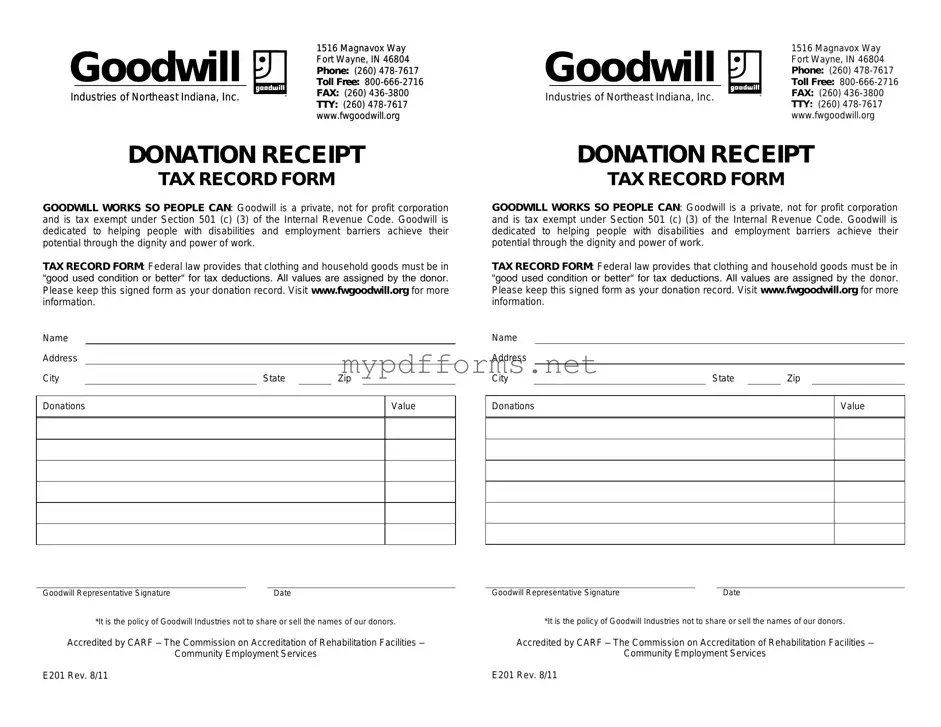

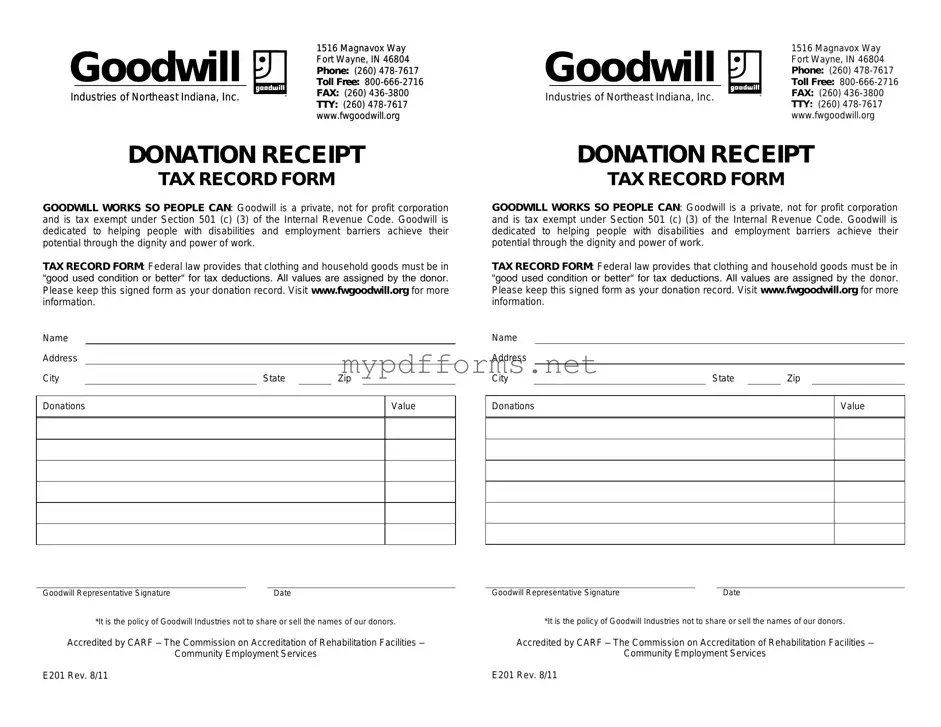

The Goodwill donation receipt form serves a specific purpose in documenting charitable contributions, similar to a charitable contribution receipt. This document is issued by various nonprofit organizations to acknowledge donations made by individuals. Like the Goodwill receipt, it typically includes the donor's name, the date of the donation, and a description of the items donated. Both documents provide proof for tax deductions, ensuring that donors can substantiate their contributions during tax filing.

Another document that shares similarities with the Goodwill donation receipt is the IRS Form 8283. This form is used for reporting noncash charitable contributions exceeding $500. It requires detailed information about the donated items, much like the Goodwill receipt, which also lists the donated goods. Both documents serve as essential records for taxpayers, helping them to claim deductions while complying with IRS requirements.

When considering the various forms associated with charitable donations, it's important to ensure accurate reporting for tax purposes. One document that individuals may need to complete is the Beneficiary Identification Form, which assists in providing necessary taxpayer information that may be crucial when claiming deductions for non-cash contributions and other charitable donations.

The donation acknowledgment letter is another document that parallels the Goodwill receipt. Nonprofits often send these letters to donors to confirm their contributions. Similar to the Goodwill receipt, these letters include the donor's name, the donation date, and a description of the items or cash donated. This letter can also serve as a tax receipt, reinforcing its importance for record-keeping purposes.

A bill of sale can be compared to the Goodwill donation receipt in that both documents serve as proof of a transaction. While a bill of sale is typically used for the sale of goods, it can also be adapted for donations. Both documents include details such as the date, item description, and parties involved. They provide a formal record that can be referenced if questions about the transaction arise.

The sales receipt, commonly issued by retailers, also shares characteristics with the Goodwill donation receipt. It documents a transaction and includes information such as the date, item description, and amount paid. While a sales receipt is used for purchases, both documents serve as proof of an exchange, whether it be a sale or a donation, and can be used for record-keeping and tax purposes.

The donor intent letter can be likened to the Goodwill donation receipt in that it expresses the donor's intention regarding their contribution. This letter often outlines how the donor wishes their gift to be used by the organization. Like the Goodwill receipt, it provides a written record of the donation, which can be beneficial for both the donor and the receiving organization.

A gift-in-kind acknowledgment is another document similar to the Goodwill donation receipt. This acknowledgment is provided by organizations receiving noncash gifts, confirming the receipt of goods or services. Both documents list the donated items and serve as proof for tax purposes, ensuring that donors have the necessary documentation to support their charitable contributions.

The donor agreement is comparable to the Goodwill donation receipt in that it formalizes the terms of a donation. This document outlines the specifics of the donation, including the items being donated and any conditions attached. Like the Goodwill receipt, it serves as a record of the transaction, helping to clarify the expectations of both the donor and the organization.

Lastly, the tax return documentation can be considered similar to the Goodwill donation receipt. When individuals file their taxes, they often need to provide evidence of charitable contributions. The Goodwill receipt serves as this evidence, just as other forms of tax documentation do. Both are essential for ensuring compliance with tax laws and for maximizing potential deductions.