The Florida Deed form is closely related to the Quitclaim Deed. Both documents serve the purpose of transferring ownership of real estate from one party to another. However, the Quitclaim Deed is unique in that it transfers whatever interest the grantor has in the property, without guaranteeing that the title is clear. This means that if there are any liens or other claims against the property, the grantee may inherit those issues. It’s often used in situations where the parties know each other well, such as family transfers or divorces.

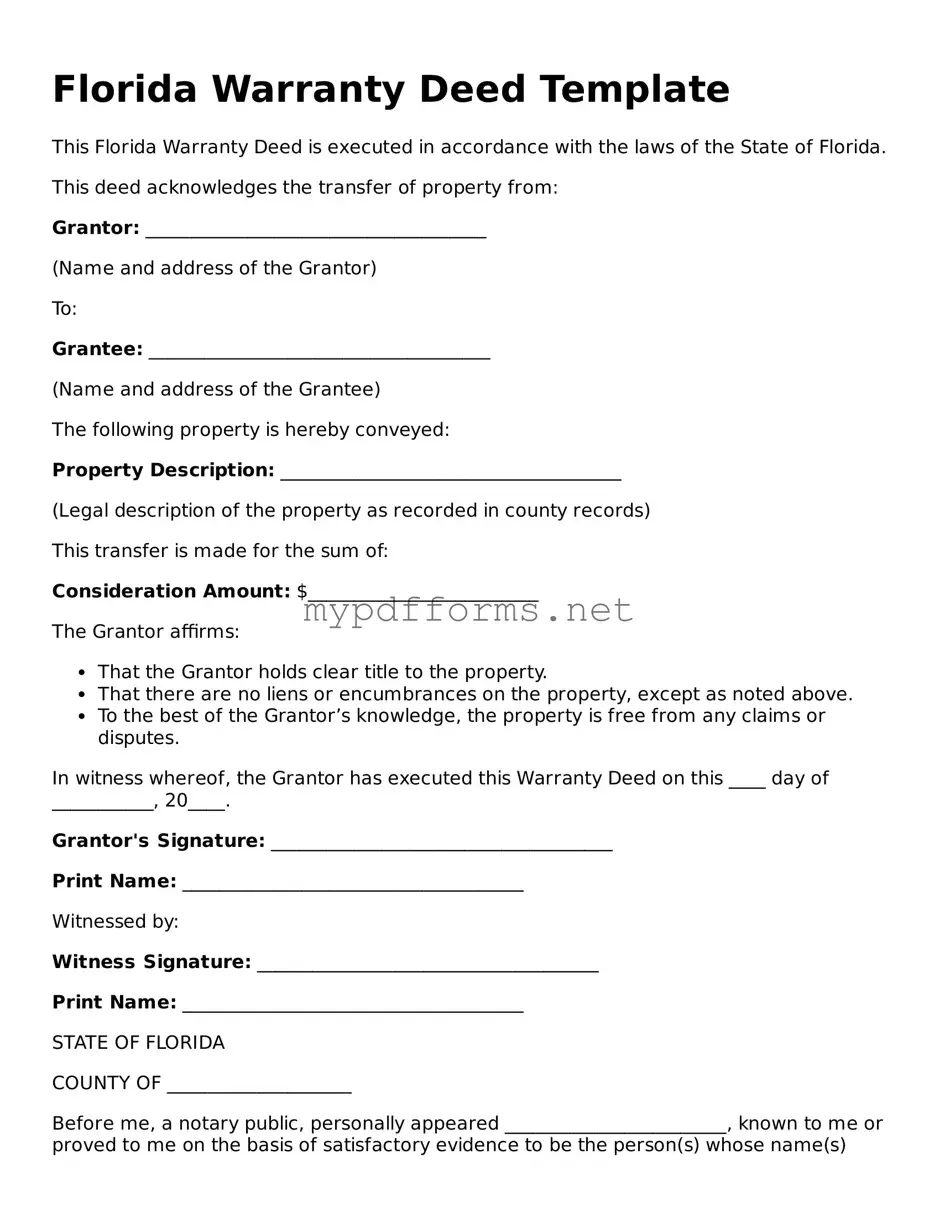

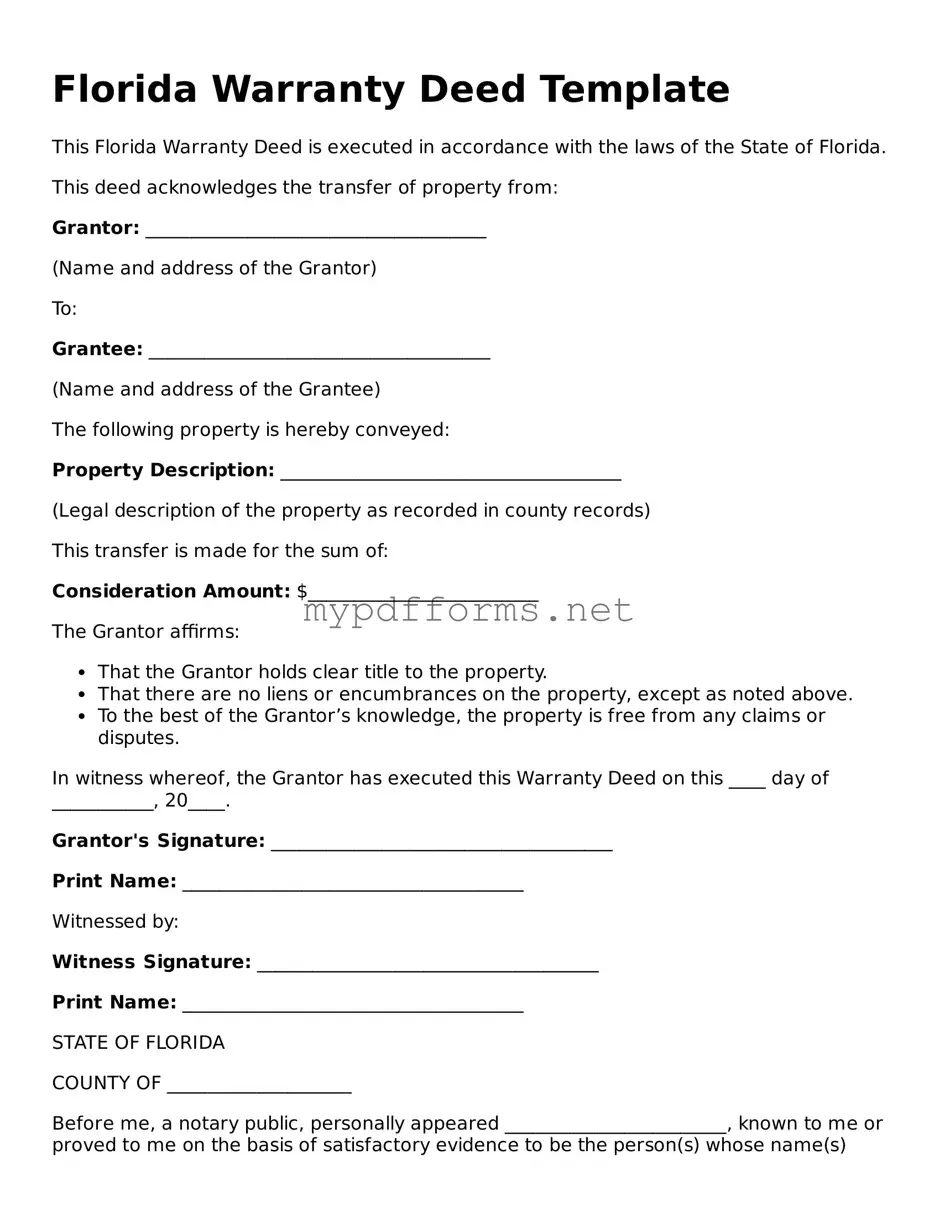

Another document similar to the Florida Deed is the Warranty Deed. Unlike the Quitclaim Deed, a Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. This means that if any issues arise with the title after the sale, the seller is responsible for resolving them. This added layer of security makes Warranty Deeds a preferred choice in most real estate transactions, especially those involving buyers who want assurance of their investment.

The Bargain and Sale Deed is another document that shares similarities with the Florida Deed. This type of deed implies that the grantor has ownership of the property and the right to sell it, but it does not provide the same guarantees as a Warranty Deed. The grantee receives whatever interest the grantor has, but without the assurance that the title is free from encumbrances. This type of deed is often used in foreclosure sales or tax lien sales, where the seller may not have complete knowledge of the property's title status.

The Special Purpose Deed is yet another document that resembles the Florida Deed. This type of deed is used for specific purposes, such as transferring property between family members or in a trust. It may have certain restrictions or conditions attached to the transfer. While it serves the same fundamental purpose of transferring property ownership, the Special Purpose Deed is tailored to meet the unique needs of the transaction, often reflecting the specific circumstances surrounding the transfer.

A Trust Deed also shares characteristics with the Florida Deed, particularly in how it facilitates the transfer of property. In a Trust Deed, the property is transferred to a trustee, who holds it for the benefit of a third party, known as the beneficiary. This arrangement can provide certain protections and benefits, especially in estate planning. While it serves a different function than a standard Florida Deed, it still involves the transfer of real estate ownership, albeit under different legal frameworks.

In navigating the complexities of property transfers, it's essential to have a solid understanding of various deed forms. For instance, the Illinois Forms provide a valuable resource for those dealing with legal documentation, ensuring that the necessary forms are readily available to facilitate proper adherence to state laws and regulations.

The Mortgage Deed is another document that relates to the Florida Deed, albeit in a different context. A Mortgage Deed is used when a borrower takes out a loan to purchase property. The borrower conveys a security interest in the property to the lender, which means that if the borrower fails to repay the loan, the lender can take possession of the property. While this document does not transfer ownership outright, it establishes a legal claim on the property, connecting it to the broader framework of property transactions.

Lastly, the Bill of Sale can be considered similar in that it facilitates the transfer of ownership, though it typically applies to personal property rather than real estate. A Bill of Sale is a legal document that records the sale of tangible items, such as vehicles or equipment. While it does not deal with land or real estate, it serves the same purpose of documenting a transfer of ownership and protecting the rights of both parties involved in the transaction.