Purchase Letter of Intent Template

A Purchase Letter of Intent is a document that outlines the preliminary terms and conditions of a potential purchase agreement between a buyer and a seller. This form serves as a starting point for negotiations and helps clarify each party's intentions before finalizing a deal. To begin the process, fill out the form by clicking the button below.

Modify Document Here

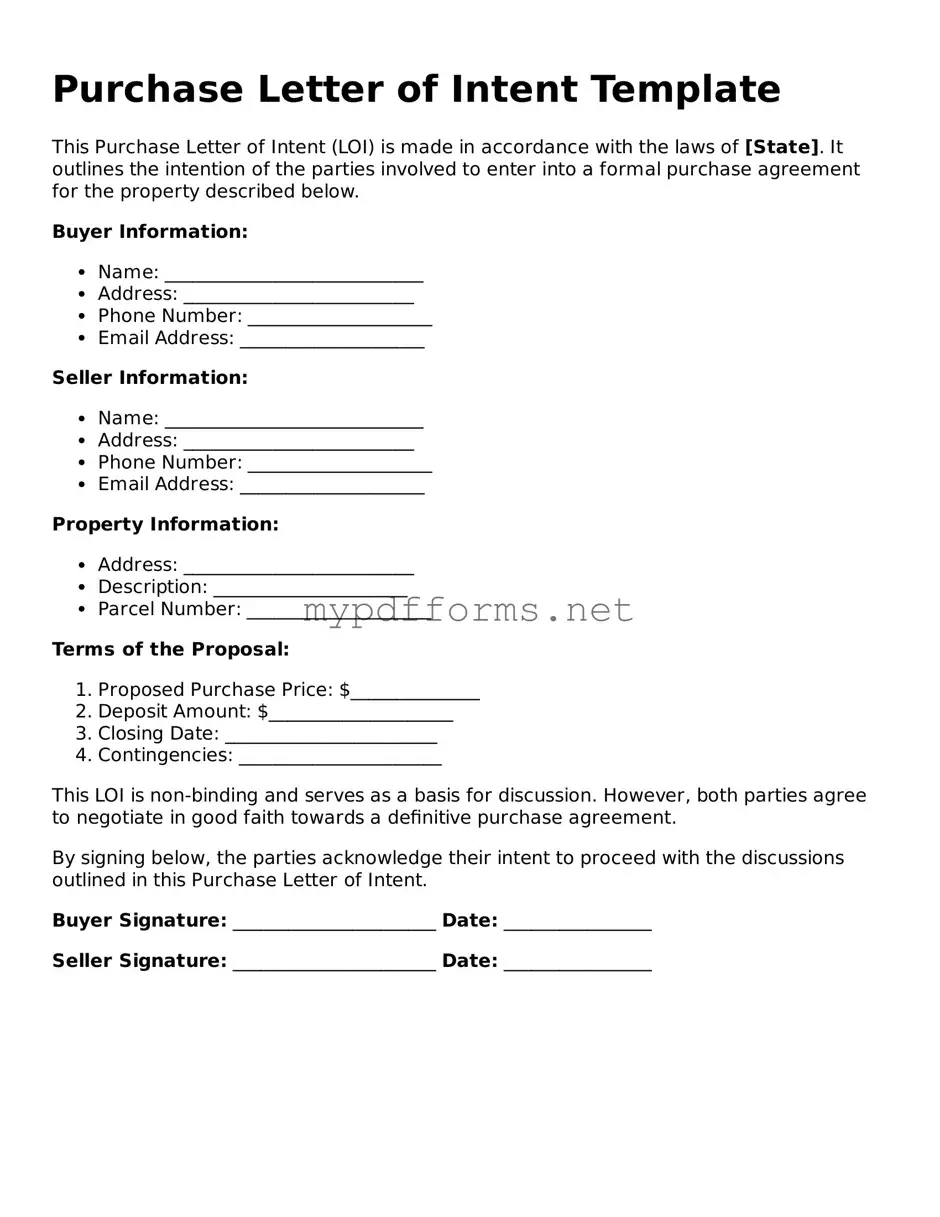

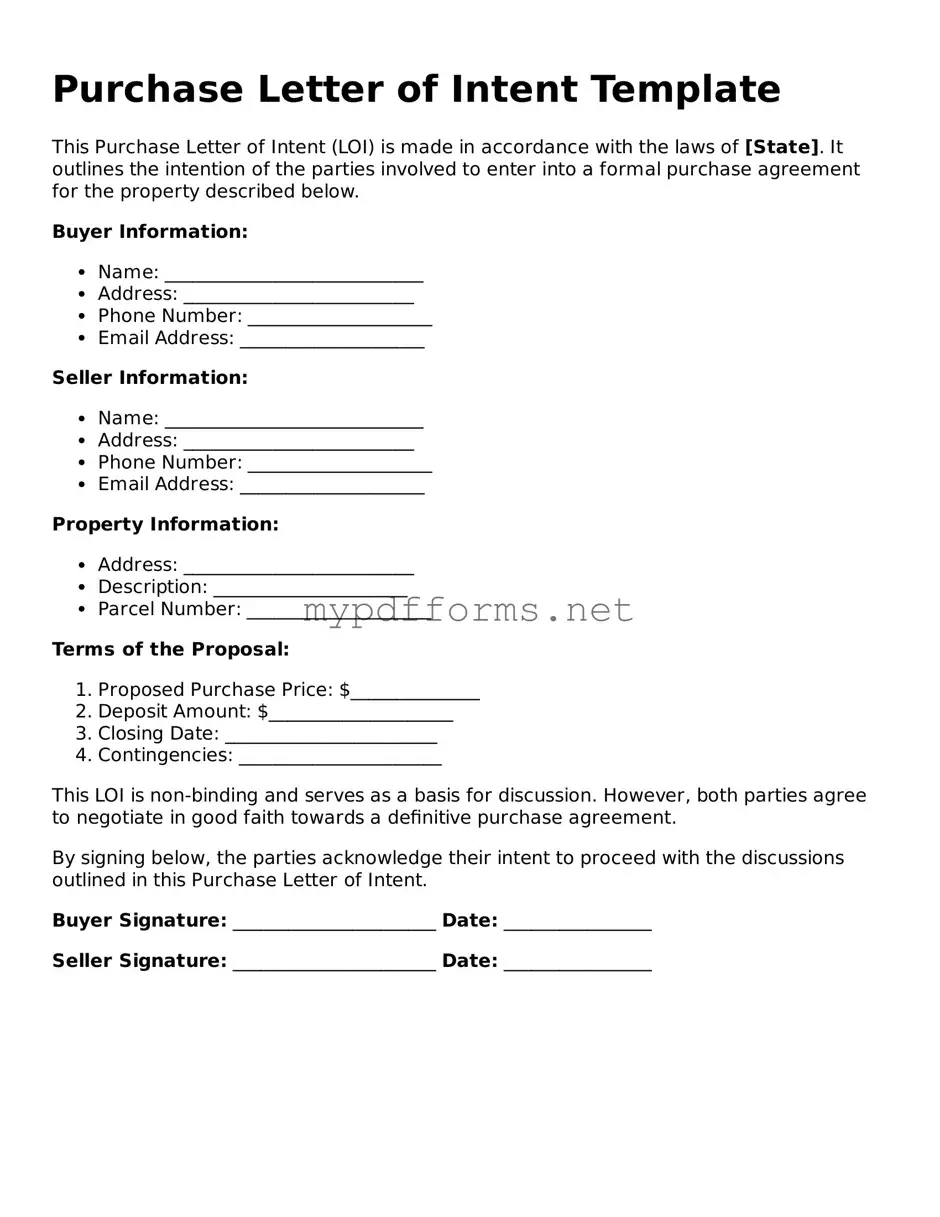

Purchase Letter of Intent Template

Modify Document Here

Modify Document Here

or

⇓ PDF

Need to check this off quickly?

Edit and complete Purchase Letter of Intent online in just a few steps.