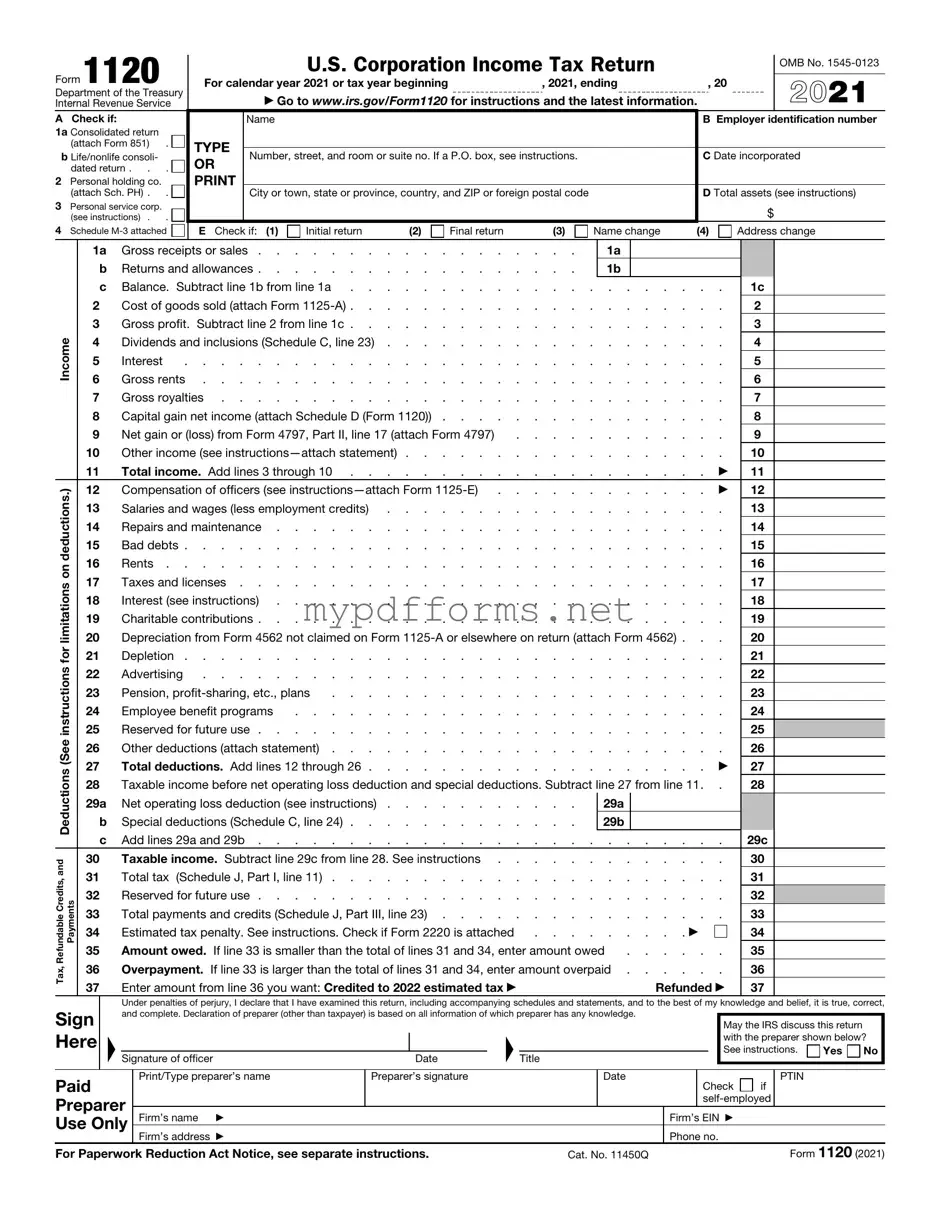

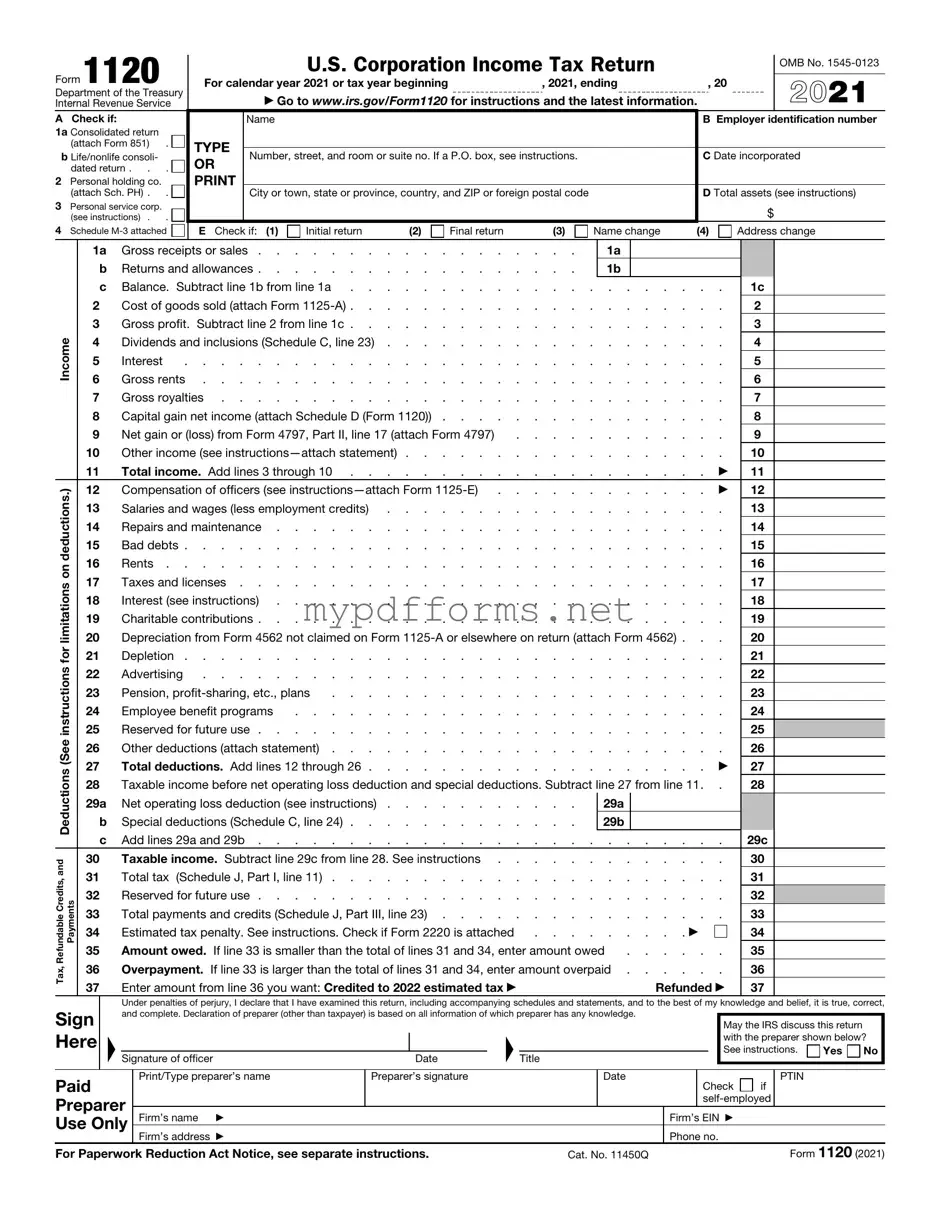

The IRS Form 1120 is primarily used by corporations to report their income, gains, losses, deductions, and credits. It serves as the standard corporate tax return. A similar document is the IRS Form 1120-S, which is specifically designed for S corporations. Unlike the standard Form 1120, which is for regular corporations, Form 1120-S allows S corporations to pass income directly to shareholders, avoiding double taxation. This form also requires reporting of various income sources, deductions, and credits, but it emphasizes the flow-through nature of income in S corporations.

For those involved in transactions requiring liability protection, understanding the importance of a strict Hold Harmless Agreement clause can prove invaluable. This legal document not only safeguards interests but also delineates responsibilities in scenarios like property rentals or special events. By utilizing this form, parties can ensure that they are taking appropriate legal steps to mitigate risks associated with their engagements.

Another related document is the IRS Form 1065, which is used by partnerships to report income, deductions, gains, and losses. Like Form 1120, Form 1065 serves to inform the IRS about the financial activities of the business. However, it differs in that partnerships do not pay taxes at the entity level; instead, income is passed through to partners, who report it on their personal tax returns. This form also includes a Schedule K-1 for each partner, detailing their share of the partnership's income and deductions.

The IRS Form 990 is a key document for tax-exempt organizations, such as charities. While Form 1120 focuses on corporations, Form 990 provides transparency for nonprofits by requiring them to disclose their financial activities, governance, and compliance with tax regulations. Both forms aim to ensure proper reporting and compliance, but Form 990 emphasizes public accountability and the use of funds for charitable purposes.

Form 941, the Employer's Quarterly Federal Tax Return, is another important document for businesses, though it focuses on employment taxes. Businesses use this form to report income taxes, Social Security, and Medicare taxes withheld from employee paychecks. While Form 1120 reports overall corporate income and expenses, Form 941 is specifically for payroll taxes, highlighting the different aspects of business taxation.

The IRS Form 1065-B is similar to Form 1065 but is used by electing large partnerships. This form allows large partnerships with specific characteristics to report their income and deductions in a manner that is slightly different from regular partnerships. While both forms share the goal of reporting partnership income, Form 1065-B includes provisions tailored to larger entities, reflecting their unique structure and tax requirements.

Form 1120-POL is used by political organizations to report their income, gains, losses, deductions, and credits. While it serves a similar purpose to Form 1120, it is specifically tailored for organizations that primarily engage in political activities. This form ensures that political organizations comply with tax regulations while also providing a clear picture of their financial activities to the IRS.

The IRS Form 5500 is relevant for employee benefit plans, such as pension and health plans. While not a corporate tax return, it shares similarities in that it requires detailed reporting of financial activities related to employee benefits. Like Form 1120, it aims to ensure compliance with federal regulations, but it focuses on the management and funding of employee benefit plans instead of corporate income.

Form 1120-F is for foreign corporations that have income effectively connected with a trade or business in the United States. This form is similar to Form 1120 in that it reports income and deductions, but it addresses the unique tax situation of foreign entities. It ensures that foreign corporations comply with U.S. tax laws while providing a framework for reporting their U.S.-sourced income.

Finally, IRS Form 990-T is used by tax-exempt organizations to report unrelated business income. This form is similar to Form 1120 in that it requires reporting of income and expenses, but it specifically addresses income that is not related to the organization’s primary exempt purpose. Both forms ensure proper reporting and compliance, but Form 990-T focuses on the income generated from activities that may be subject to taxation despite the organization’s tax-exempt status.