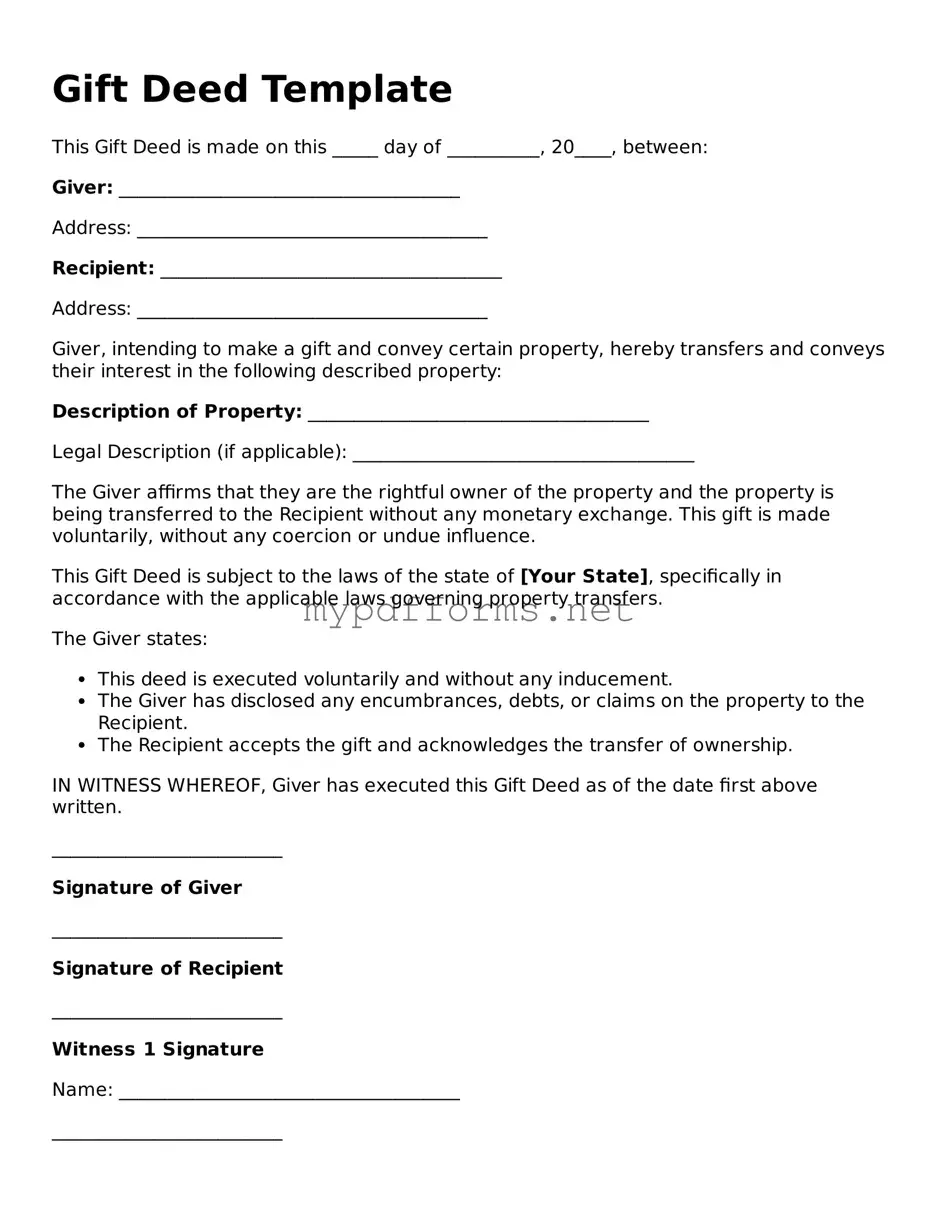

Gift Deed Template

A Gift Deed is a legal document that facilitates the transfer of property or assets from one individual to another without any exchange of money. This form serves to clearly outline the intentions of the giver and ensures that the recipient receives the gift in a legally binding manner. To get started on your Gift Deed, click the button below to fill out the form.

Modify Document Here

Gift Deed Template

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Gift Deed online in just a few steps.