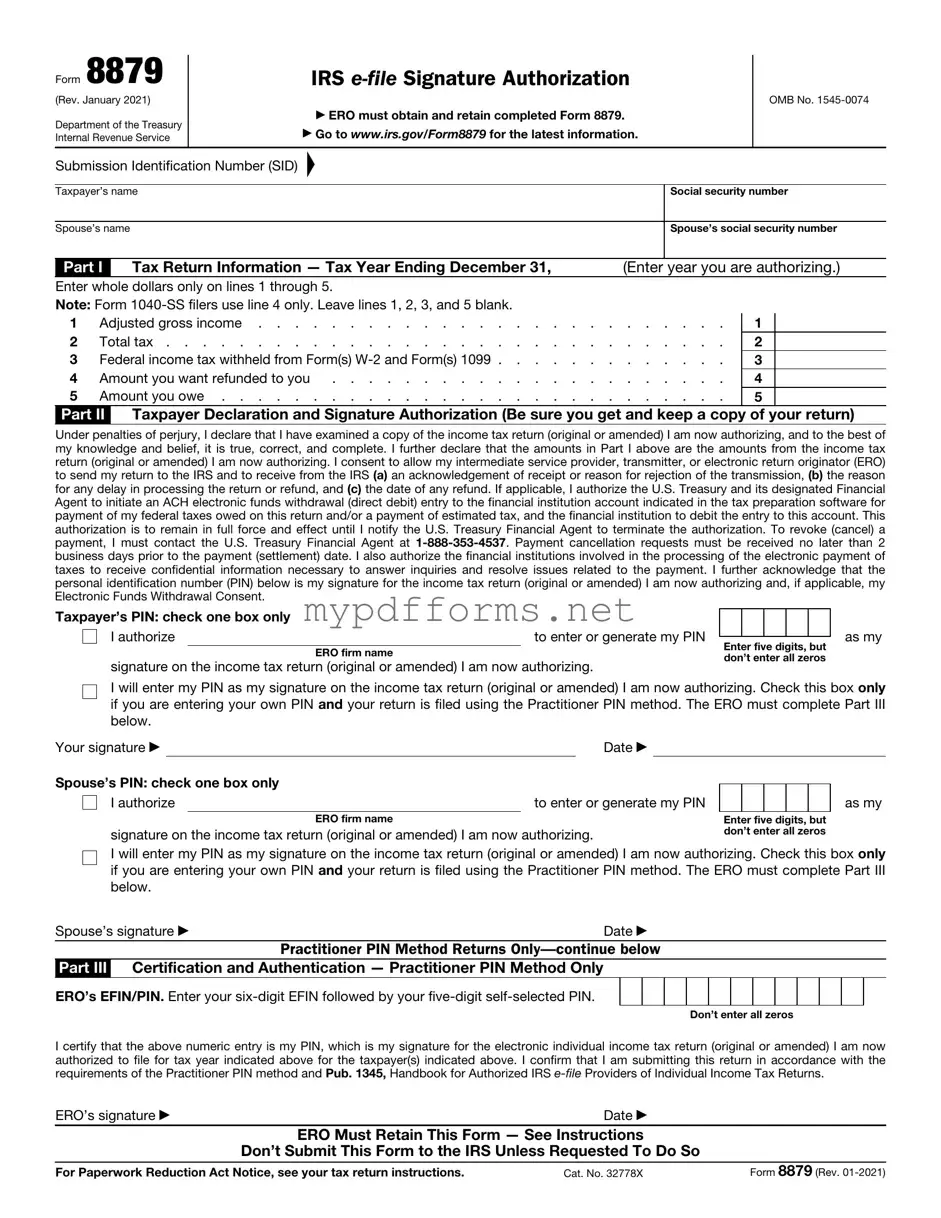

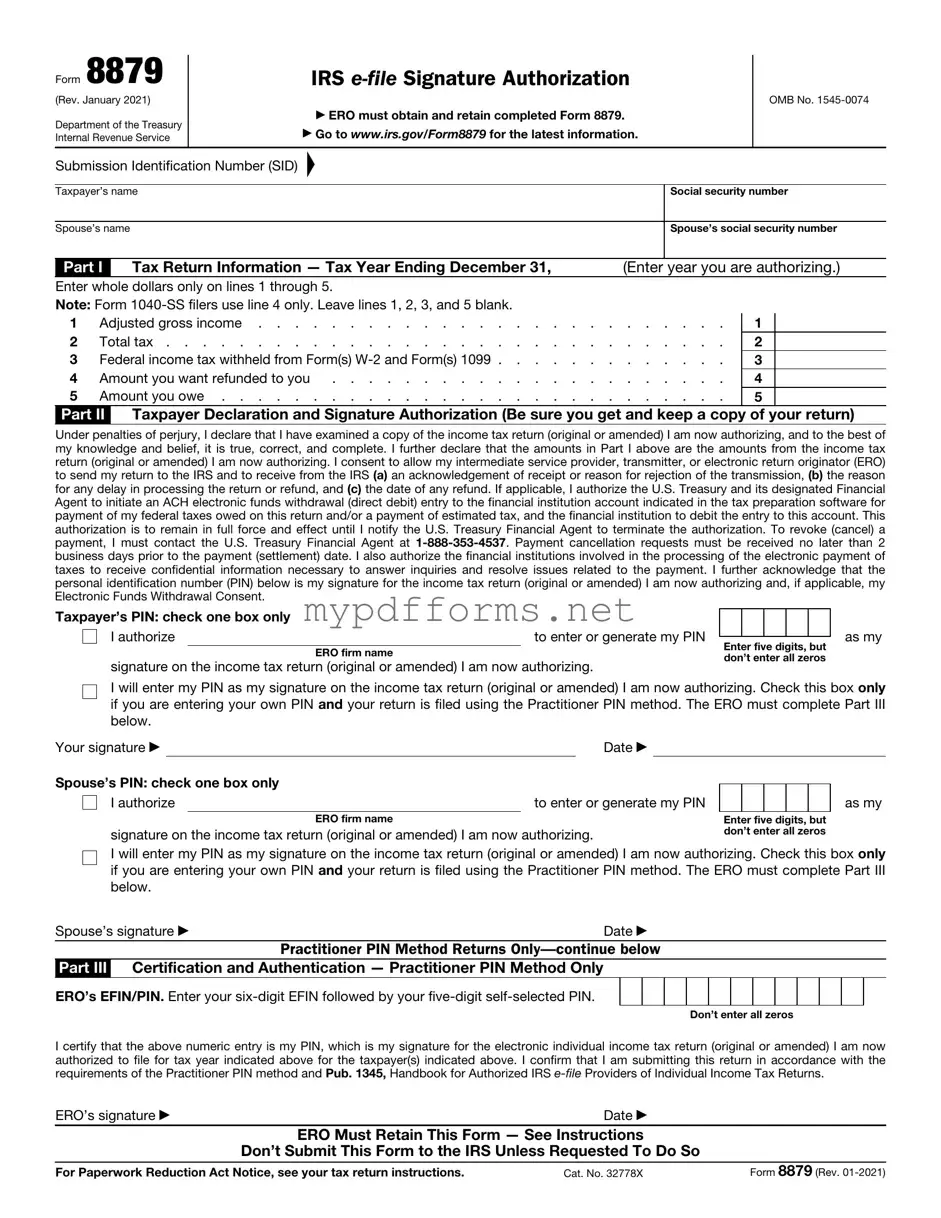

The IRS Form 1040 is perhaps the most well-known tax form used by individual taxpayers. Like Form 8879, which is used to authorize an e-filed tax return, Form 1040 serves as the primary document for reporting personal income and calculating tax liability. Both forms require accurate information about income, deductions, and credits. While Form 1040 provides a comprehensive overview of a taxpayer's financial situation, Form 8879 functions as a permission slip, allowing a tax professional to submit the 1040 electronically on the taxpayer’s behalf. This similarity highlights the importance of consent in the e-filing process.

Another document that shares similarities with Form 8879 is the IRS Form 8453. This form is also used in conjunction with e-filing, specifically to submit paper documents that cannot be filed electronically. Like Form 8879, Form 8453 requires the taxpayer's signature and acts as a verification tool. Both forms ensure that the taxpayer has reviewed their return before submission, providing a layer of security and accuracy. While Form 8879 is used primarily for e-filing authorization, Form 8453 serves to authenticate the filing process by allowing certain attachments to be submitted in paper form.

In navigating the complexities of tax forms, it is essential to understand that the WC-200a form, known as the Change of Physician/Additional Treatment by Consent, plays a crucial role within the Georgia State Board of Workers' Compensation system. To further assist with various administrative needs, you can also find useful resources for additional forms, including Georgia PDF Forms, which can streamline the process of handling your tax and compensation paperwork efficiently.

The IRS Form 8862 is another document that resembles Form 8879 in terms of its purpose of verification. This form is used to claim the Earned Income Tax Credit (EITC) after a previous denial. Similar to Form 8879, which authorizes e-filing, Form 8862 requires the taxpayer to affirm their eligibility for the credit. Both forms emphasize the importance of accuracy and honesty in tax filings. While Form 8879 focuses on the e-filing process, Form 8862 serves as a safeguard for taxpayers who have faced issues in the past, ensuring that they meet the necessary criteria to claim specific credits.

Form 8821, the Tax Information Authorization form, also shares a connection with Form 8879. This document allows a taxpayer to designate someone to receive their tax information from the IRS. Similar to Form 8879, which authorizes a tax professional to e-file on behalf of the taxpayer, Form 8821 ensures that the designated individual has access to the necessary information to assist the taxpayer. Both forms highlight the importance of consent and trust in the relationship between taxpayers and their representatives, allowing for smoother communication with the IRS.

Lastly, the IRS Form 4868, the Application for Automatic Extension of Time to File, is another document that reflects the need for authorization in the tax process. While Form 8879 is used to give permission for e-filing, Form 4868 provides taxpayers with an extension to file their returns without incurring penalties. Both forms require the taxpayer’s signature, demonstrating the importance of the taxpayer’s involvement in the filing process. By submitting Form 4868, taxpayers can alleviate some stress, similar to how Form 8879 simplifies the e-filing process through authorization.