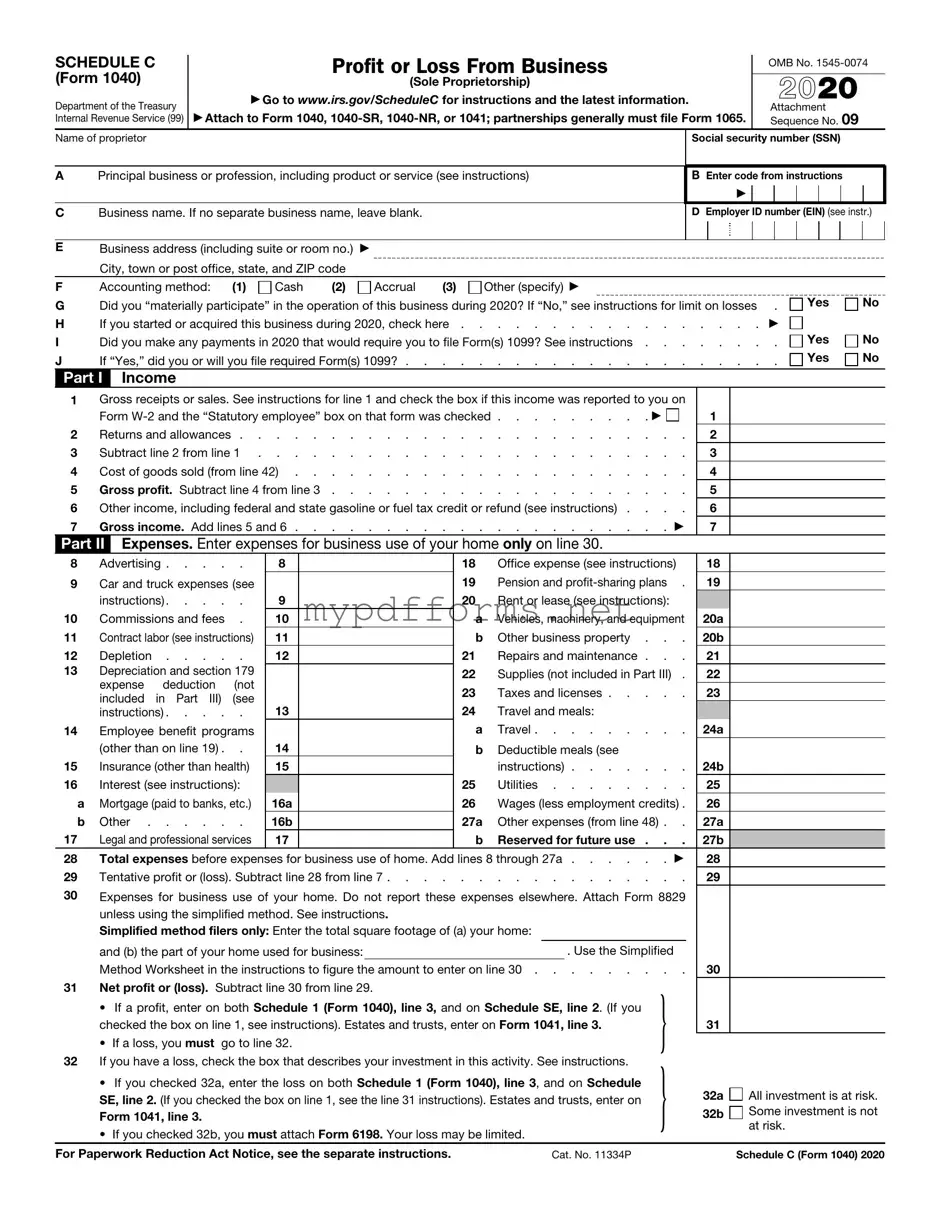

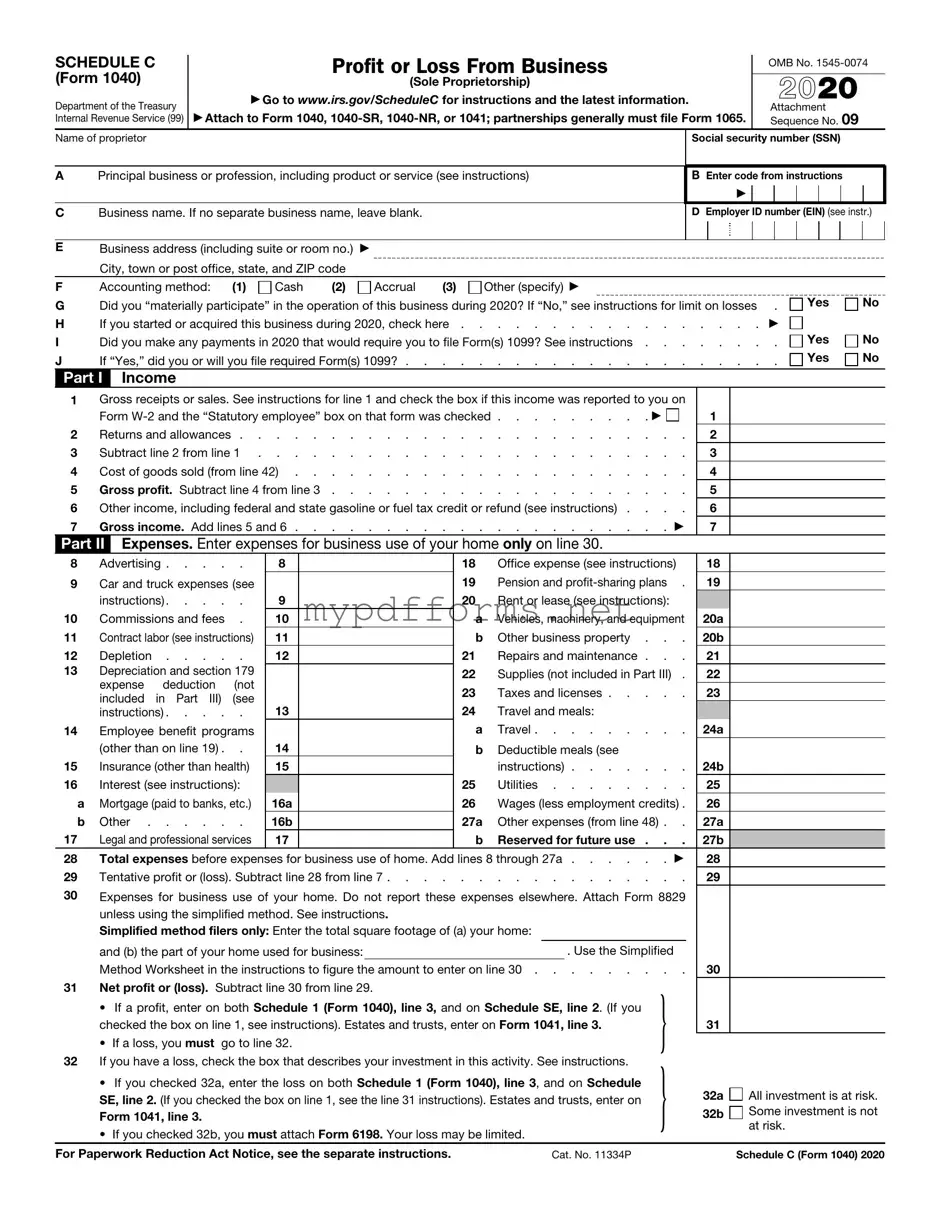

The IRS Schedule C form is similar to the Form 1040, which is the individual income tax return used by taxpayers in the United States. Both forms are integral to the tax filing process, as they help individuals report their income and determine their tax liability. While Form 1040 provides a comprehensive overview of an individual’s total income, Schedule C specifically focuses on income derived from self-employment, allowing business owners to detail their earnings and expenses. This distinction is crucial for accurately assessing tax obligations for those who operate their own businesses.

Another document similar to Schedule C is the IRS Schedule C-EZ. This simplified version is designed for small businesses with straightforward financial situations. Like Schedule C, it allows taxpayers to report income and expenses from self-employment. However, Schedule C-EZ is less complex and has fewer requirements, making it easier for eligible taxpayers to complete. This form is ideal for individuals who have minimal expenses and meet specific criteria, streamlining the filing process for those with simpler business operations.

Form 1065, the U.S. Return of Partnership Income, is also comparable to Schedule C. While Schedule C is for sole proprietors, Form 1065 is used by partnerships to report their income, deductions, and credits. Both forms require detailed financial information, but Form 1065 allows multiple partners to report their share of the business income and expenses. This document ensures that partnerships accurately reflect their financial performance and comply with tax obligations collectively.

Form 1120, the U.S. Corporation Income Tax Return, shares similarities with Schedule C in that both forms are used to report business income. However, Form 1120 is specifically for corporations, while Schedule C is for sole proprietorships. Both forms require detailed reporting of income and expenses, but the structure and tax treatment differ significantly. Corporations face different tax rates and regulations, making Form 1120 essential for corporate compliance.

Another related document is Form 941, the Employer's Quarterly Federal Tax Return. While Schedule C focuses on individual income from self-employment, Form 941 is used by employers to report payroll taxes withheld from employees' wages. Both forms require careful attention to detail and accuracy, but they serve different purposes. Schedule C is about personal income, while Form 941 addresses employer responsibilities regarding employee compensation.

Form 1099-MISC, which reports miscellaneous income, can also be compared to Schedule C. Independent contractors and freelancers often receive Form 1099-MISC from clients who pay them for services rendered. Similar to Schedule C, this form is essential for reporting income that is not subject to withholding. Both documents help taxpayers accurately report earnings and ensure compliance with tax regulations, particularly for those who are self-employed.

When considering the important documentation involved in boat ownership transactions, the New York Boat Bill of Sale form is particularly noteworthy as it serves as proof of sale and protects both parties throughout the process. Much like other financial forms, the proper completion and understanding of this form ensure compliance with legal requirements. For more information on this essential document, you can visit newyorkpdfdocs.com.

Form 4562, Depreciation and Amortization, is another document that interacts with Schedule C. This form allows business owners to report depreciation on assets used in their business, which can reduce taxable income reported on Schedule C. Both forms work together to give a complete picture of a taxpayer's financial situation, especially when it comes to the tax benefits associated with business investments.

Form 8829, Expenses for Business Use of Your Home, is also similar to Schedule C in that it pertains to self-employed individuals. This form allows taxpayers to deduct home office expenses, which can significantly impact the net income reported on Schedule C. Both forms require meticulous documentation of expenses to ensure compliance with IRS regulations, providing tax relief for those who operate their businesses from home.

Lastly, Schedule SE, which is used to calculate self-employment tax, is closely related to Schedule C. After reporting income and expenses on Schedule C, taxpayers use Schedule SE to determine their self-employment tax liability. This form is essential for individuals who earn income from self-employment, ensuring they pay the appropriate amount of Social Security and Medicare taxes based on their reported earnings.