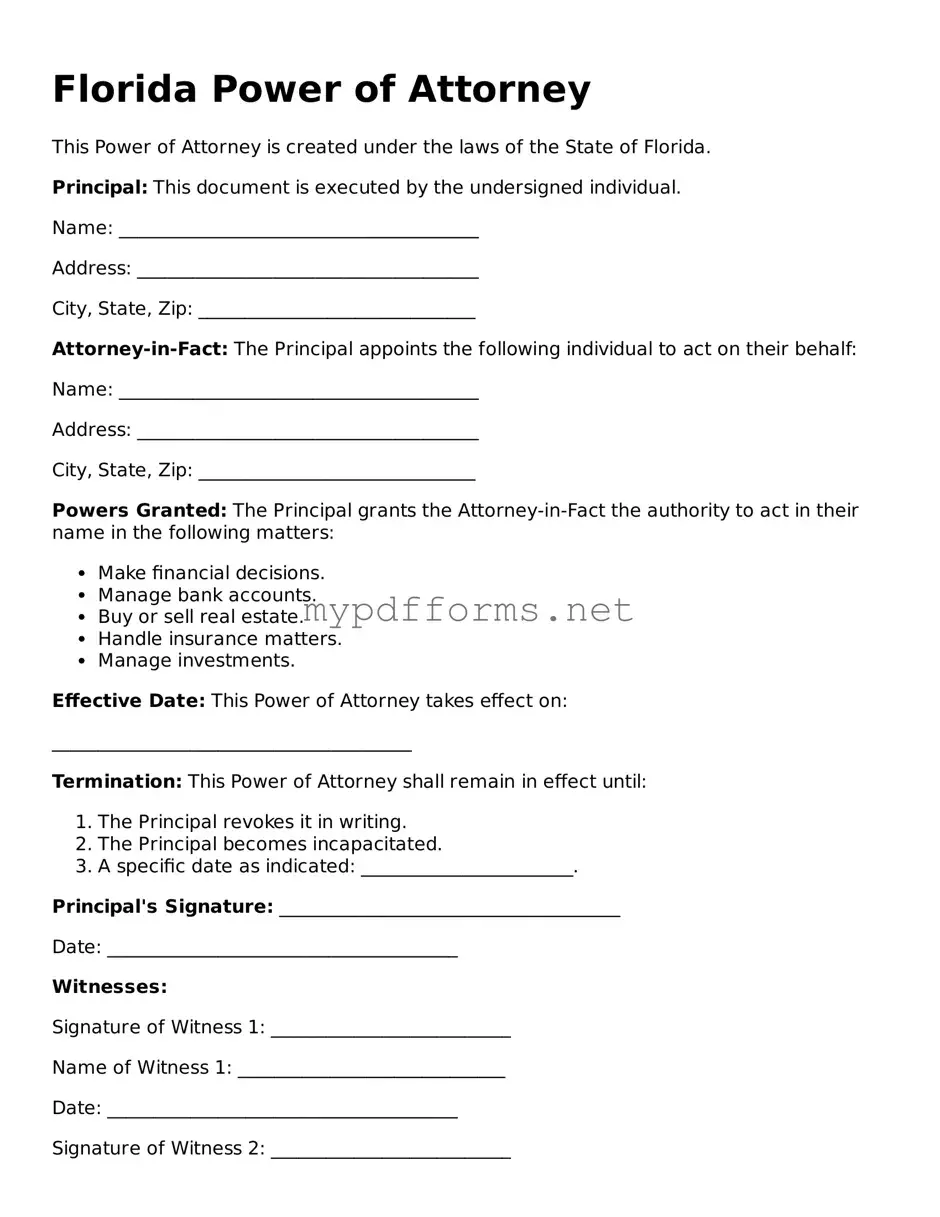

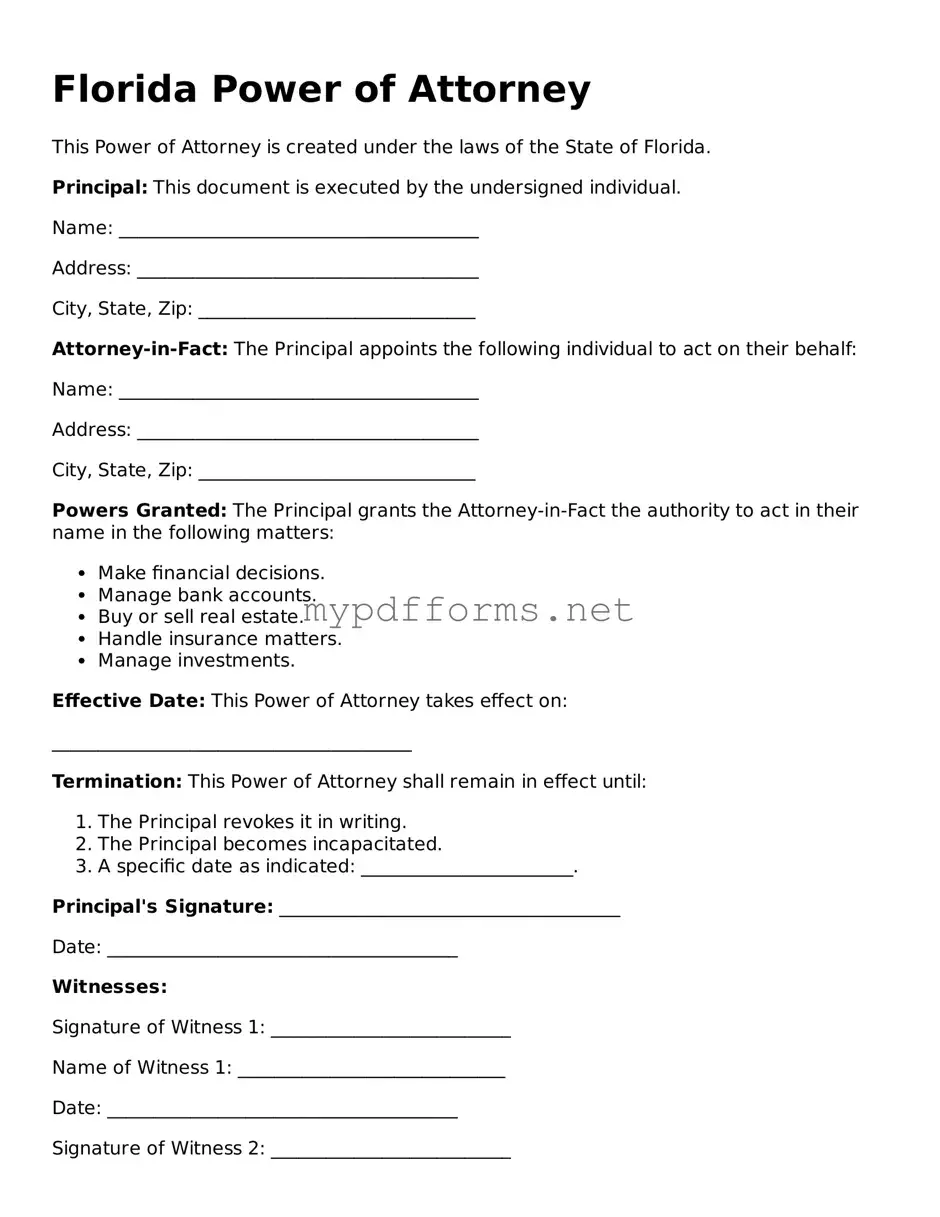

Attorney-Verified Power of Attorney Document for Florida

A Florida Power of Attorney form is a legal document that allows one person to grant another the authority to make decisions on their behalf. This can include financial matters, healthcare decisions, or other personal affairs. Understanding how to properly fill out this form is essential for ensuring your wishes are respected, so take the first step by clicking the button below.

Modify Document Here

Attorney-Verified Power of Attorney Document for Florida

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Power of Attorney online in just a few steps.