The Payroll Check form is closely related to the Direct Deposit Authorization form. Both documents serve the purpose of facilitating employee compensation. While the Payroll Check form provides a physical check for wages, the Direct Deposit Authorization form allows employees to receive their pay directly into their bank accounts. This method not only streamlines the payment process but also reduces the risk of lost or stolen checks. Both forms require employee information and authorization, ensuring that payment details are accurate and secure.

Another document similar to the Payroll Check form is the Wage Garnishment Order. This legal document mandates that a portion of an employee's earnings be withheld to satisfy a debt. Like the Payroll Check form, it involves the calculation of wages and requires precise information about the employee's earnings. Both documents must be processed by the payroll department to ensure compliance with legal obligations while ensuring that employees receive their remaining wages correctly and on time.

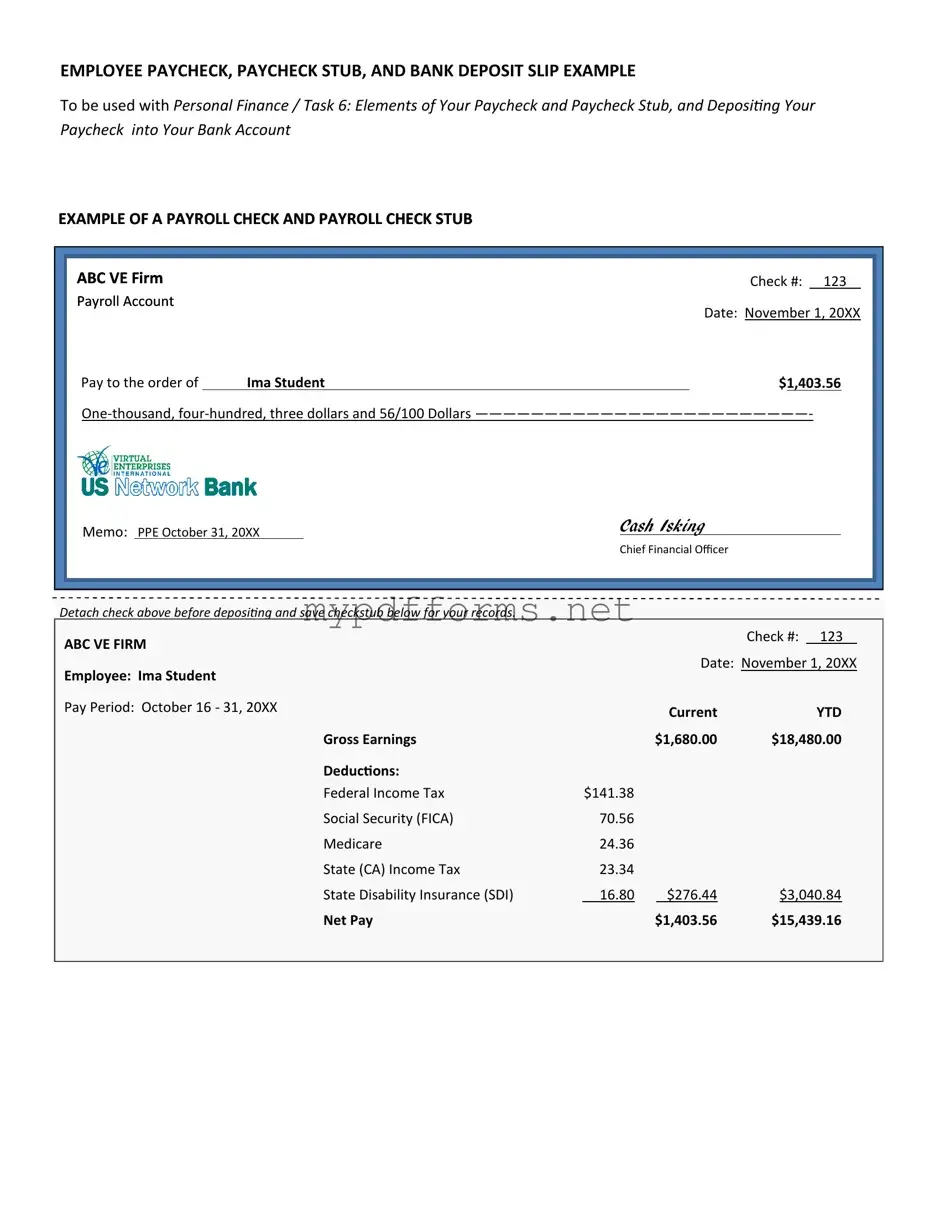

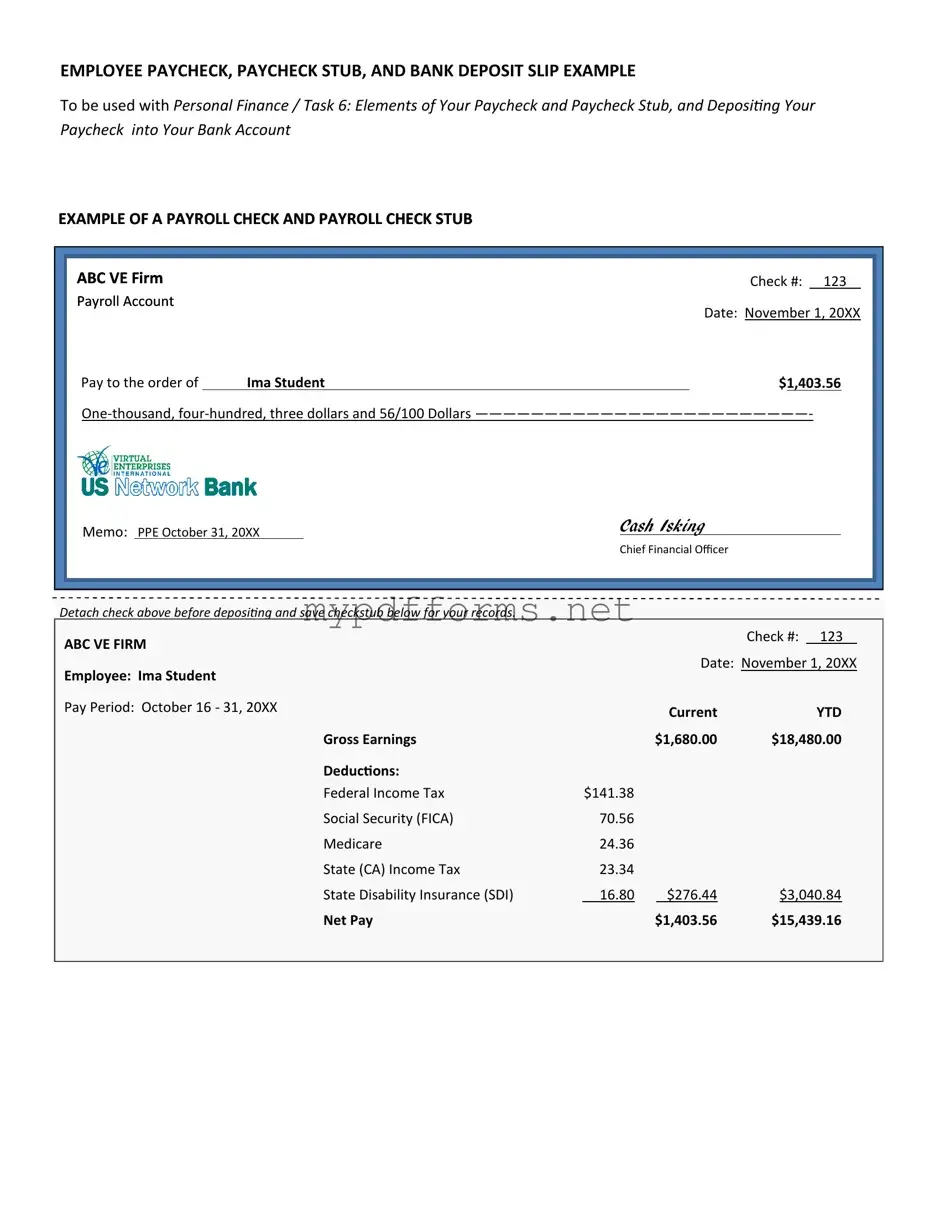

The Employee Pay Stub is also akin to the Payroll Check form. This document provides a detailed breakdown of an employee's earnings, deductions, and net pay for a specific pay period. While the Payroll Check form indicates the payment method, the Pay Stub offers transparency regarding how the total pay was calculated. Both documents work in tandem to keep employees informed about their compensation and the deductions taken from their pay.

The Texas Motorcycle Bill of Sale form is a legal document that records the sale and transfer of ownership of a motorcycle. This form serves as proof of the transaction between the buyer and seller, ensuring that both parties have a clear understanding of the terms. By completing this form, individuals can protect their rights and avoid potential disputes in the future. For more information, refer to motorcyclebillofsale.com/free-texas-motorcycle-bill-of-sale/.

The Time Sheet is another document that shares similarities with the Payroll Check form. Time Sheets track the hours worked by employees, which directly affects their pay. Payroll departments rely on accurate Time Sheets to calculate wages, whether through checks or direct deposits. Both documents are crucial in ensuring that employees are compensated fairly based on the hours they have worked, highlighting the connection between time worked and payment received.

The IRS Form W-4 is related to the Payroll Check form as well. This form determines the amount of federal income tax withholding from an employee's paycheck. While the Payroll Check form shows the final payment amount, the W-4 influences how much of that amount is withheld for taxes. Both documents are essential for ensuring that employees receive the correct net pay and comply with tax regulations.

The Employment Agreement is another document that can be compared to the Payroll Check form. This agreement outlines the terms of employment, including salary and payment methods. While the Payroll Check form is used for actual disbursement of wages, the Employment Agreement sets the expectations for compensation. Both documents are critical in establishing a clear understanding of how and when employees will be paid.

Lastly, the Payroll Register is similar to the Payroll Check form. This internal document provides a comprehensive overview of all payroll transactions for a specific period, including employee names, hours worked, and amounts paid. While the Payroll Check form is focused on individual payments, the Payroll Register aggregates this information for administrative purposes. Both documents are vital for payroll management, ensuring accuracy and accountability in employee compensation.