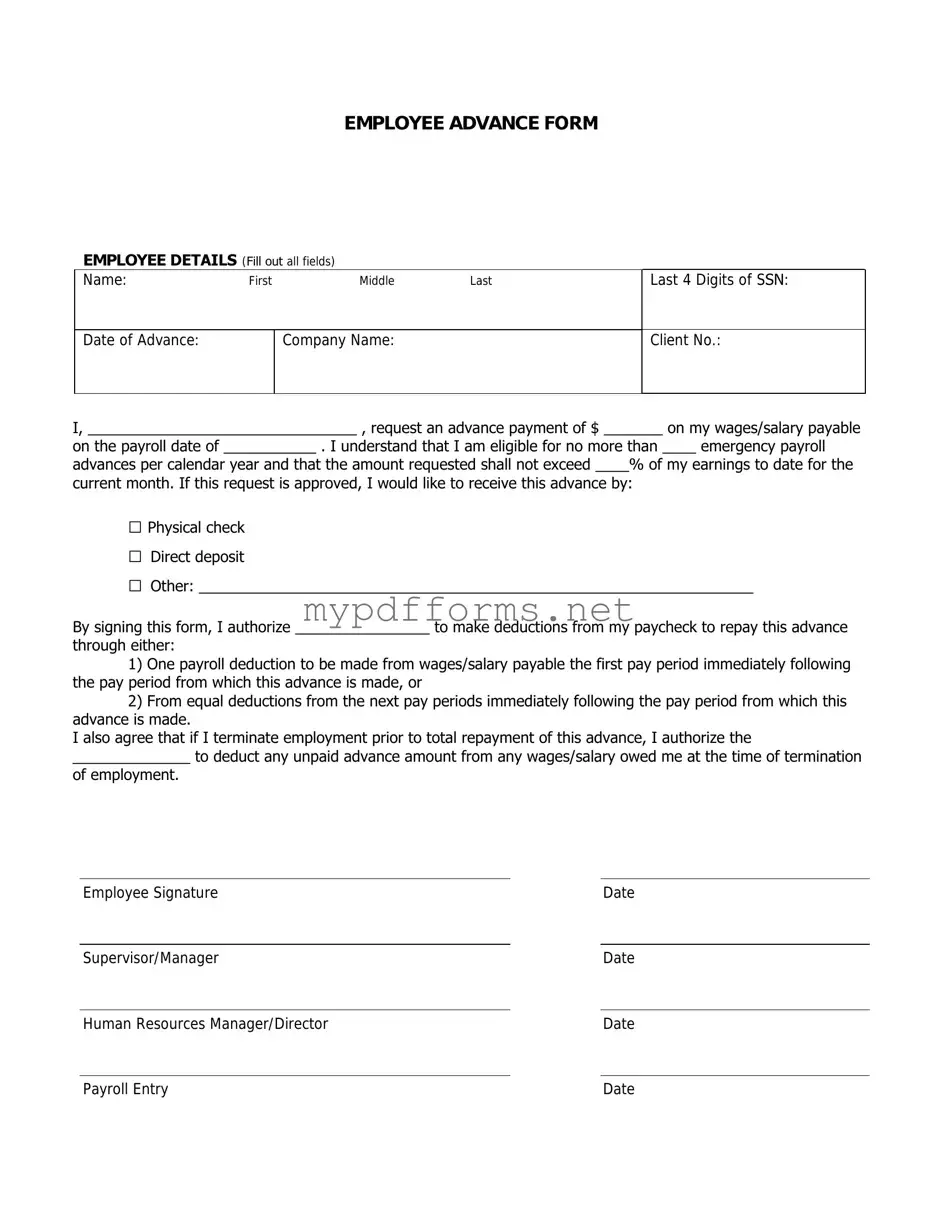

Get Employee Advance Form in PDF

The Employee Advance form is a document that allows employees to request an advance on their wages for various reasons, such as unexpected expenses or emergencies. This form ensures that employees have a streamlined process for obtaining financial assistance while maintaining transparency with their employer. If you need to request an advance, be sure to fill out the form by clicking the button below.

Modify Document Here

Get Employee Advance Form in PDF

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Employee Advance online in just a few steps.