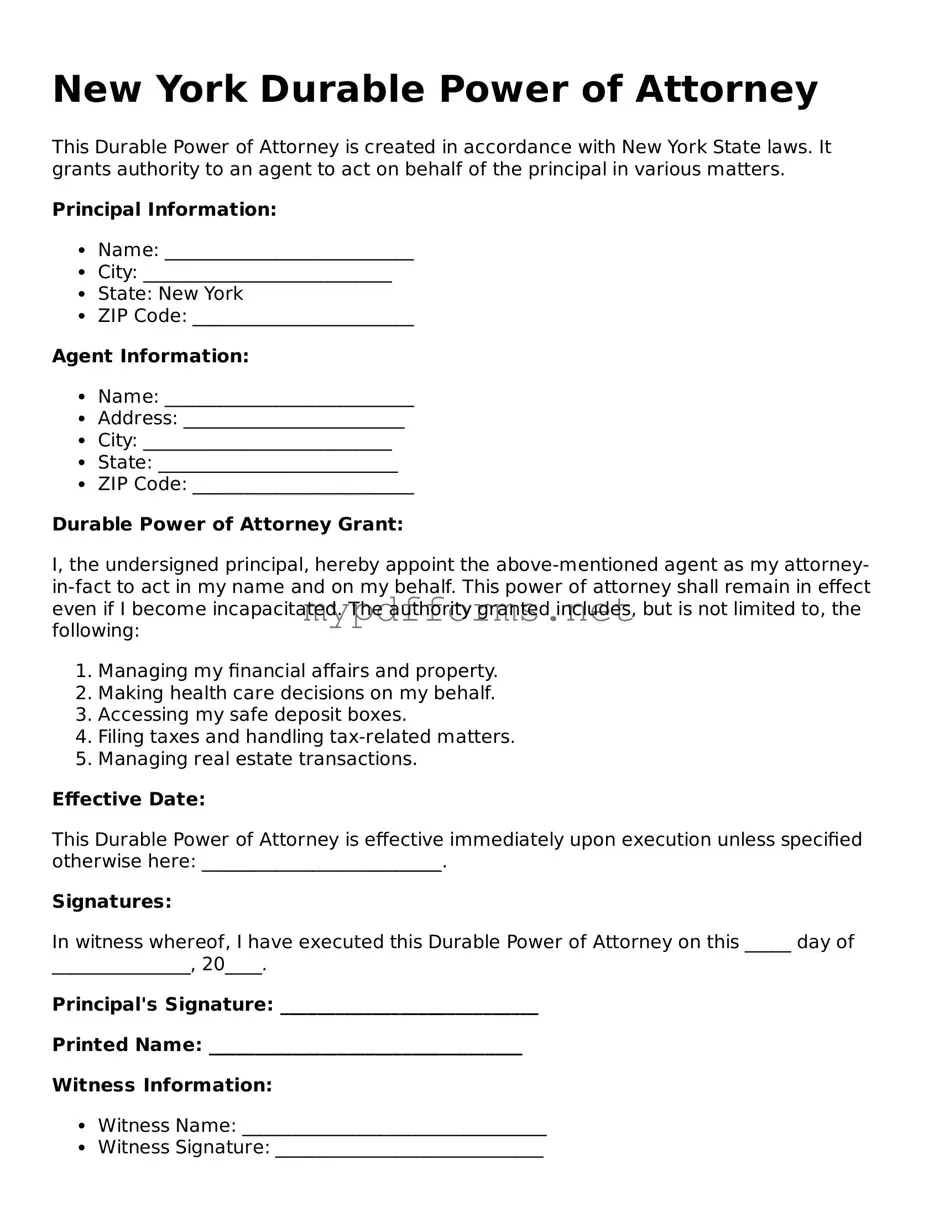

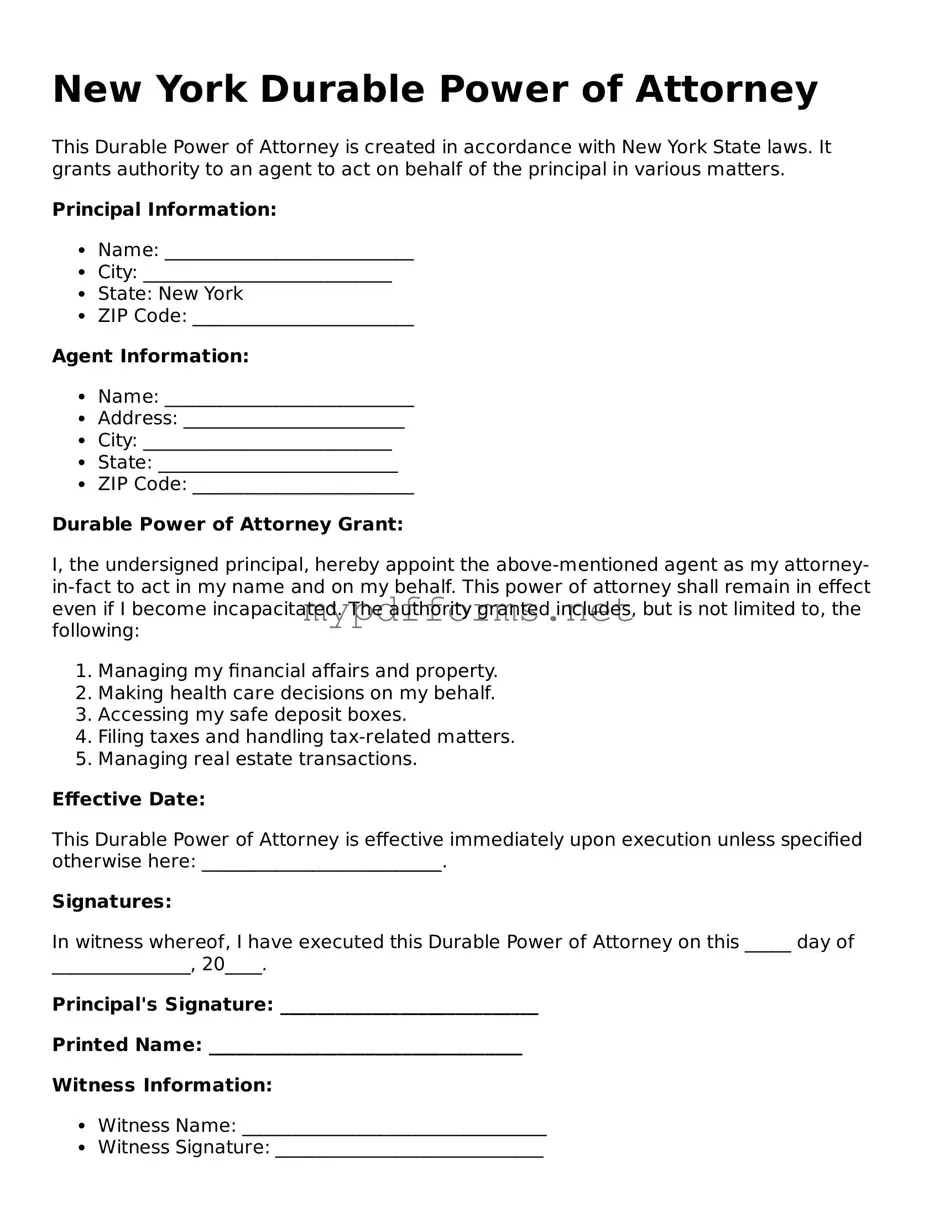

Attorney-Verified Durable Power of Attorney Document for New York

A Durable Power of Attorney in New York is a legal document that allows an individual to designate another person to make financial and legal decisions on their behalf, even if they become incapacitated. This form ensures that the appointed agent can act in the best interest of the principal, providing a means to manage affairs without court intervention. Understanding the nuances of this form is essential for anyone considering its use; take the first step by filling out the form below.

Modify Document Here

Attorney-Verified Durable Power of Attorney Document for New York

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Durable Power of Attorney online in just a few steps.