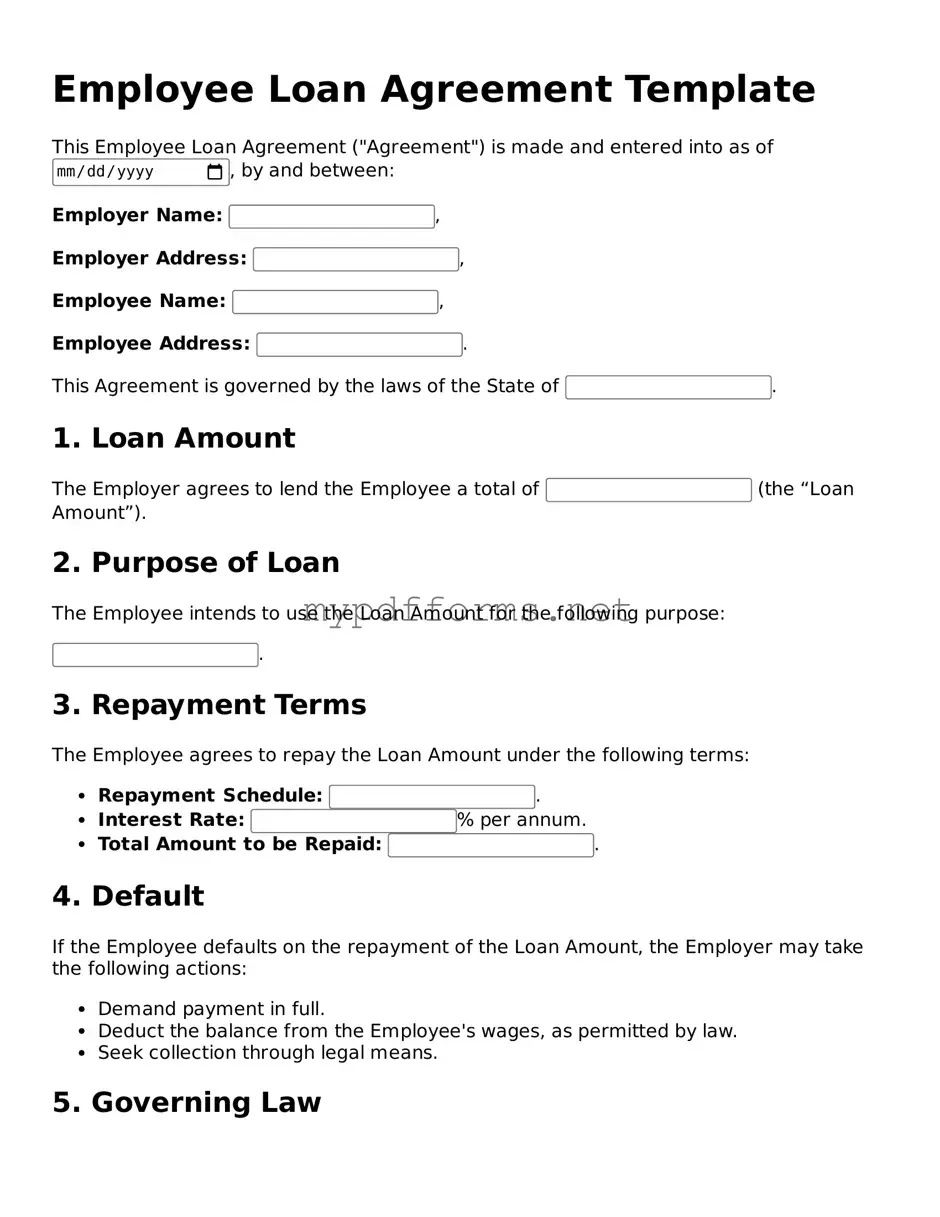

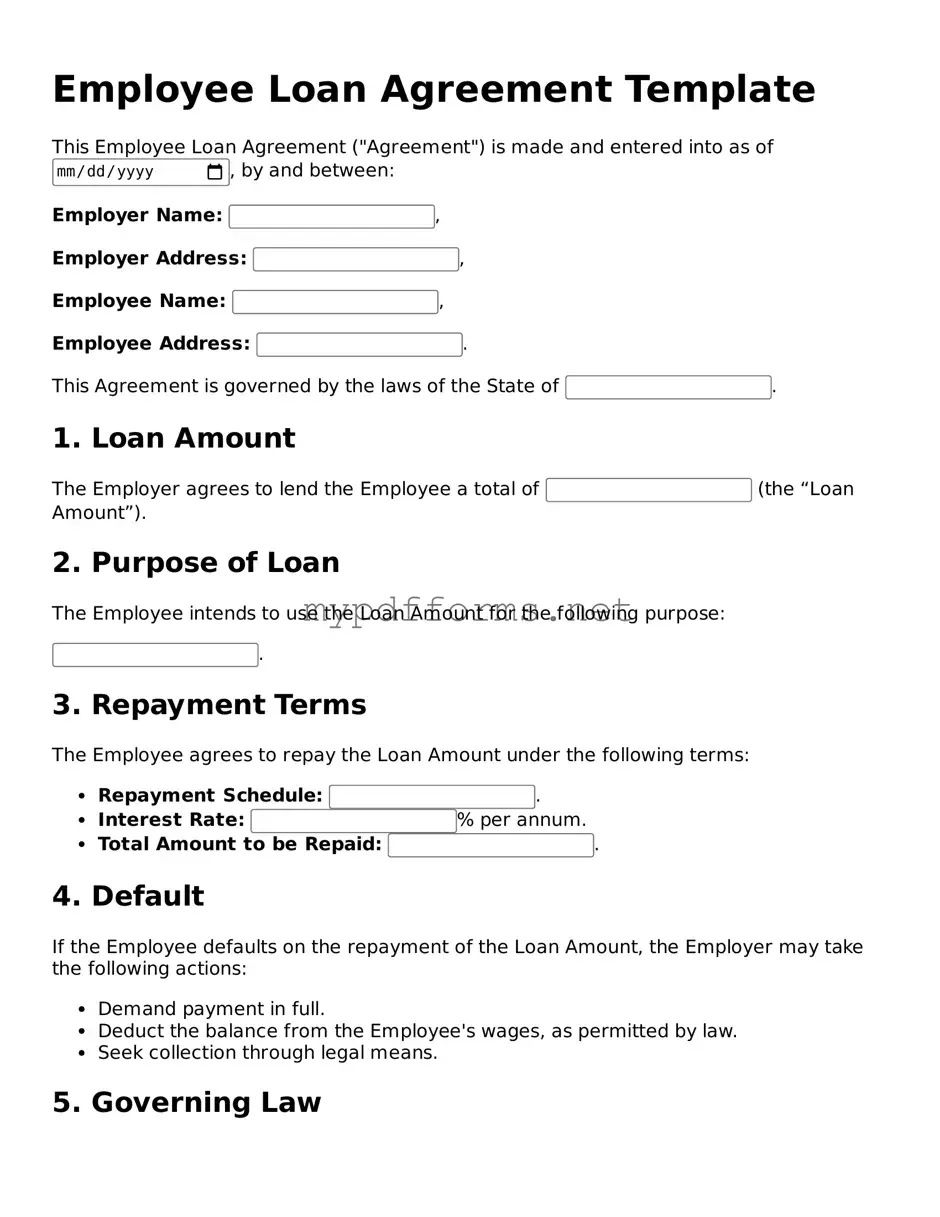

The Employee Loan Agreement is similar to a Personal Loan Agreement. Both documents outline the terms under which a borrower receives funds from a lender. They detail the loan amount, interest rate, repayment schedule, and consequences of default. The primary difference lies in the relationship between the parties involved; a Personal Loan Agreement typically involves a financial institution, while an Employee Loan Agreement is between an employer and an employee.

The Loan Agreement form provides vital structure in financial transactions, similar to various other contracts that outline responsibilities and terms between parties. For those seeking further information or a customizable template for such agreements, resources like https://formcalifornia.com can be quite beneficial, ensuring a clear understanding of obligations and protecting the interests of both lenders and borrowers.

Another similar document is the Promissory Note. This legal document serves as a written promise to repay a specified amount of money under agreed-upon terms. Like the Employee Loan Agreement, it includes details about the loan amount, interest rate, and repayment terms. However, a Promissory Note may not always require the same level of detail regarding the relationship between the borrower and lender.

The Loan Application Form shares similarities with the Employee Loan Agreement. Both documents require the borrower to provide personal and financial information. They also assess the borrower’s ability to repay the loan. While the Employee Loan Agreement focuses on the terms of a specific loan, the Loan Application Form is used to evaluate eligibility for various types of loans.

A Credit Agreement is another document that resembles the Employee Loan Agreement. This agreement outlines the terms of a credit arrangement between a lender and a borrower. It includes details about the credit limit, interest rates, and repayment conditions. Both documents aim to protect the interests of the lender while ensuring that the borrower understands their obligations.

The Loan Repayment Plan is also akin to the Employee Loan Agreement. This plan specifies how a borrower will repay the loan over time, detailing installment amounts and due dates. Like the Employee Loan Agreement, it aims to establish clear expectations for both parties regarding repayment. However, the Loan Repayment Plan may be more focused on the schedule rather than the initial loan terms.

A Security Agreement may resemble the Employee Loan Agreement in cases where collateral is involved. This document outlines the collateral that secures a loan, providing the lender with rights to the asset if the borrower defaults. While the Employee Loan Agreement typically does not require collateral, both documents share the purpose of ensuring repayment and protecting the lender’s interests.

Lastly, a Mortgage Agreement can be compared to the Employee Loan Agreement, especially when it comes to the structure and terms. Both documents detail the amount borrowed, interest rates, and repayment terms. However, a Mortgage Agreement specifically pertains to real estate transactions, whereas the Employee Loan Agreement focuses on loans provided to employees for personal use.