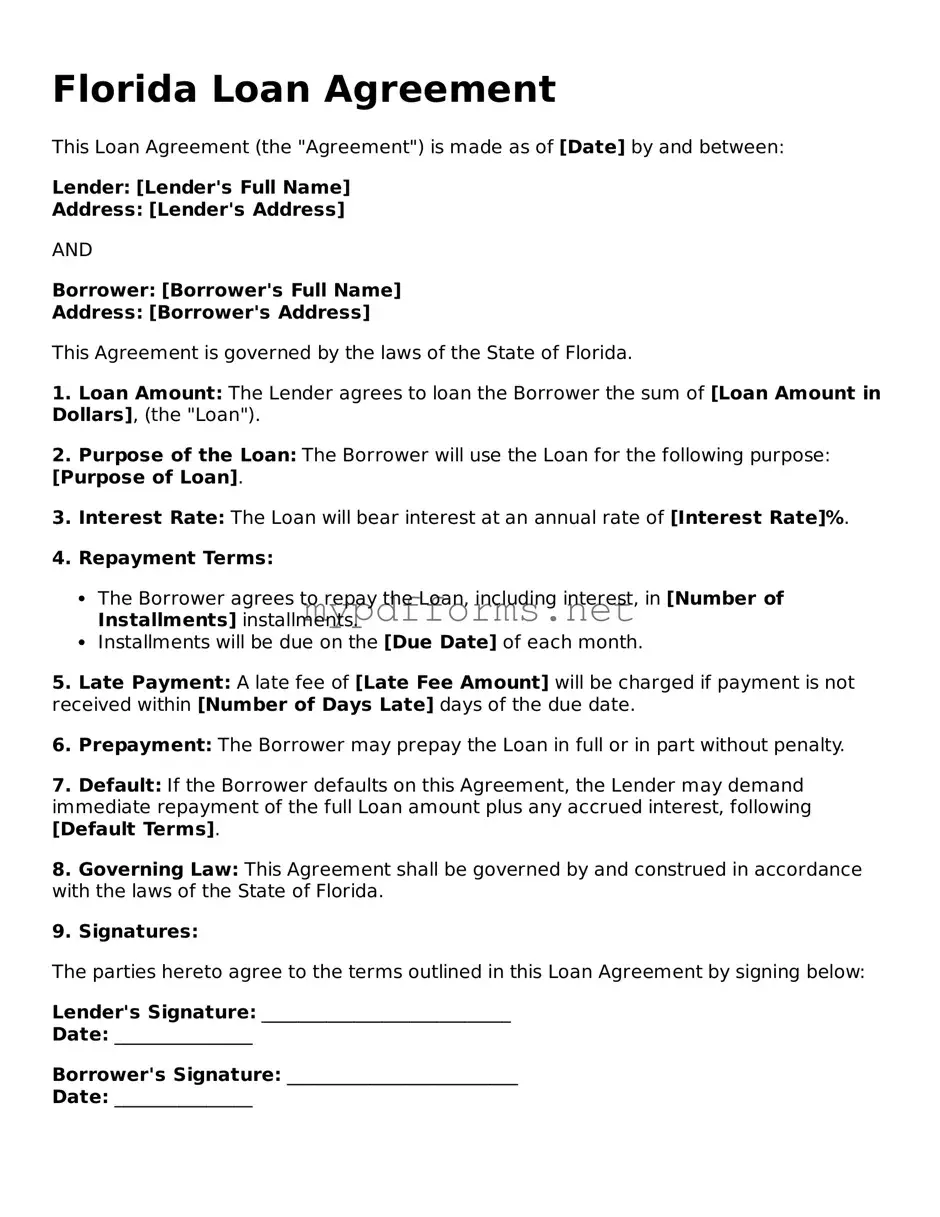

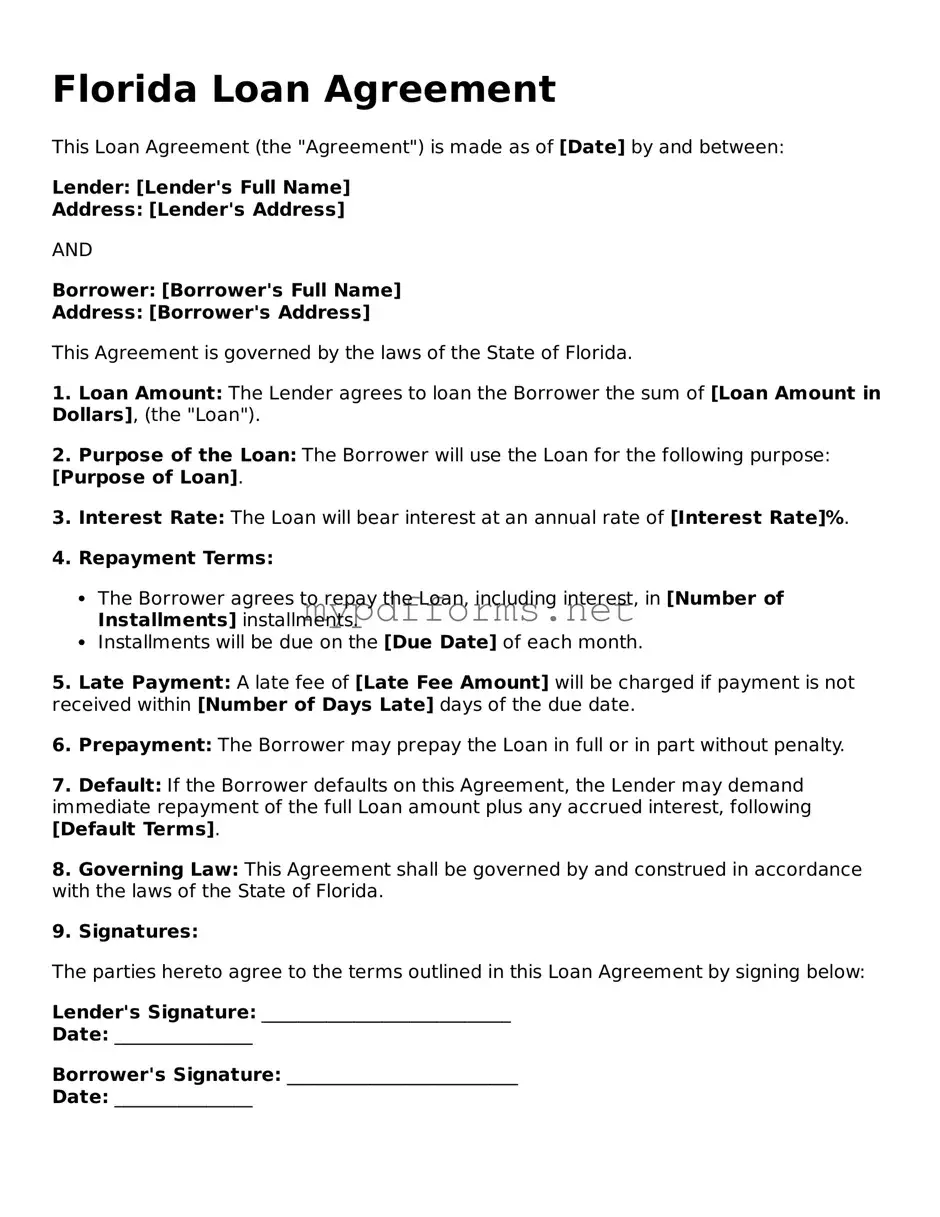

The Florida Loan Agreement form shares similarities with a Personal Loan Agreement. Both documents outline the terms and conditions under which money is borrowed. They specify the loan amount, interest rates, repayment schedules, and the obligations of both the lender and the borrower. Personal Loan Agreements are typically used for unsecured loans, while the Florida Loan Agreement may also encompass secured loans, depending on the circumstances. Each agreement aims to protect the interests of both parties while ensuring clarity in the lending process.

Another document that resembles the Florida Loan Agreement is the Mortgage Agreement. This type of agreement is specifically related to real estate transactions. It details the terms under which a borrower receives funds to purchase property, using the property itself as collateral. Like the Florida Loan Agreement, it includes information on interest rates, repayment terms, and the consequences of default. Both documents serve to formalize the lending process and protect the lender’s investment.

A Business Loan Agreement is another similar document. This agreement is used when a business seeks financing from a lender. It outlines the terms of the loan, including the amount, interest rates, and repayment schedule. The Florida Loan Agreement and Business Loan Agreement both aim to ensure that the lender’s and borrower’s rights and responsibilities are clearly defined. Each document is tailored to the specific needs of the borrower, whether an individual or a business entity.

The Promissory Note is closely related to the Florida Loan Agreement as well. This document serves as a written promise from the borrower to repay a specified amount of money to the lender. While the Loan Agreement often contains more detailed terms and conditions, the Promissory Note focuses primarily on the promise to pay. Both documents are essential in establishing a legal obligation between the parties involved in the loan.

A Secured Loan Agreement is also similar to the Florida Loan Agreement. In this type of agreement, the borrower offers collateral to the lender, which can be seized if the borrower defaults on the loan. Both documents detail the loan amount, interest rates, and repayment terms, but the Secured Loan Agreement emphasizes the collateral aspect. This added layer of security for the lender is a key difference that can affect the terms of the loan.

In real estate transactions, understanding the various legal documents involved is crucial, and one important form to be aware of is the Quitclaim Deed, as it facilitates the transfer of property ownership without warranties. For those interested in a comprehensive overview, detailed information can be found at https://floridapdfform.com/, which provides access to printable forms and additional resources related to real estate conveyancing in Florida.

The Installment Loan Agreement bears resemblance to the Florida Loan Agreement as well. This document specifies a loan that is repaid through a series of scheduled payments over time. Both agreements outline the total loan amount, interest rates, and payment frequency. The Installment Loan Agreement, like the Florida Loan Agreement, aims to provide clear expectations for both the borrower and the lender regarding repayment.

A Credit Agreement is another document that shares similarities with the Florida Loan Agreement. This agreement outlines the terms under which credit is extended to a borrower. It includes details about the credit limit, interest rates, and repayment terms. Both the Credit Agreement and the Florida Loan Agreement serve to protect the lender’s interests while providing the borrower with a clear understanding of their obligations.

The Loan Modification Agreement is also comparable to the Florida Loan Agreement. This document is used when the terms of an existing loan need to be changed, often due to financial hardship. It outlines the new terms, including any adjustments to the interest rate or repayment schedule. Like the Florida Loan Agreement, it aims to ensure that both parties understand their rights and responsibilities under the modified terms.

The Lease Agreement is another document that, while serving a different purpose, shares structural similarities with the Florida Loan Agreement. A Lease Agreement outlines the terms under which a tenant rents property from a landlord. Both documents detail the obligations of each party, including payment terms and conditions for default. The clarity provided in both agreements helps to foster a positive relationship between the parties involved.

Lastly, the Loan Application is related to the Florida Loan Agreement in that it initiates the lending process. This document collects essential information from the borrower, including their financial history and creditworthiness. While the Loan Application does not finalize the terms of the loan, it is a critical step that leads to the creation of a Loan Agreement, such as the Florida Loan Agreement. Both documents work together to ensure that the lending process is transparent and fair.