The Owner Financing Contract is similar to a Lease Purchase Agreement. In a Lease Purchase Agreement, a tenant has the option to buy the property after a specified lease period. Like owner financing, this arrangement allows the buyer to occupy the home while making payments, but it also includes a rental component. This can be beneficial for buyers who may not be ready to secure a mortgage immediately but want to lock in a purchase price and work towards ownership.

Another document that shares similarities is the Land Contract, also known as a Contract for Deed. In this arrangement, the seller retains the title to the property until the buyer has paid the full purchase price. Similar to owner financing, the buyer makes regular payments to the seller, but they do not receive ownership until the contract terms are fulfilled. This option can provide flexibility for buyers who may face challenges in obtaining traditional financing.

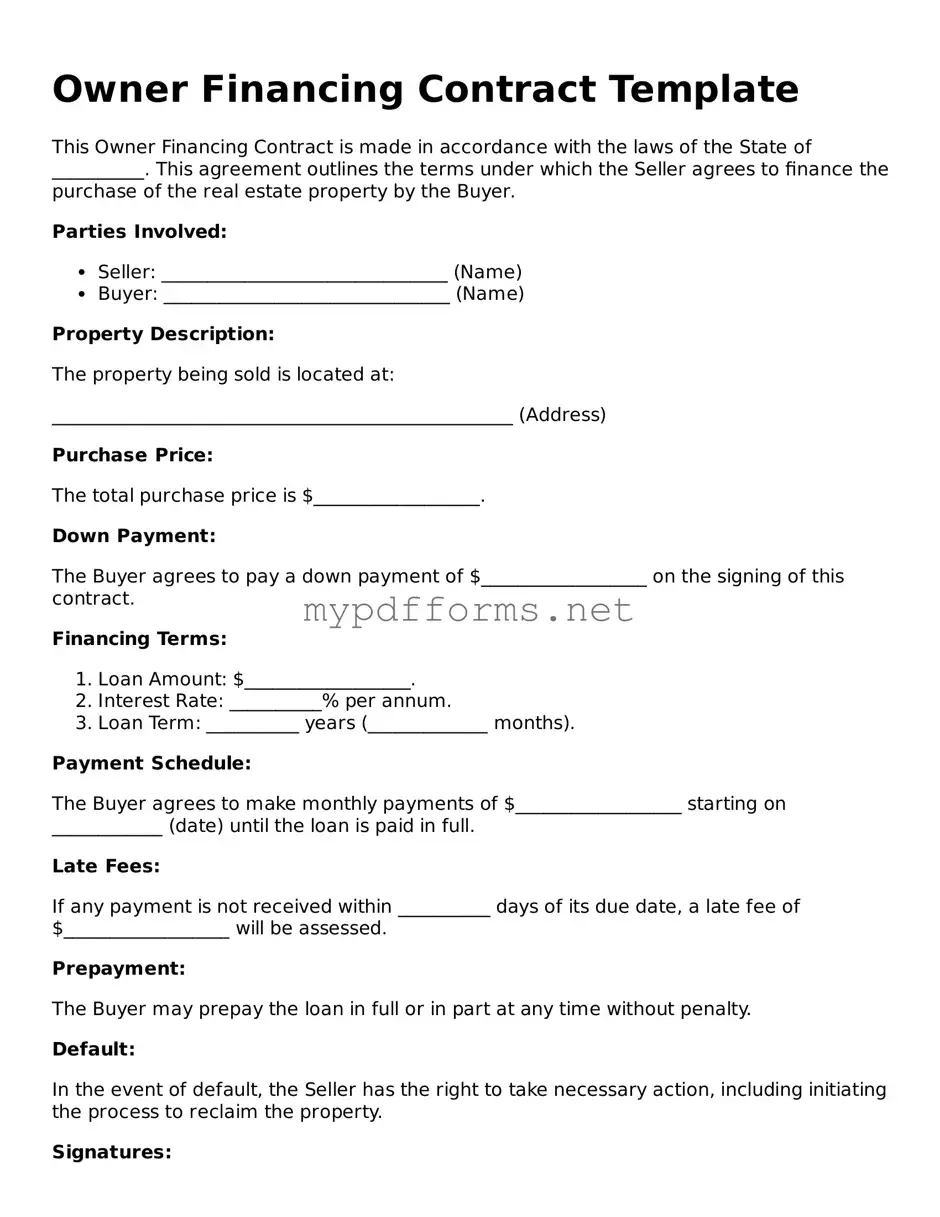

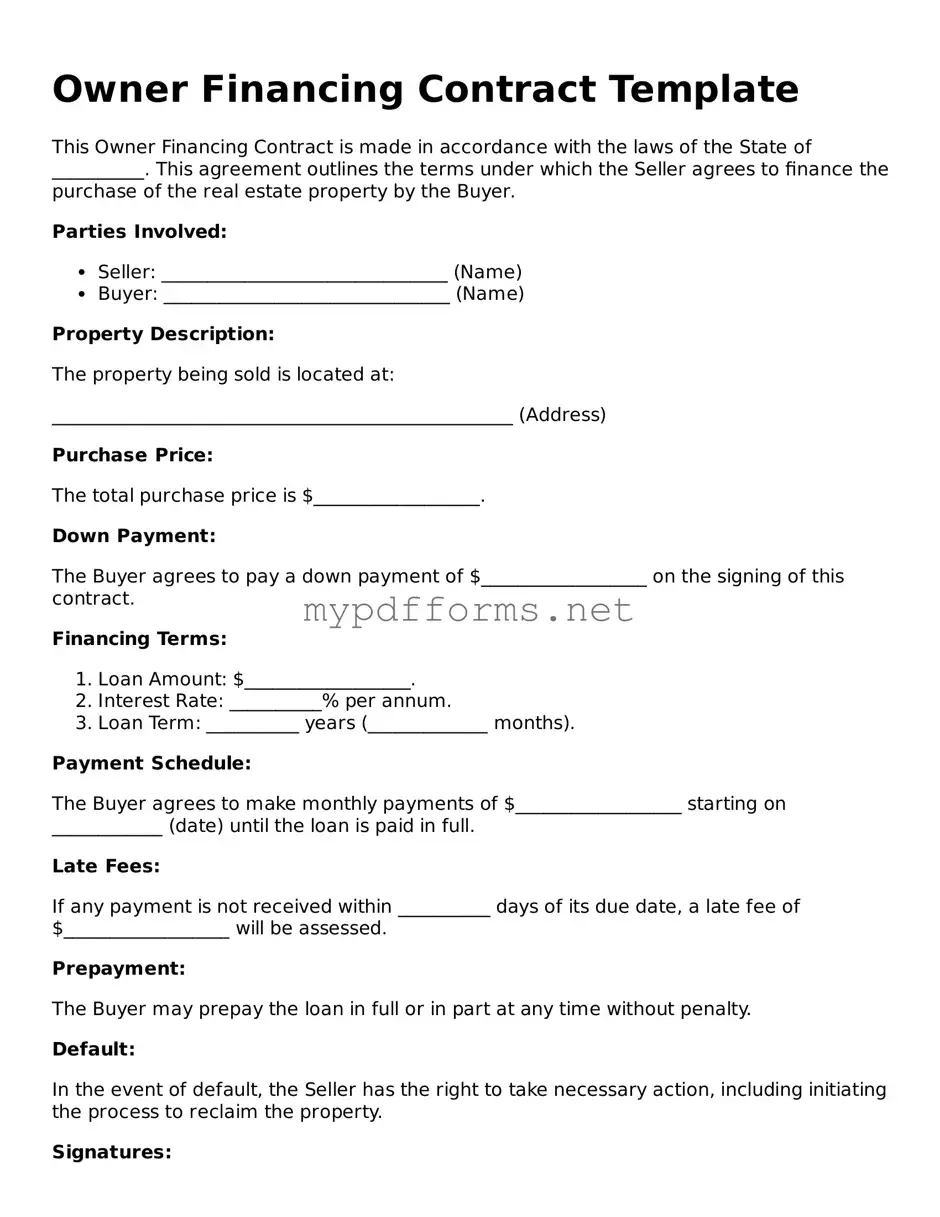

A Promissory Note is also related to the Owner Financing Contract. This document outlines the borrower's promise to repay the loan under specific terms, such as interest rate and payment schedule. In owner financing, the promissory note serves as a key component, detailing the financial obligations between the buyer and seller. It provides legal assurance to the seller that the buyer is committed to fulfilling their payment obligations.

The Mortgage Agreement is another document that shares characteristics with owner financing. A mortgage agreement is a formal loan document that secures the loan with the property as collateral. While owner financing does not typically involve a bank, the principles are similar in that the seller holds a security interest in the property until the buyer pays off the loan. This agreement protects both parties by clarifying the terms of the financing arrangement.

The Installment Sale Agreement is also comparable to the Owner Financing Contract. This agreement allows the buyer to make payments over time while taking possession of the property. Like owner financing, the seller retains some rights until the purchase price is fully paid. This type of arrangement can be appealing to buyers who prefer to spread out their payments rather than securing a large loan upfront.

A Real Estate Purchase Agreement is another relevant document. This contract outlines the terms and conditions of the sale between the buyer and seller. While it can involve traditional financing, it can also accommodate owner financing terms. Both documents serve to protect the interests of both parties, ensuring that all aspects of the transaction are clearly defined.

In navigating the complexities of real estate transactions, it is crucial for buyers and sellers to familiarize themselves with various legal documents, including the Colorado PDF Forms, which provide essential resources like the Real Estate Purchase Agreement. This understanding not only equips them with the knowledge to make informed decisions but also aids in ensuring that all terms and obligations are clearly outlined, thereby minimizing any potential ambiguities in the contractual relationship.

Finally, a Seller Financing Addendum can be similar to the Owner Financing Contract. This addendum is often attached to a standard purchase agreement to specify the terms of seller financing. It outlines the interest rate, payment schedule, and other relevant details. This addendum allows for flexibility in negotiations and can make the transaction more appealing to buyers who may not qualify for traditional loans.