The Gift Letter form is closely related to the Affidavit of Support. This document is often used when an individual sponsors a foreign national seeking a visa. It serves to demonstrate that the sponsor has sufficient financial resources to support the visa applicant. Both documents require a declaration of funds, ensuring that the recipient will not become a public charge. This similarity emphasizes the importance of financial stability in both personal and immigration contexts.

Another document similar to the Gift Letter is the Bank Statement. This financial document provides a detailed overview of an individual’s account activity over a specific period. Like the Gift Letter, a Bank Statement can be used to show proof of funds. It offers transparency regarding financial resources, which is crucial in both lending and gifting scenarios.

The Loan Agreement also shares similarities with the Gift Letter. This document outlines the terms and conditions under which a loan is provided. While a Loan Agreement involves repayment, both documents require a clear statement of the funds involved. They highlight the importance of financial accountability, whether in a gift or a loan situation.

The Promissory Note is another document that resembles the Gift Letter. A Promissory Note is a written promise to pay a specified amount of money to a designated party. Both documents require the acknowledgment of the transfer of funds. However, the key difference lies in the expectation of repayment in a Promissory Note, while a Gift Letter indicates a gift with no strings attached.

The Statement of Assets is similar to the Gift Letter in that it provides a comprehensive overview of an individual's financial situation. This document lists all assets and liabilities, giving a clear picture of one’s net worth. Both documents can be used to establish financial stability, whether for personal transactions or loan applications.

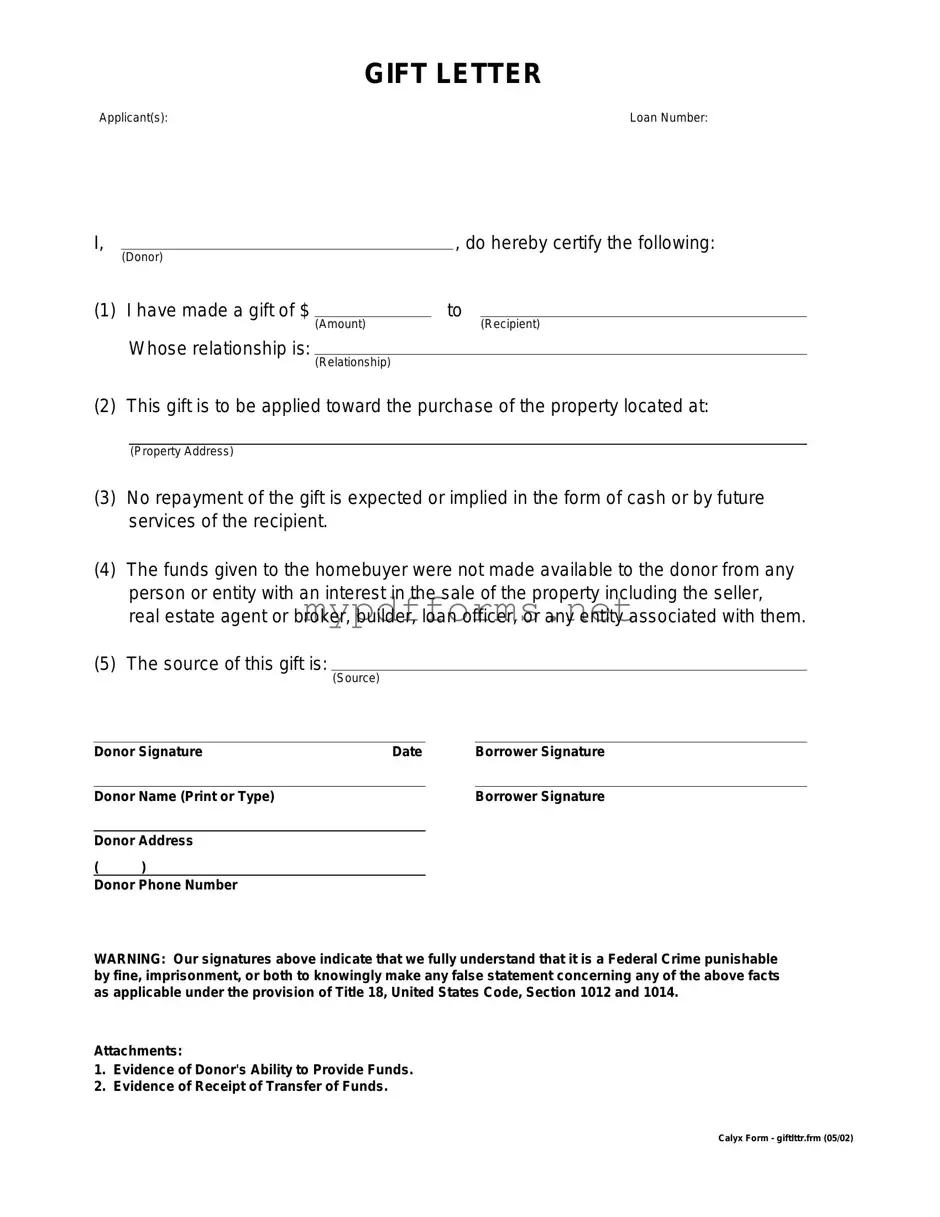

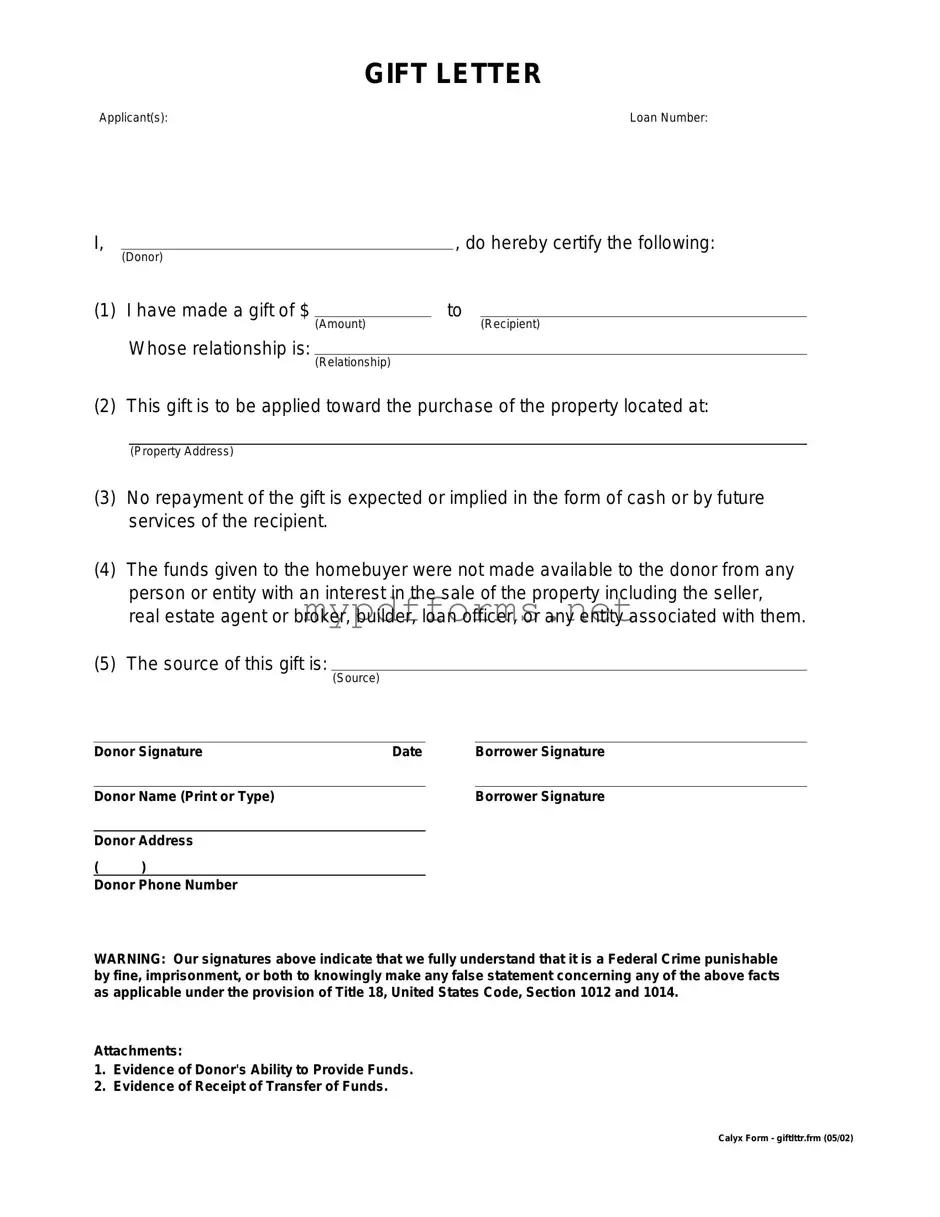

The Financial Gift Declaration is another document akin to the Gift Letter. This declaration explicitly states that a financial gift has been made, often for tax purposes. Like the Gift Letter, it requires the donor to confirm that the funds are a gift and not a loan. This ensures clarity in the nature of the transaction, which is important for both parties.

The Tax Return can also be compared to the Gift Letter. While a Tax Return details an individual's income and tax obligations, it can also reflect financial gifts received. Both documents serve as evidence of financial transactions and can be important in assessing an individual’s financial health, particularly when applying for loans or mortgages.

The Gift Tax Return is closely related to the Gift Letter. This document is filed with the IRS to report gifts exceeding a certain value. Similar to the Gift Letter, it requires the donor to disclose the amount gifted. Both documents are essential for tax compliance and help clarify the nature of financial transfers between individuals.

When dealing with the sale of a motorcycle, it's essential to have the proper documentation in place, such as the North Carolina Motorcycle Bill of Sale. This legal form ensures the transaction is recorded accurately, offering peace of mind to both buyer and seller. To assist in this process, you can find a comprehensive resource at motorcyclebillofsale.com/free-north-carolina-motorcycle-bill-of-sale, which provides guidelines and a downloadable template to help streamline the transfer of ownership.

Lastly, the Mortgage Application often requires a Gift Letter as part of the documentation. When a borrower receives a gift to help with a down payment, the lender may request a Gift Letter to confirm the funds are not a loan. Both documents aim to ensure that financial support is clearly understood, protecting both the lender and the borrower in the transaction.