A car loan agreement is similar to a promissory note in that both documents outline the terms of a loan for purchasing a vehicle. A car loan agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. While a promissory note serves as a promise to repay the borrowed amount, the car loan agreement provides a more comprehensive overview of the lender's and borrower's rights and responsibilities. Both documents are legally binding and aim to protect the interests of both parties involved in the transaction.

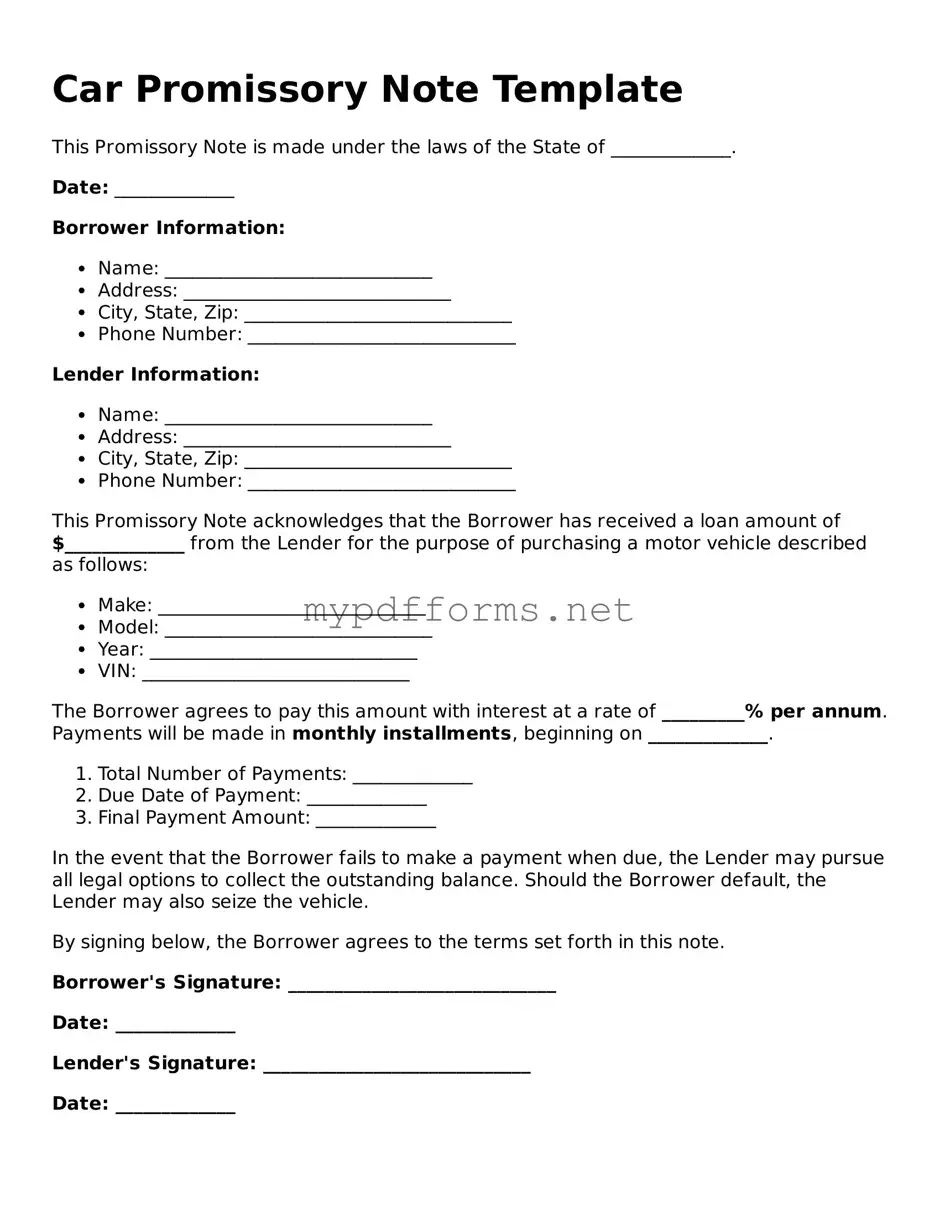

Understanding the essentials of a comprehensive Promissory Note template can significantly enhance your financial dealings. This document not only outlines the specifics of the repayment terms but also safeguards the interests of both the lender and the borrower throughout the loan process.

A lease agreement for a vehicle shares similarities with a promissory note as it also involves a financial commitment related to the use of a car. In a lease agreement, the lessee agrees to make regular payments for the right to use the vehicle for a specified period. Like a promissory note, the lease outlines the payment terms, including the amount and due dates. However, unlike a promissory note, a lease does not involve ownership transfer at the end of the term, making it a distinct but related financial document.

A mortgage note is another document akin to a promissory note, as it represents a borrower's promise to repay a loan, typically for real estate. While the promissory note for a car focuses on vehicle financing, a mortgage note details the terms of a home loan, including the loan amount, interest rate, and repayment schedule. Both documents serve as legal evidence of the debt and are enforceable in court. They also establish the consequences of default, ensuring that the lender has recourse if the borrower fails to meet their obligations.

An installment agreement can also be compared to a promissory note, as it involves a borrower agreeing to repay a loan in regular payments over time. This type of agreement is often used for various types of purchases, including cars, furniture, or appliances. The installment agreement outlines the total amount financed, the payment schedule, and any applicable interest rates. Like a promissory note, it serves as a commitment from the borrower to fulfill their payment obligations, providing both parties with a clear understanding of the terms involved.