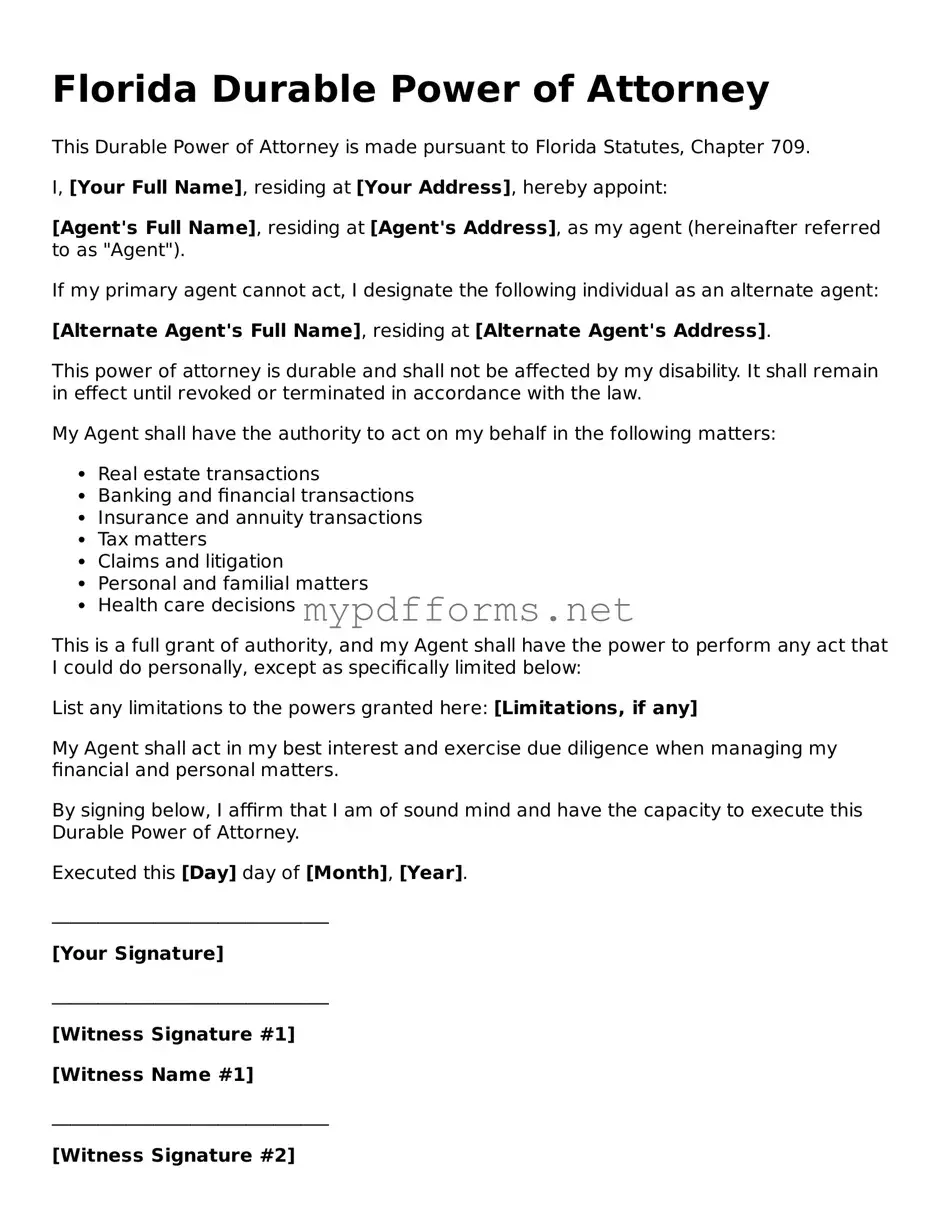

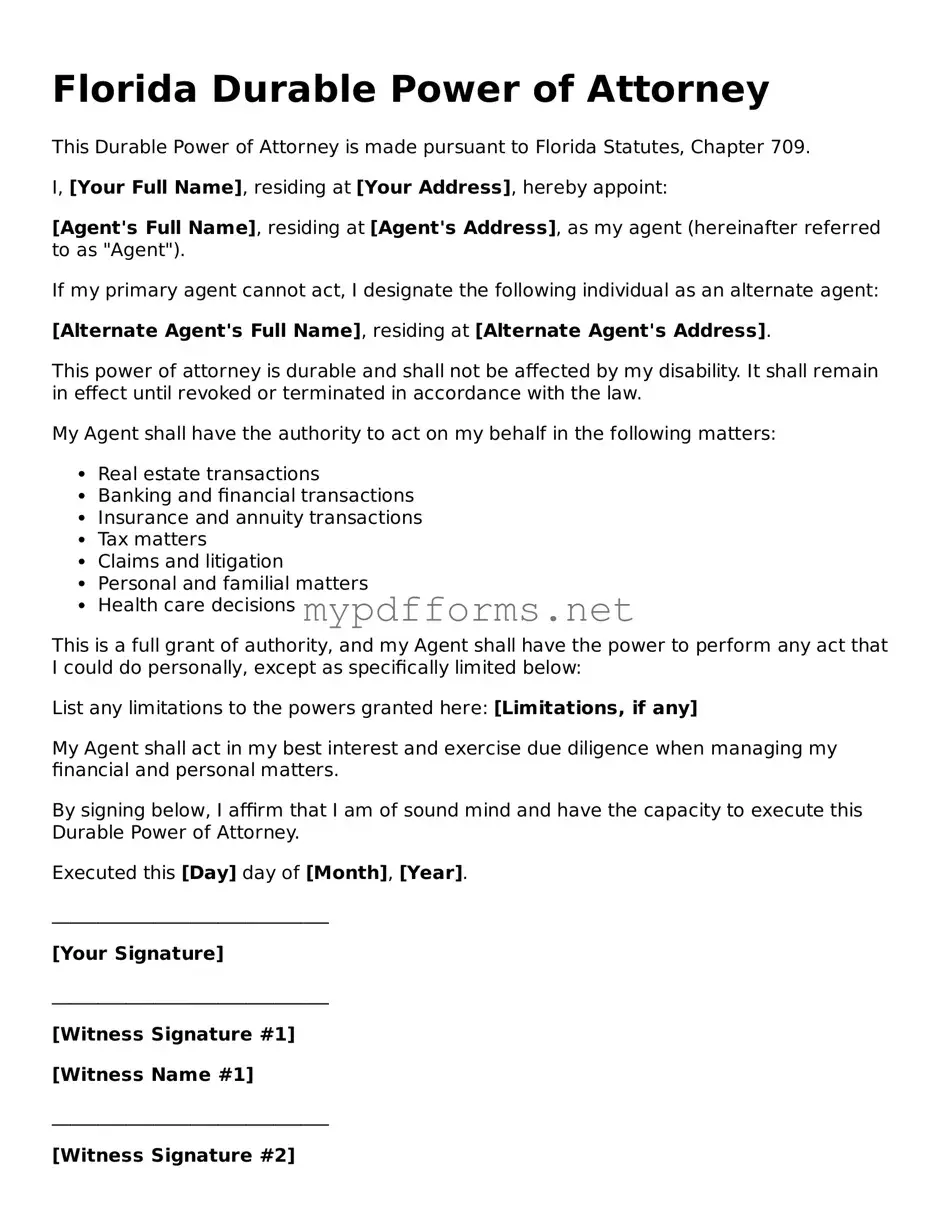

The Florida Durable Power of Attorney form is similar to the General Power of Attorney. Both documents allow an individual, known as the principal, to designate another person, called the agent, to manage their financial and legal affairs. The key difference lies in durability; the General Power of Attorney becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains in effect during such circumstances.

Another similar document is the Medical Power of Attorney. This form specifically grants authority to an agent to make healthcare decisions on behalf of the principal if they are unable to do so. While the Durable Power of Attorney focuses on financial matters, the Medical Power of Attorney addresses medical care and treatment preferences, ensuring that the principal's health-related wishes are respected.

The Limited Power of Attorney is also comparable. This document allows the principal to specify particular tasks or decisions that the agent can handle. Unlike the Durable Power of Attorney, which provides broad authority, the Limited Power of Attorney restricts the agent's powers to specific actions, making it useful for short-term or specific situations.

For those navigating the complexities of establishing an LLC, understanding the importance of essential documents like the Operating Agreement is crucial. An Illinois Forms offers various resources to guide you through the process, ensuring you have the right tools at your disposal to create a solid foundation for your business operations.

A Financial Power of Attorney is another related document. It allows the agent to handle financial matters on behalf of the principal, similar to the Durable Power of Attorney. However, the Financial Power of Attorney may not include provisions that remain in effect after the principal's incapacitation, depending on how it is drafted.

The Springing Power of Attorney is similar in that it becomes effective only upon a specific event, typically the incapacitation of the principal. This contrasts with the Durable Power of Attorney, which is effective immediately upon execution. The Springing Power of Attorney can provide peace of mind, as the agent’s authority is activated only when needed.

A Revocable Trust also shares some similarities. It allows an individual to manage their assets during their lifetime and can specify how those assets are handled after death. While a Durable Power of Attorney grants authority to an agent, a Revocable Trust places control in the hands of the trustee, who manages the trust assets according to the terms set by the principal.

The Advance Healthcare Directive is akin to the Medical Power of Attorney. It combines elements of both a living will and a Medical Power of Attorney, outlining the principal's wishes regarding medical treatment and appointing an agent to make healthcare decisions. This document ensures that both preferences and decision-making authority are clearly defined.

The Living Will is another related document. It expresses an individual’s wishes regarding end-of-life medical care. While the Durable Power of Attorney allows an agent to make decisions, a Living Will communicates the principal's desires directly to healthcare providers, providing guidance in situations where the principal cannot speak for themselves.

Lastly, the Guardianship Petition can be compared to the Durable Power of Attorney. This legal document is filed in court to appoint a guardian for an individual who is incapacitated. Unlike the Durable Power of Attorney, which allows individuals to choose their agent, a Guardianship Petition involves a court process to determine who will manage the affairs of the incapacitated person, often leading to a more formal and regulated arrangement.