Get Generic Direct Deposit Form in PDF

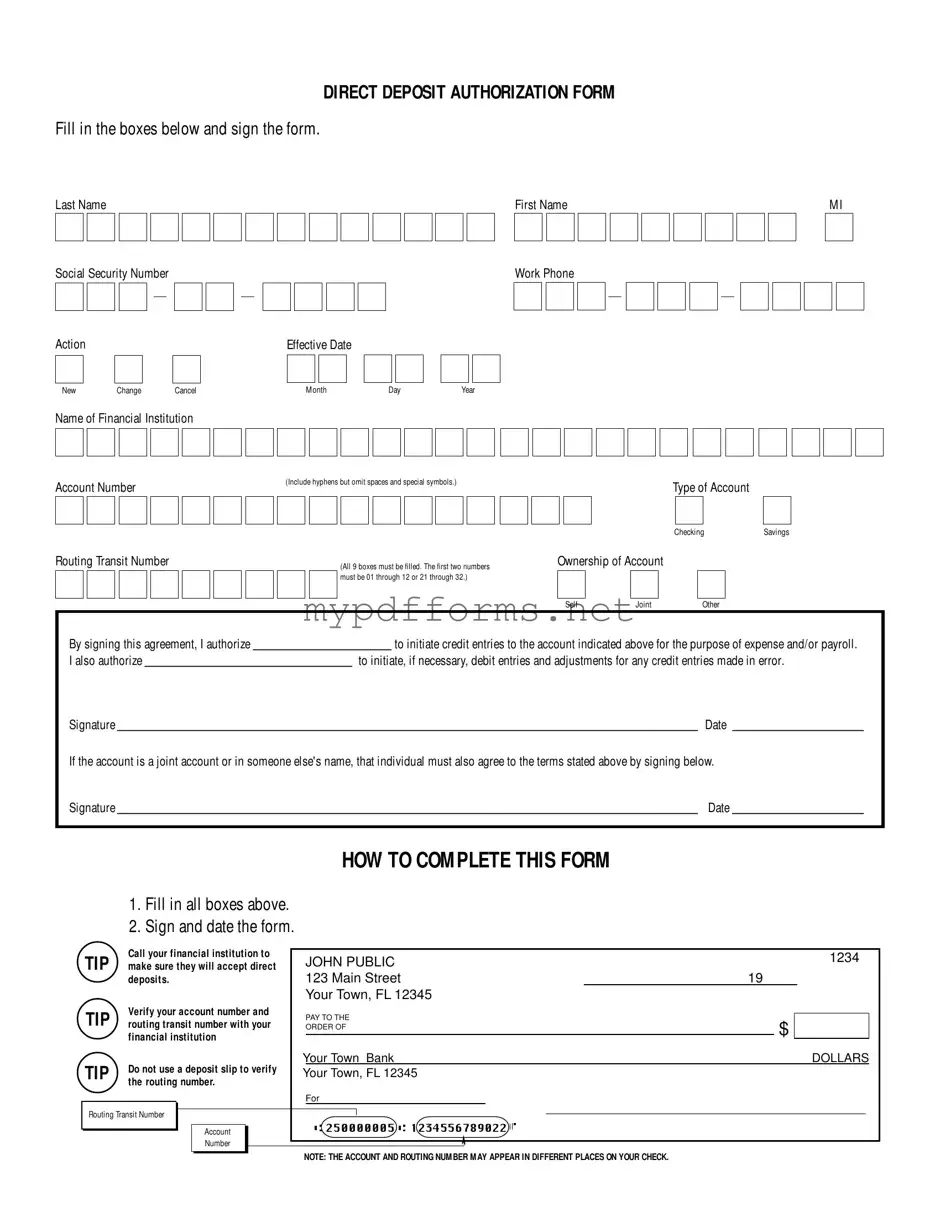

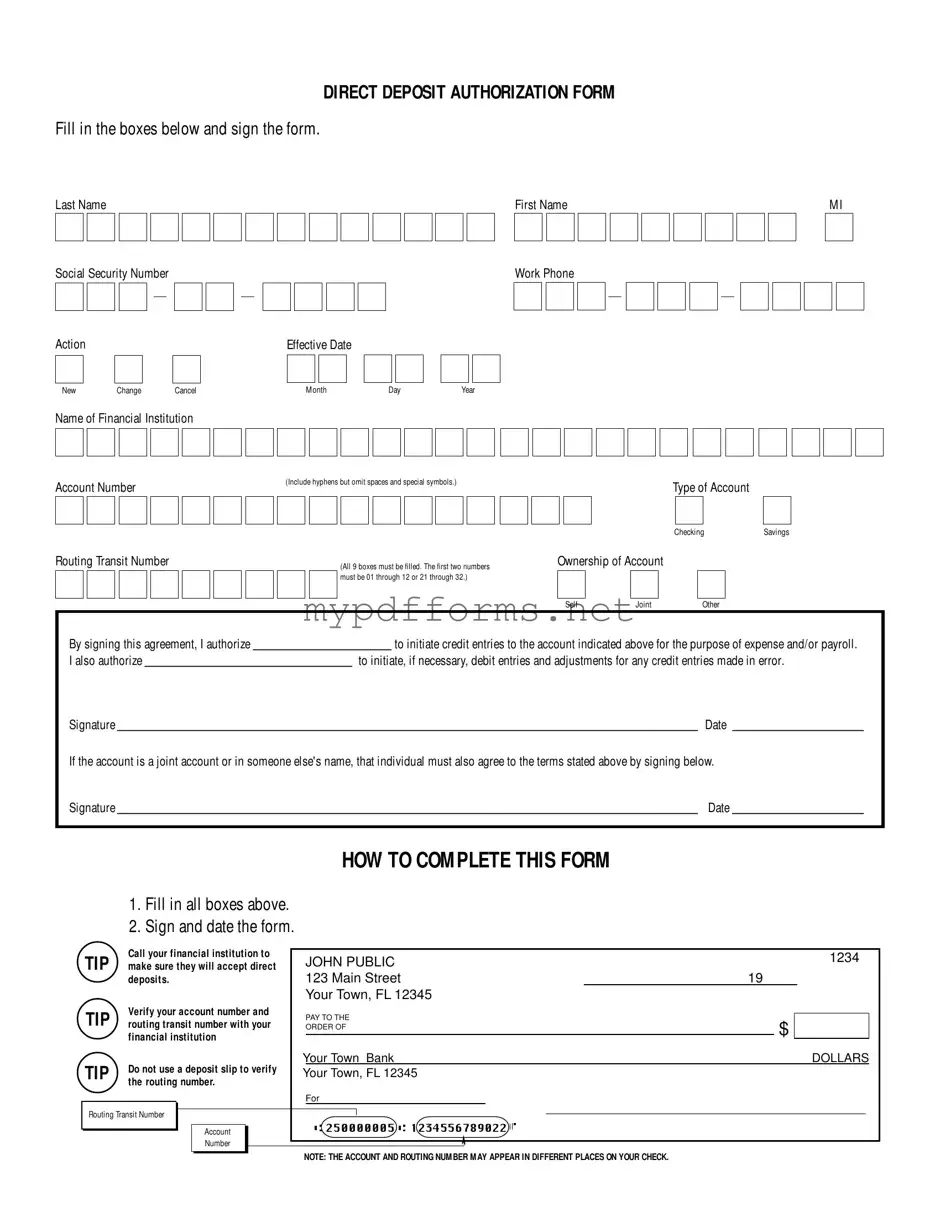

The Generic Direct Deposit Authorization Form is a document that allows individuals to authorize their employer or another entity to deposit funds directly into their bank account. By completing this form, you streamline the process of receiving payments, ensuring that funds are transferred securely and efficiently. To get started, please fill out the form by clicking the button below.

Modify Document Here

Get Generic Direct Deposit Form in PDF

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Generic Direct Deposit online in just a few steps.