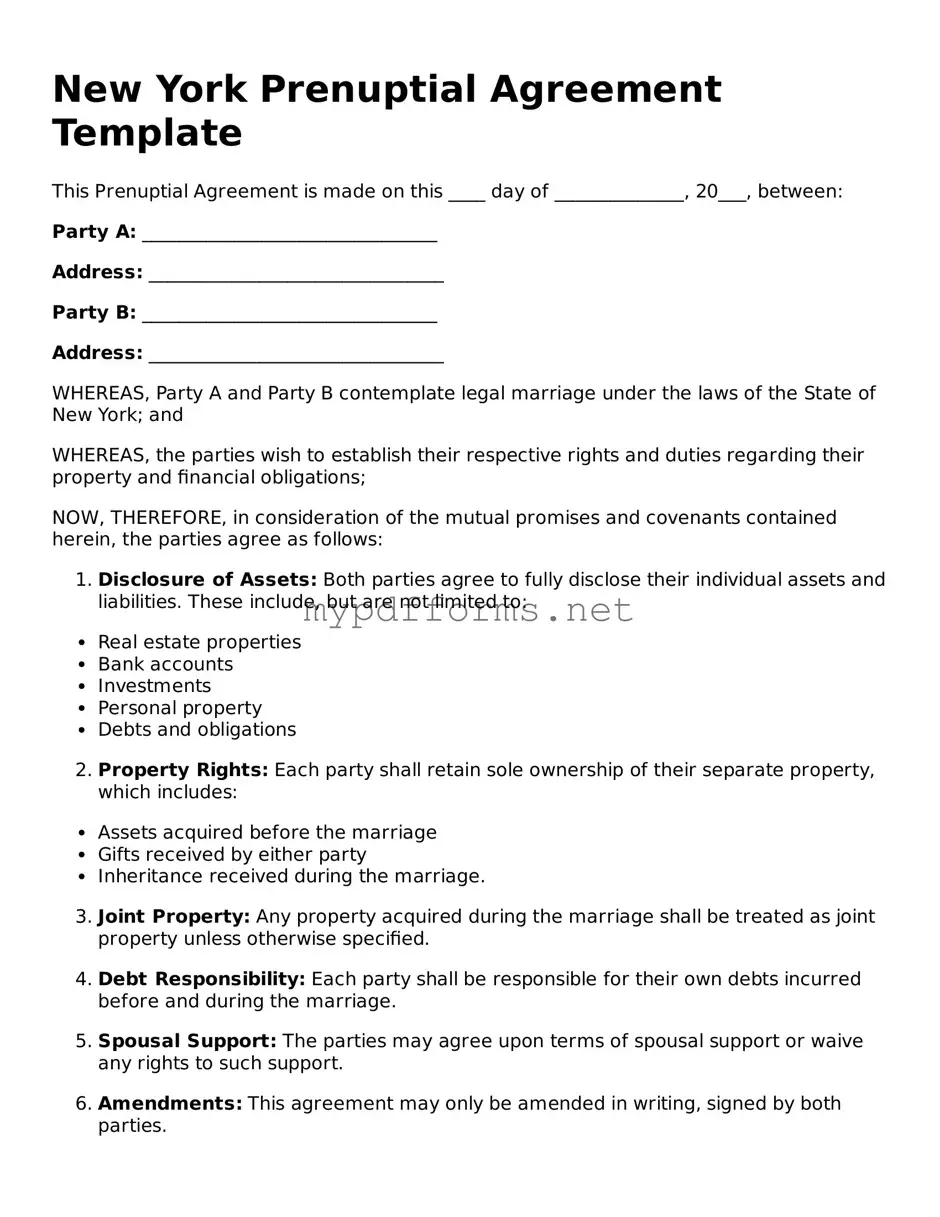

Attorney-Verified Prenuptial Agreement Document for New York

A Prenuptial Agreement is a legal document that outlines the division of assets and responsibilities between partners before marriage. This form serves to protect individual interests and clarify expectations, ensuring both parties are on the same page. Ready to secure your future? Fill out the form by clicking the button below.

Modify Document Here

Attorney-Verified Prenuptial Agreement Document for New York

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Prenuptial Agreement online in just a few steps.