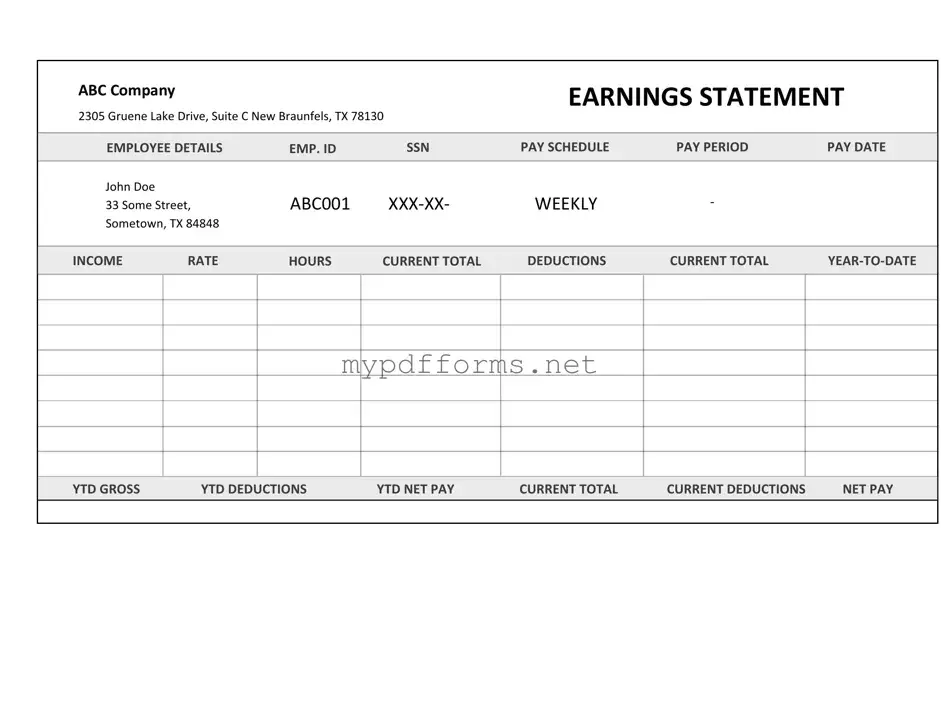

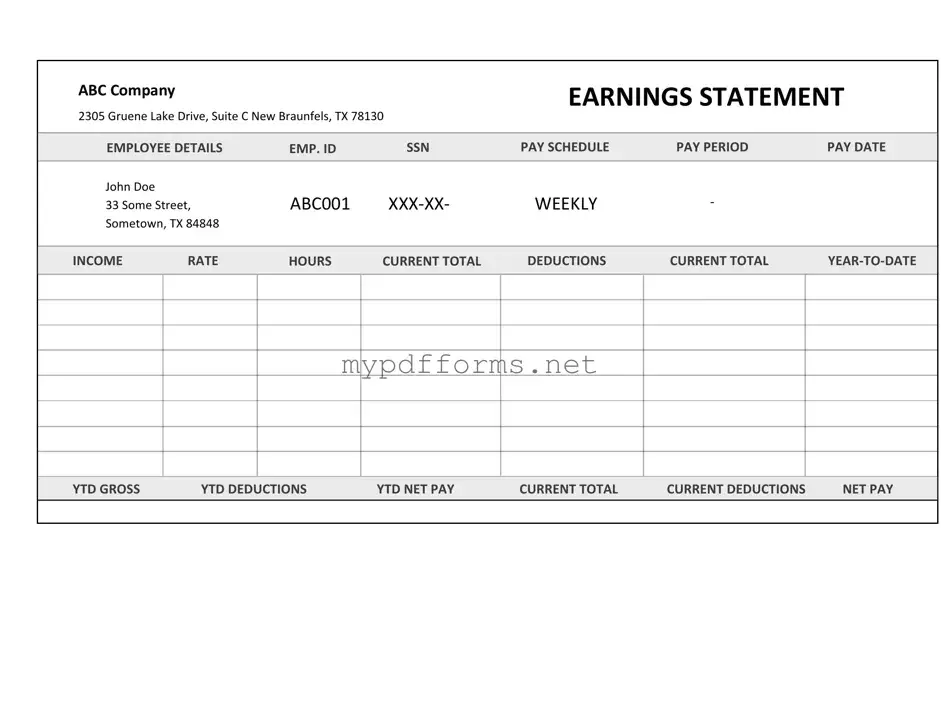

The Independent Contractor Agreement is a crucial document that outlines the terms of the working relationship between a contractor and a client. Similar to a pay stub, it details payment terms, including rates and deadlines. This agreement establishes the scope of work and ensures both parties understand their rights and obligations. Just like a pay stub summarizes earnings, the Independent Contractor Agreement summarizes the expectations and deliverables expected from the contractor.

The W-9 form is another document closely related to the Independent Contractor Pay Stub. This form collects essential information about the contractor, such as their name, address, and taxpayer identification number. When a contractor completes a W-9, it facilitates accurate reporting of income to the IRS. Much like a pay stub, which reflects earnings for a specific period, the W-9 ensures that the contractor’s income is correctly documented for tax purposes.

The 1099 form serves a similar function as the Independent Contractor Pay Stub but focuses on reporting income to the IRS. At the end of the tax year, businesses use the 1099 form to report payments made to contractors. This form shows the total amount paid, paralleling how a pay stub summarizes earnings for a specific period. Both documents are essential for tax compliance and financial record-keeping.

The Invoice is another document that shares similarities with the Independent Contractor Pay Stub. An invoice is issued by the contractor to request payment for services rendered. It typically includes details such as the amount due, payment terms, and a description of the services provided. Like a pay stub, an invoice provides a clear record of what has been earned and what is owed, ensuring transparency in financial transactions.

For anyone looking to buy or sell a vehicle in Illinois, understanding the importance of proper documentation is crucial. The Illinois Motor Vehicle Bill of Sale form serves as an essential tool in this process, ensuring both parties have a clear record of the transaction. To learn more about this form and easily access it, you can visit the Illinois Forms.

The Service Agreement outlines the terms and conditions under which services will be provided. This document is similar to a pay stub in that it clarifies payment expectations and deliverables. It serves as a reference point for both parties, ensuring that the contractor is compensated fairly for their work. Just as a pay stub provides a summary of earnings, a Service Agreement summarizes the responsibilities and expectations of both the contractor and the client.

The Timesheet is a document used to track the hours worked by an independent contractor. It records the time spent on various tasks, which is essential for calculating payment. This document is akin to a pay stub, as it provides a breakdown of work completed and the corresponding compensation. Both documents serve as tools for tracking earnings and ensuring that contractors are paid accurately for their time and effort.

The Employment Verification Letter is often used to confirm a contractor's work history and income. While it is not a direct payment document, it shares similarities with a pay stub in that it provides proof of earnings. This letter can be used when a contractor applies for loans or other financial services. Just as a pay stub verifies income for a specific period, an Employment Verification Letter serves as a formal acknowledgment of the contractor’s earnings over time.

The Receipt is another document that functions similarly to the Independent Contractor Pay Stub. A receipt is issued after payment is made, confirming that the contractor has received funds for their services. It provides a record of the transaction, much like a pay stub summarizes the earnings for a specific time frame. Both documents play a vital role in financial record-keeping and ensuring accountability in transactions.