The IRS Form 1099 is a crucial document used to report various types of income other than wages, salaries, and tips. Like the IRS Form 8300, which reports cash transactions exceeding $10,000, the 1099 form serves to inform the IRS about income received by individuals or entities. Both forms aim to ensure transparency and compliance with tax regulations, helping the IRS track income that may otherwise go unreported. They both require accurate information about the payer and recipient, emphasizing the importance of record-keeping for tax purposes.

Form W-2 is another essential document that shares similarities with the IRS Form 8300. While the W-2 reports wages and salaries paid to employees, it also serves to document income for tax reporting. Both forms require detailed information about the payer and recipient, including identification numbers. They function as tools for the IRS to monitor income and ensure that taxes are paid appropriately, reinforcing the integrity of the tax system.

The IRS Form 8949 is used to report capital gains and losses from the sale of assets. Similar to the IRS Form 8300, it plays a role in maintaining transparency in financial transactions. While Form 8300 focuses on large cash transactions, Form 8949 addresses the sale of investments, requiring detailed reporting of each transaction. Both forms highlight the importance of accurate reporting and compliance with tax laws, ensuring that all financial activities are properly documented.

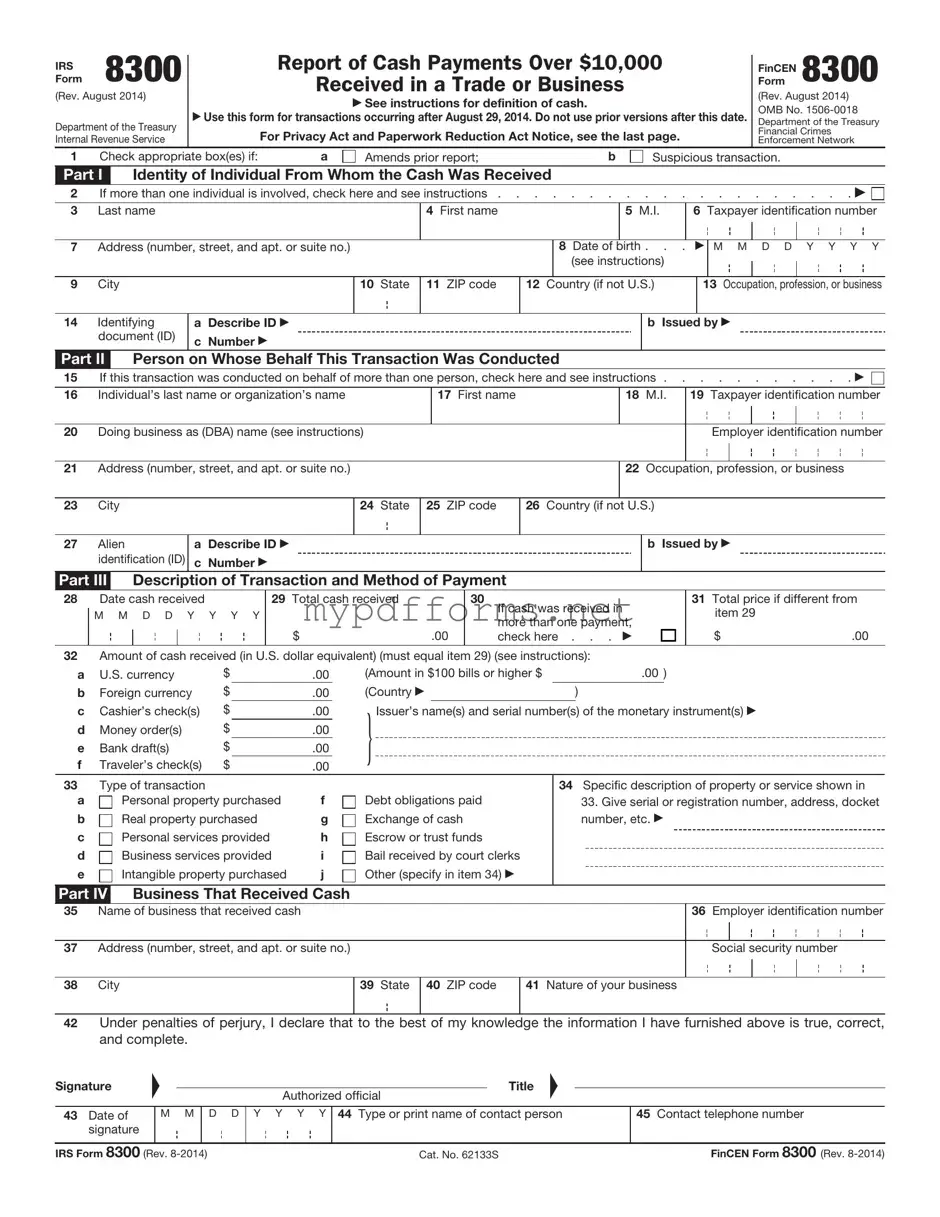

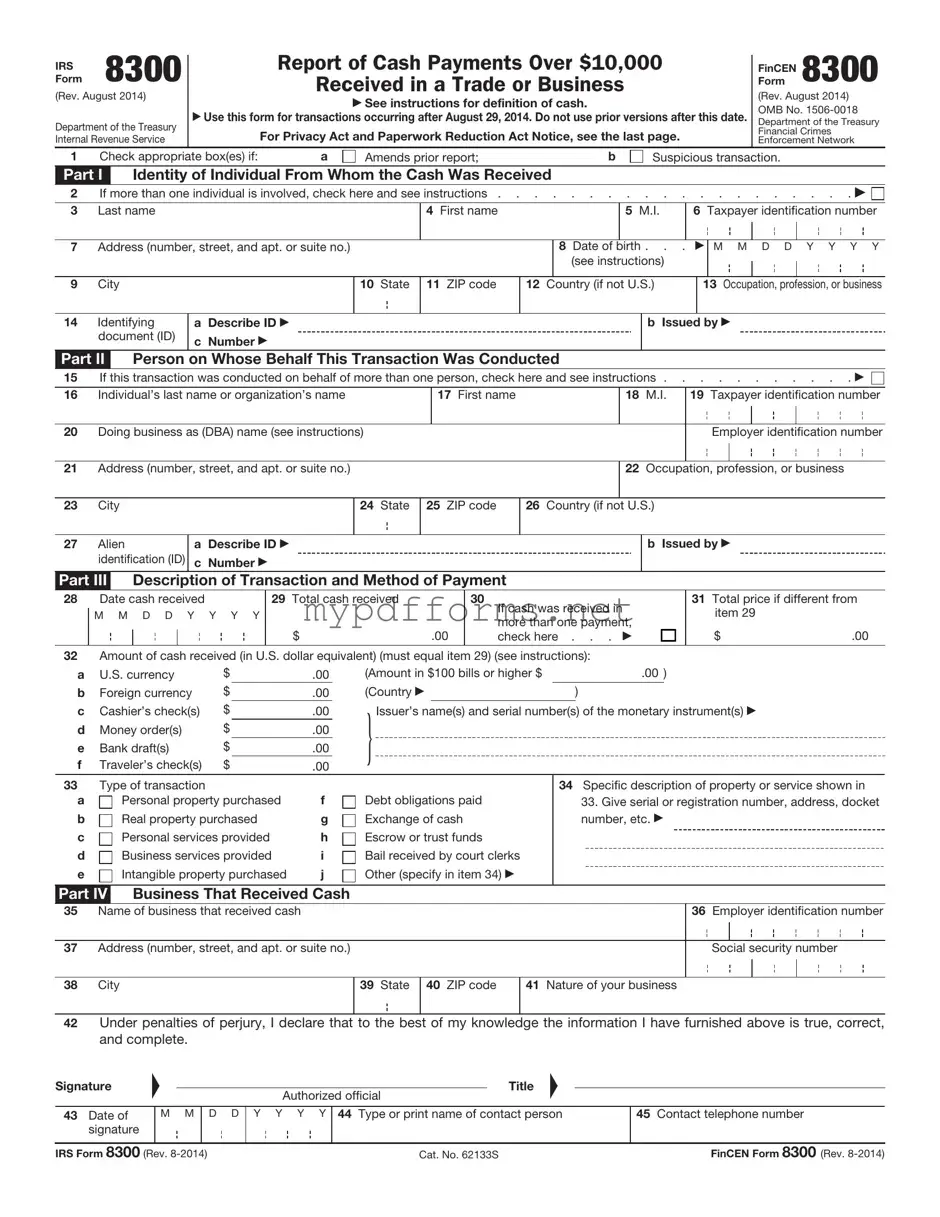

The Bank Secrecy Act (BSA) Currency Transaction Report (CTR) is a document that banks and financial institutions must file when a customer conducts a cash transaction exceeding $10,000. This report is similar to the IRS Form 8300 in that both documents aim to monitor large cash transactions to prevent money laundering and other financial crimes. Both forms require detailed information about the transaction and the parties involved, reinforcing the need for vigilance in financial reporting.

The Foreign Bank and Financial Accounts Report (FBAR) is another document that focuses on financial transparency. Individuals with foreign bank accounts exceeding $10,000 must file the FBAR, similar to the IRS Form 8300's requirement for reporting cash transactions. Both documents serve to inform the government about substantial financial activity, helping to combat tax evasion and ensure compliance with financial regulations.

Form 5471 is used by U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. This form requires extensive reporting of financial activities, paralleling the IRS Form 8300's focus on significant transactions. Both forms emphasize the need for transparency in financial dealings, ensuring that the IRS has a comprehensive understanding of taxpayers' financial situations.

Form 1065 is utilized by partnerships to report income, deductions, and other financial information. Similar to the IRS Form 8300, it requires detailed reporting to ensure accurate tax assessment. Both forms are essential for compliance with tax laws, as they help the IRS track financial activities and ensure that all income is reported appropriately.

The IRS Form 990 is filed by tax-exempt organizations to provide the IRS with information about their financial activities. Like the IRS Form 8300, it serves as a tool for transparency and accountability. Both forms require detailed reporting and aim to ensure compliance with tax regulations, helping to maintain the integrity of the tax system.

Form 1066 is used by real estate investment trusts (REITs) to report income, deductions, and other financial information. This form shares similarities with the IRS Form 8300 in that both require comprehensive reporting of financial activities. They both play a vital role in ensuring compliance with tax laws and providing the IRS with necessary information to assess tax obligations accurately.

Understanding the various forms used for reporting income and financial transactions is crucial for compliance. For instance, if you're dealing with a real estate recovery situation in Illinois, you may need to familiarize yourself with the Illinois 20A form. This document is essential for notifying a defendant about a pending forcible entry action and it plays a significant role in the eviction process. To ensure you have all the necessary details, you can access the Illinois Forms that can guide you through the proper procedures.

Finally, Form 941 is the Employer's Quarterly Federal Tax Return, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. Like the IRS Form 8300, it emphasizes the importance of accurate reporting and compliance with tax regulations. Both forms require detailed information about financial transactions, ensuring that the IRS can effectively monitor tax liabilities and enforce tax laws.