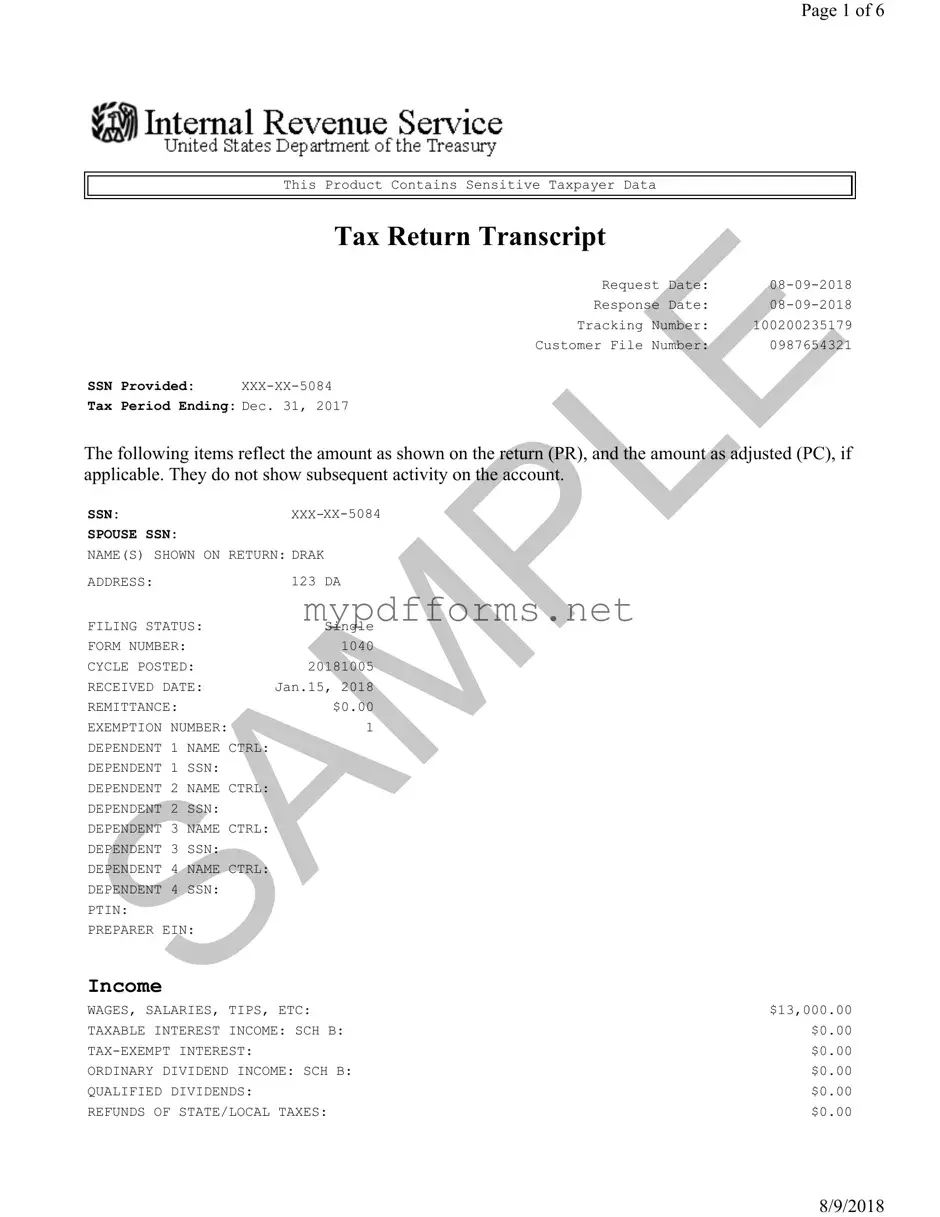

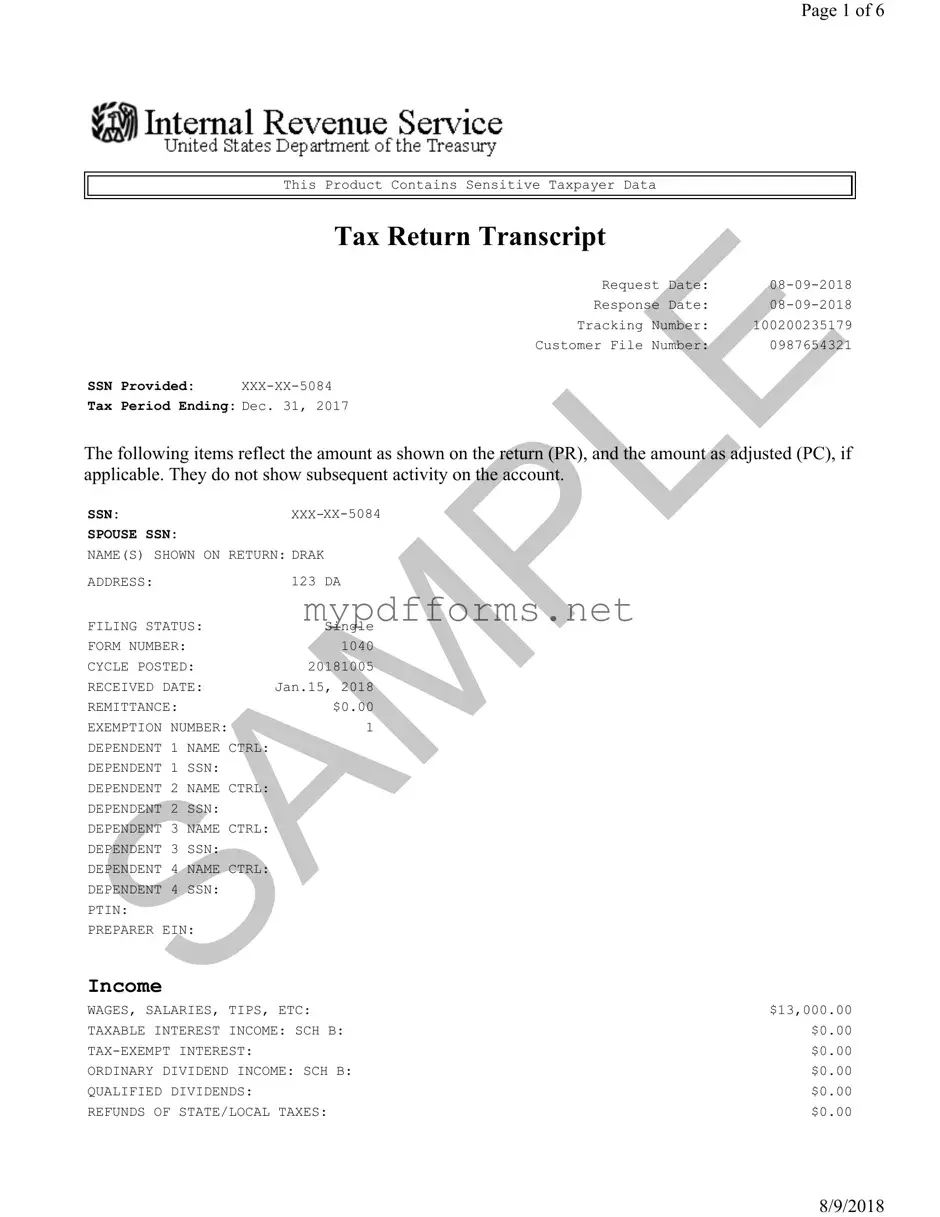

The Form 1040, U.S. Individual Income Tax Return, serves as the primary document for individual taxpayers to report their annual income to the Internal Revenue Service (IRS). It provides a comprehensive overview of income, deductions, and tax credits. Similar to the Sample Tax Return Transcript, the Form 1040 includes detailed financial information, such as wages, interest, and tax liabilities. The Form 1040 is essential for individuals to calculate their tax obligations and determine if they owe additional taxes or are entitled to a refund.

The Form 1040A is a simplified version of the standard Form 1040. It allows taxpayers with straightforward financial situations to report income, claim deductions, and receive credits. Like the Sample Tax Return Transcript, it summarizes key financial data, but it has limitations regarding the types of income and deductions that can be reported. This form is suitable for those who do not itemize deductions and have a limited number of income sources.

The Form 1040EZ is the most basic tax return form available for individual taxpayers. It is designed for those with simple tax situations, such as single filers or married couples filing jointly without dependents. The Sample Tax Return Transcript and Form 1040EZ both present essential income information, but the latter is restricted to taxpayers with taxable income below a certain threshold and does not allow for itemized deductions. This form streamlines the filing process for eligible individuals.

The IRS Form W-2, Wage and Tax Statement, reports an employee's annual wages and the taxes withheld from their paycheck. It is similar to the Sample Tax Return Transcript in that it provides specific income data that is crucial for tax filing. The W-2 is issued by employers and is used by employees to complete their tax returns, reflecting the income that will be reported on the tax return transcript.

The IRS Form 1099 series includes various forms that report different types of income, such as freelance earnings or interest income. For example, Form 1099-MISC is used for reporting miscellaneous income. Like the Sample Tax Return Transcript, these forms provide detailed income information necessary for accurate tax reporting. The 1099 forms serve as documentation for income that is not reported on a W-2, thus complementing the information found in the tax return transcript.

The Form 4868 is an application for an automatic extension of time to file a U.S. individual income tax return. While it does not directly report income, it is similar to the Sample Tax Return Transcript in that it is a crucial document in the tax filing process. It allows taxpayers additional time to gather their financial information and file their returns without incurring penalties for late submission.

The IRS Form 4506-T, Request for Transcript of Tax Return, allows individuals to request a transcript of their tax returns from the IRS. This form is similar to the Sample Tax Return Transcript in that it provides access to the same financial data. Taxpayers may use this form to obtain their tax information for various purposes, such as applying for loans or verifying income.

The Form 1040X is the Amended U.S. Individual Income Tax Return. It is used to correct errors on a previously filed Form 1040. The Sample Tax Return Transcript may be referenced when completing a 1040X, as it provides the original tax data. This form is essential for taxpayers who need to amend their tax filings to reflect accurate information, similar to how the transcript summarizes their financial situation.

The Form 1098, Mortgage Interest Statement, reports the amount of mortgage interest paid during the year. This document is similar to the Sample Tax Return Transcript in that it provides specific financial information that can affect a taxpayer’s deductions. Taxpayers can use the information from Form 1098 to claim mortgage interest deductions on their tax returns, impacting their overall tax liability.

For those looking to navigate the complexities of boat ownership in California, understanding the necessary documentation is essential. One important form to consider is the Boat Bill of Sale, which solidifies the transfer of ownership between parties. This legal document ensures both buyers and sellers are protected in the transaction. For more details on acquiring the proper forms, visit Top Document Templates to streamline your process.

The Schedule C, Profit or Loss From Business, is used by sole proprietors to report income and expenses related to their business activities. This schedule complements the Sample Tax Return Transcript by detailing business income, which is a component of the taxpayer's overall financial picture. Both documents provide essential data for calculating tax obligations related to self-employment income.