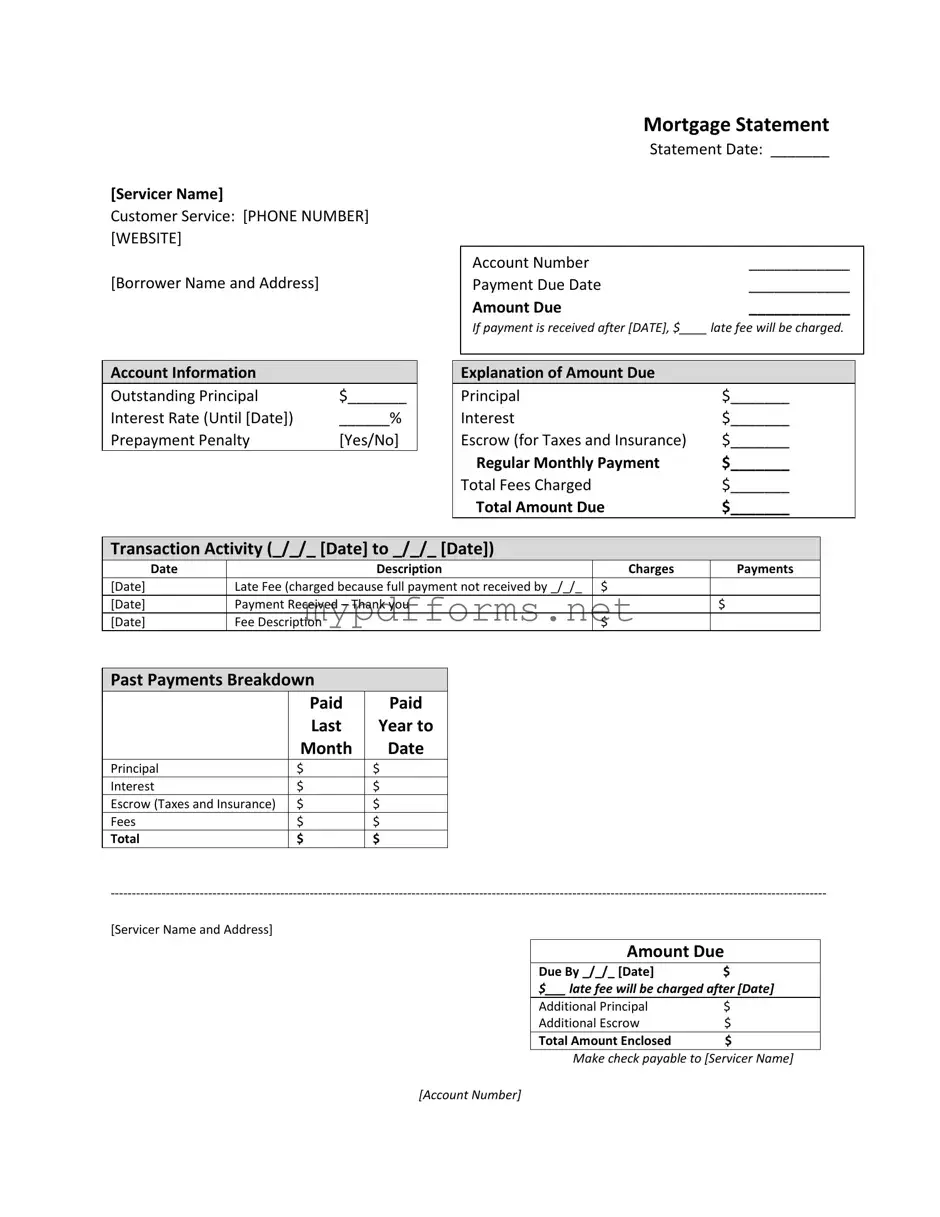

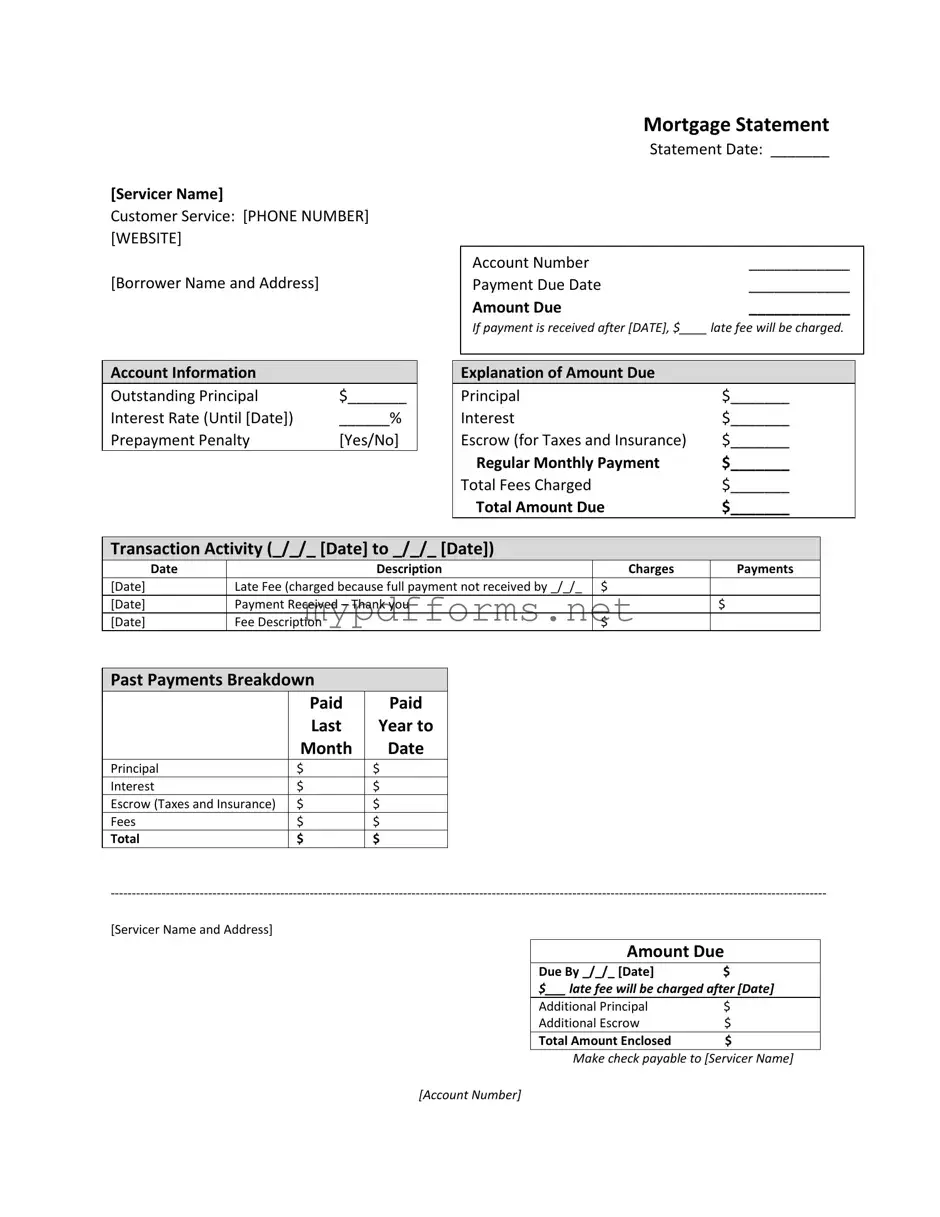

The first document similar to a Mortgage Statement is a Billing Statement. This document provides a summary of what is owed for a specific period. It includes details like the amount due, due date, and any late fees. Just like a mortgage statement, a billing statement helps the borrower keep track of their payments and understand their financial obligations.

Another related document is the Loan Statement. This statement outlines the terms of a loan, including the principal balance, interest rate, and payment history. Similar to a mortgage statement, it provides a clear picture of the borrower's current financial status regarding the loan. Both documents serve to inform the borrower about their financial responsibilities and any outstanding balances.

When dealing with motorcycle ownership in North Carolina, it's vital to have the appropriate documentation to facilitate the sale effectively. The North Carolina Motorcycle Bill of Sale form can be accessed easily at motorcyclebillofsale.com/free-north-carolina-motorcycle-bill-of-sale/, ensuring that both buyers and sellers adhere to the necessary legal requirements while making the transaction as seamless as possible.

A Payment History Report is also comparable to a Mortgage Statement. This report details all the payments made over a certain period, showing dates, amounts, and any fees incurred. Like a mortgage statement, it helps borrowers track their payment patterns and identify any issues that may arise, such as missed payments or late fees.

The Escrow Statement is another similar document. It breaks down the escrow account, showing how much money is set aside for property taxes and insurance. This document is important for homeowners, as it reflects the same escrow information found in a mortgage statement. Both statements help borrowers understand how their payments are allocated.

A Property Tax Statement shares similarities with a Mortgage Statement as well. It provides details on property taxes owed, including due dates and amounts. Just like a mortgage statement, it helps homeowners stay informed about their financial obligations related to their property, ensuring they do not miss important payments.

The Annual Mortgage Statement is also worth mentioning. This document summarizes the mortgage payments made over the past year, including principal and interest paid. It serves a similar purpose as a mortgage statement by providing an overview of the borrower’s financial activity related to their mortgage, making it easier to prepare for tax season.

Finally, a Credit Report can be seen as a related document. While it does not provide specific payment details, it reflects the borrower's credit history, including mortgage payments. Like a mortgage statement, it plays a crucial role in understanding the borrower’s financial health and can impact future borrowing opportunities.