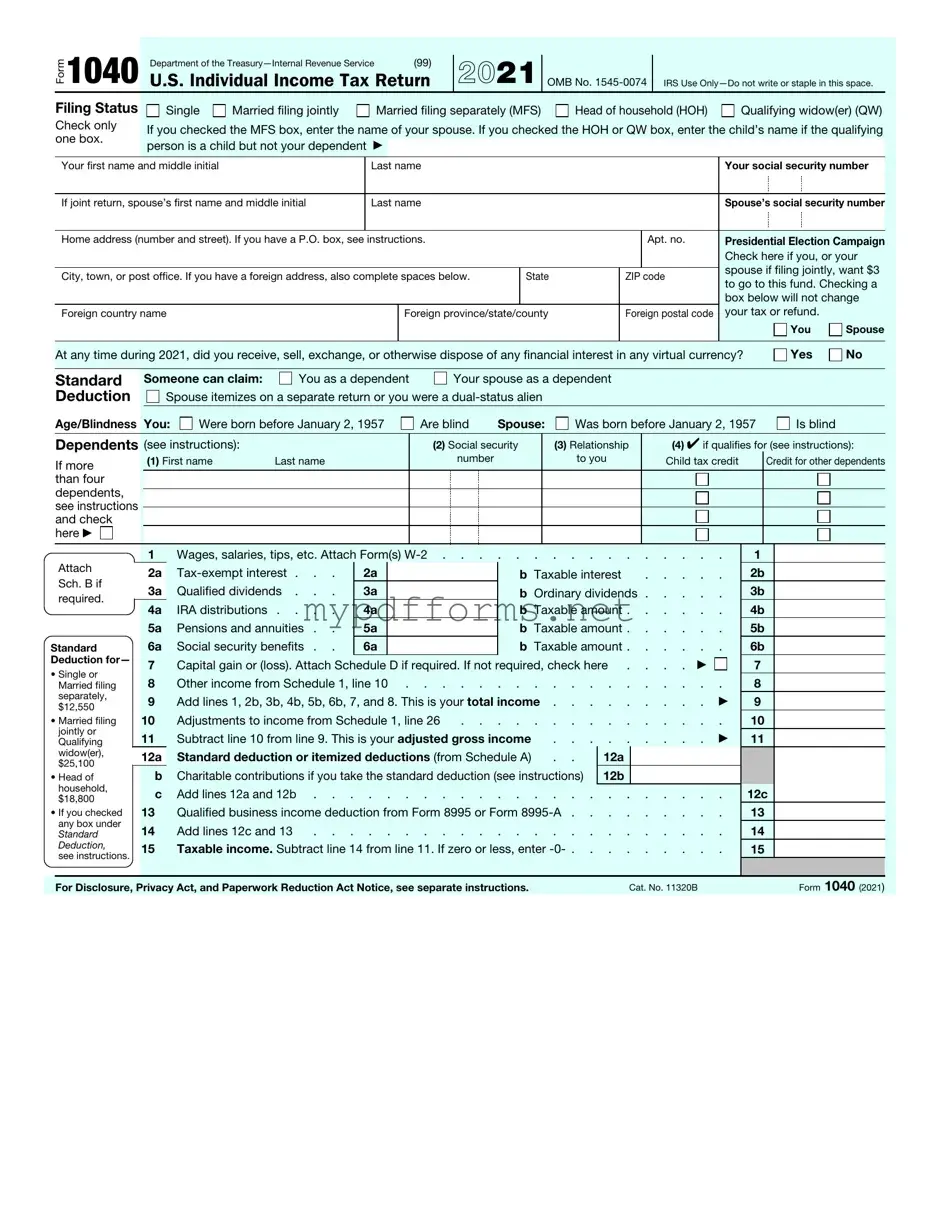

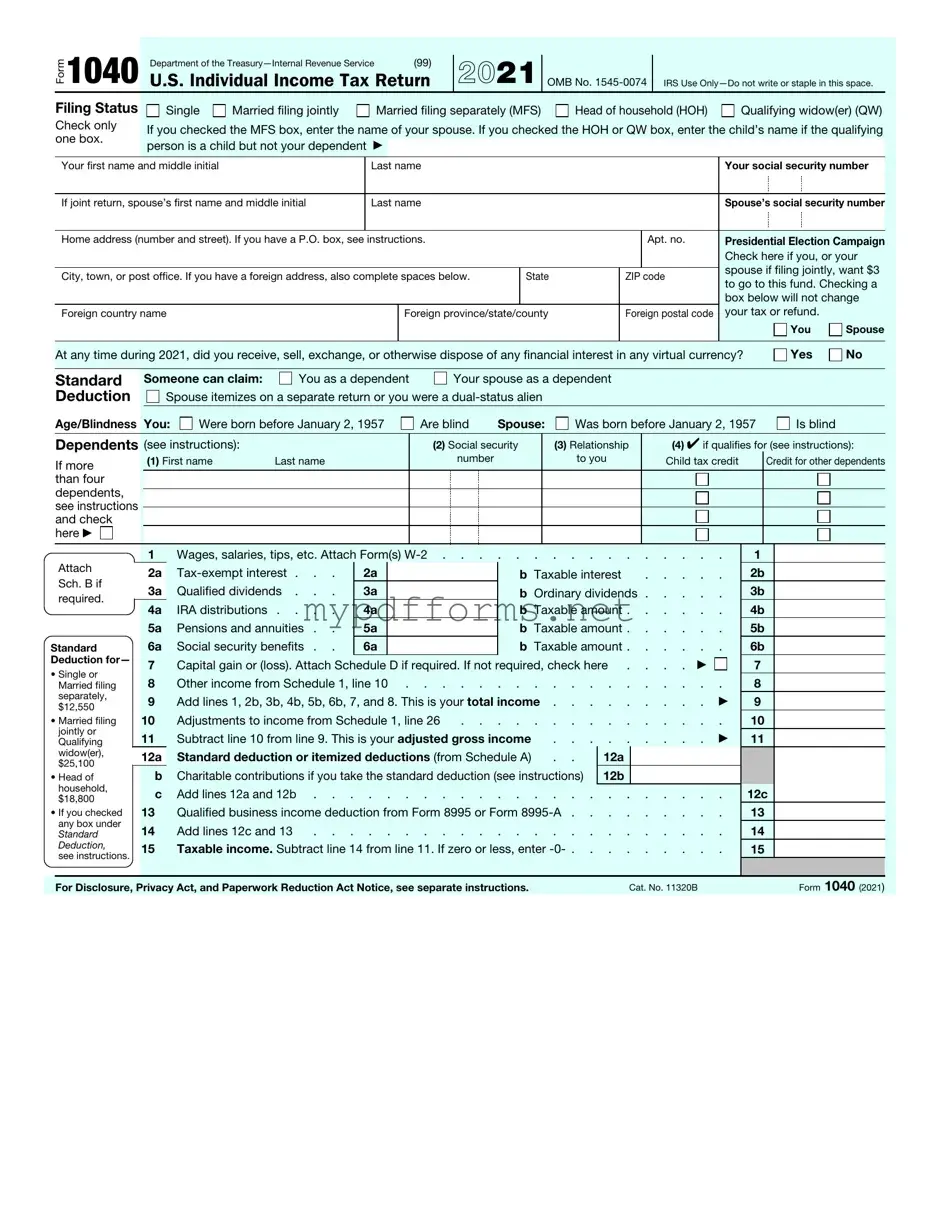

The IRS Form 1040 is similar to the W-2 form, which is issued by employers to report wages paid to employees and the taxes withheld from those wages. Both documents are essential for individuals when filing their annual tax returns. The W-2 provides detailed information about an employee’s income and tax withholdings, which is then used to complete the 1040 form. Without the W-2, taxpayers would lack critical income data necessary for accurately reporting their earnings and calculating their tax obligations.

Another document that bears similarity to the 1040 form is the 1099 form. This form is used to report various types of income other than wages, salaries, and tips. Freelancers, independent contractors, and those receiving interest or dividends often receive 1099 forms. Like the 1040, the 1099 provides crucial information for taxpayers to report their income accurately. It serves as a record of earnings that must be included when completing the 1040 form, ensuring that all income is accounted for in the tax filing process.

The Schedule C form, which is used by sole proprietors to report income and expenses from their business, is another document similar to the 1040. This form allows individuals to detail their business earnings and deductions, ultimately contributing to their overall taxable income reported on the 1040. It is essential for self-employed individuals to complete Schedule C accurately, as it impacts their total tax liability and potential refund, making it a critical component of the tax filing process.

The IRS Form 1098 is also comparable to the 1040 form, particularly in relation to mortgage interest. This form is issued by lenders to report the amount of interest paid on a mortgage during the year. Taxpayers can use the information from the 1098 to claim deductions on their 1040 form. This deduction can significantly affect a taxpayer’s overall tax bill, highlighting the importance of accurately reporting such information when filing taxes.

When dealing with tenancy issues, the Illinois Forms provide vital resources for landlords and tenants alike, ensuring they understand their rights and obligations. This comprehensive documentation allows for clear communication regarding the termination of tenancy and can significantly aid in resolving disputes efficiently.

Finally, the Form 8889, which is used to report Health Savings Account (HSA) contributions and distributions, shares similarities with the 1040. Taxpayers who have HSAs must complete this form to report their contributions and withdrawals. The information from Form 8889 is then incorporated into the 1040 to ensure that taxpayers receive the appropriate tax benefits associated with their HSA contributions. This connection underscores the importance of accurate reporting across multiple forms to ensure compliance with tax regulations.