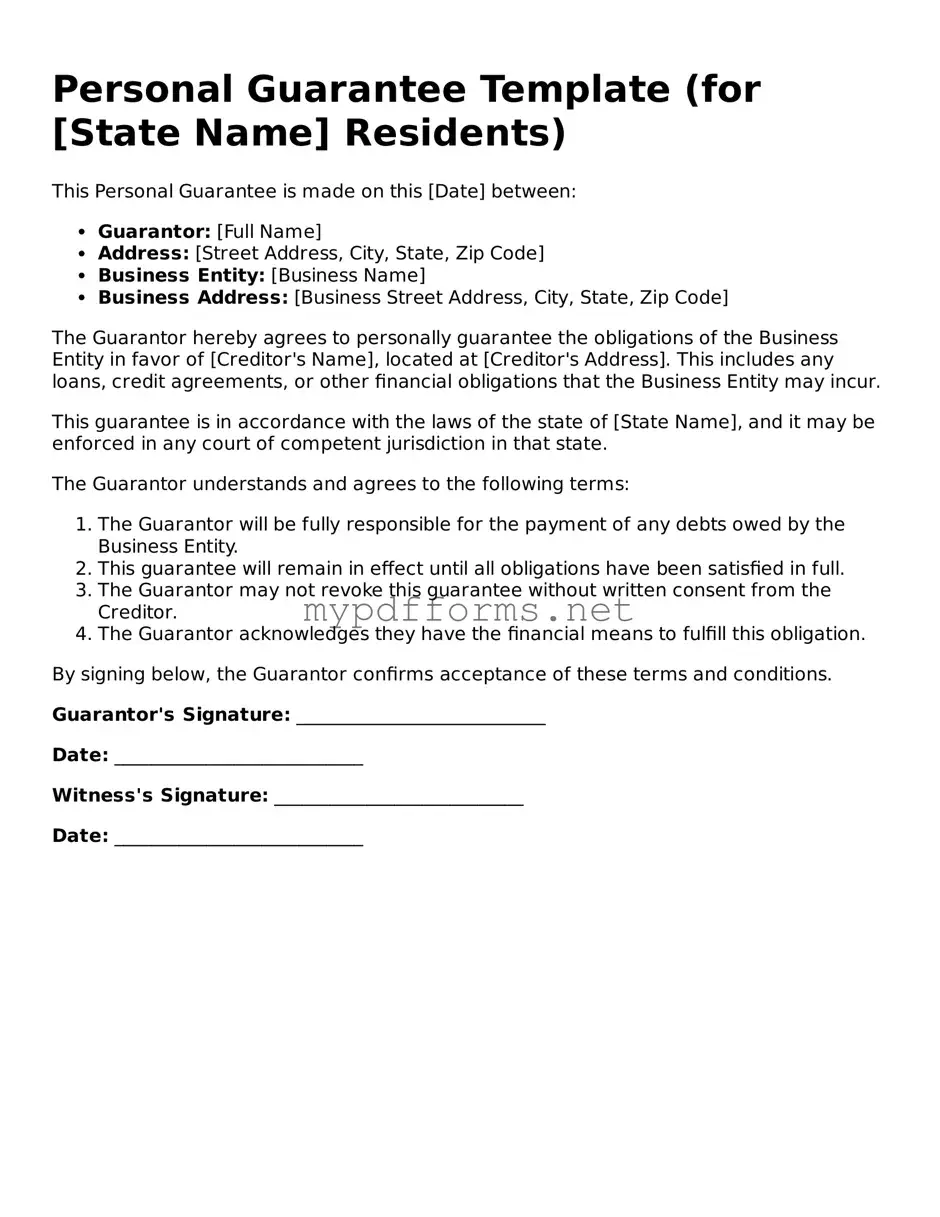

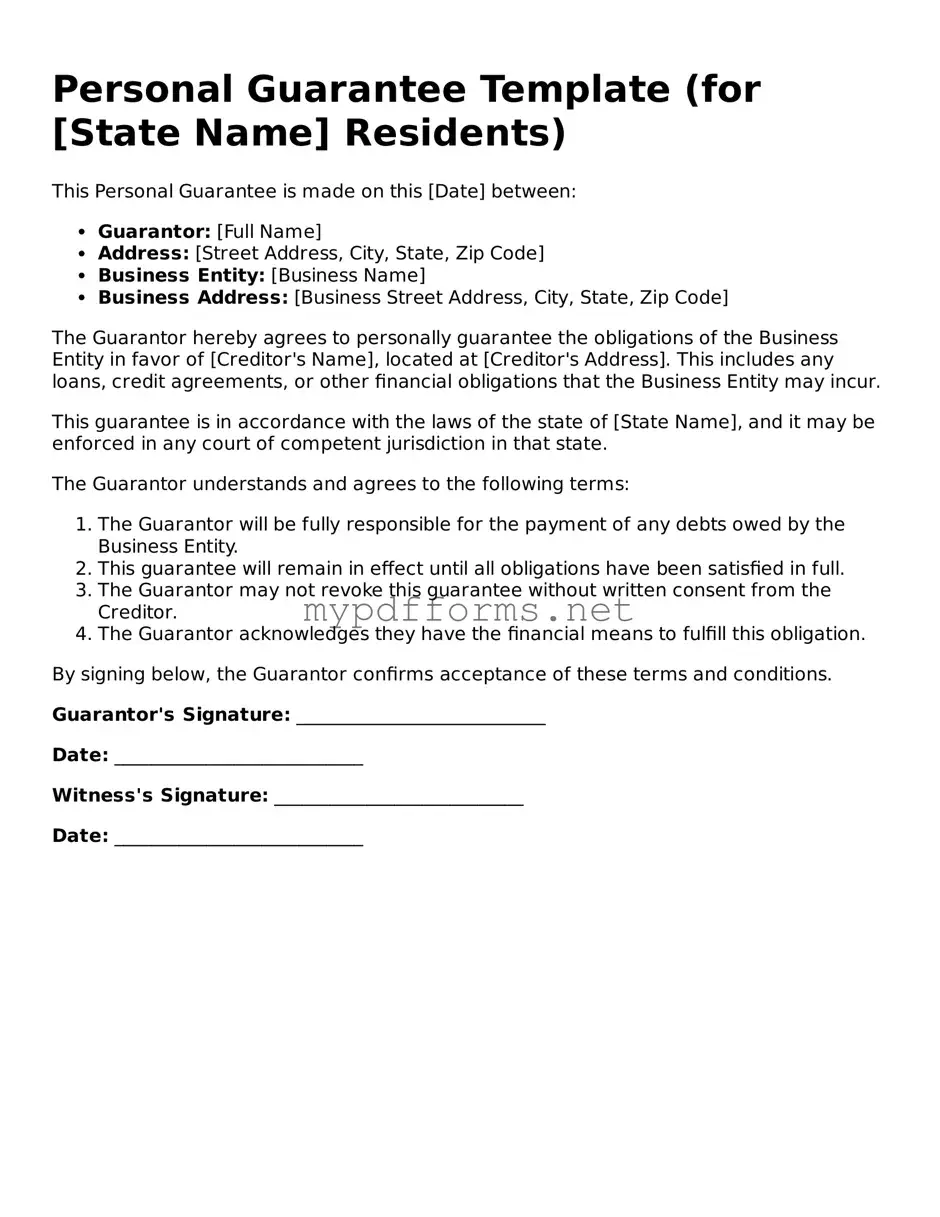

Personal Guarantee Template

A Personal Guarantee form is a legal document that an individual signs to agree to be personally responsible for a debt or obligation of a business. This form provides lenders and creditors with assurance that they can seek repayment from the individual if the business fails to meet its financial commitments. Understanding the implications of this document is crucial for anyone considering signing it; take action now by filling out the form below.

Modify Document Here

Personal Guarantee Template

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Personal Guarantee online in just a few steps.