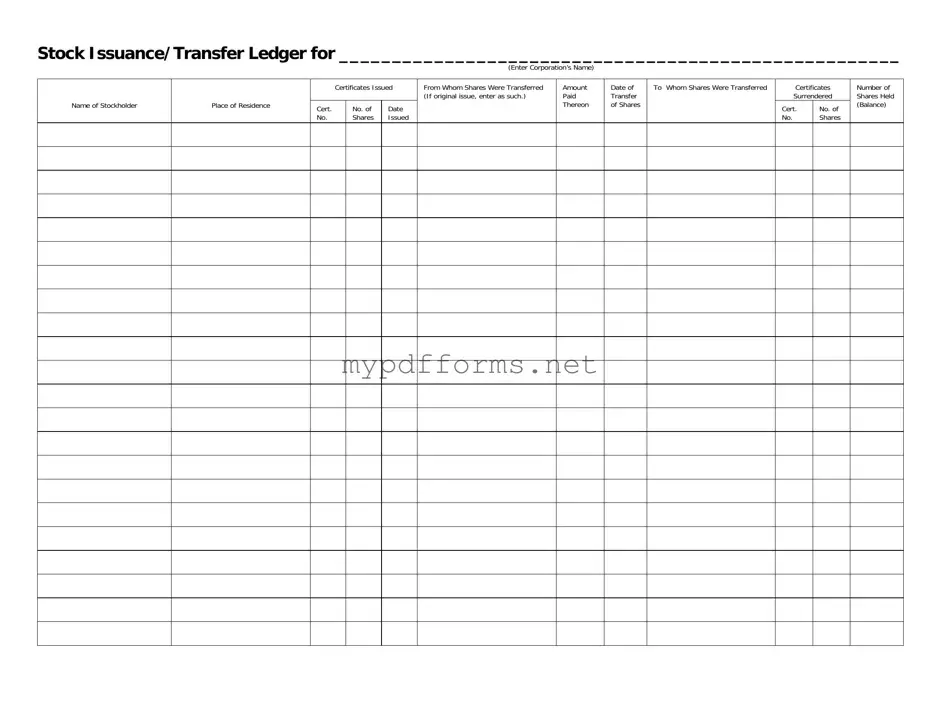

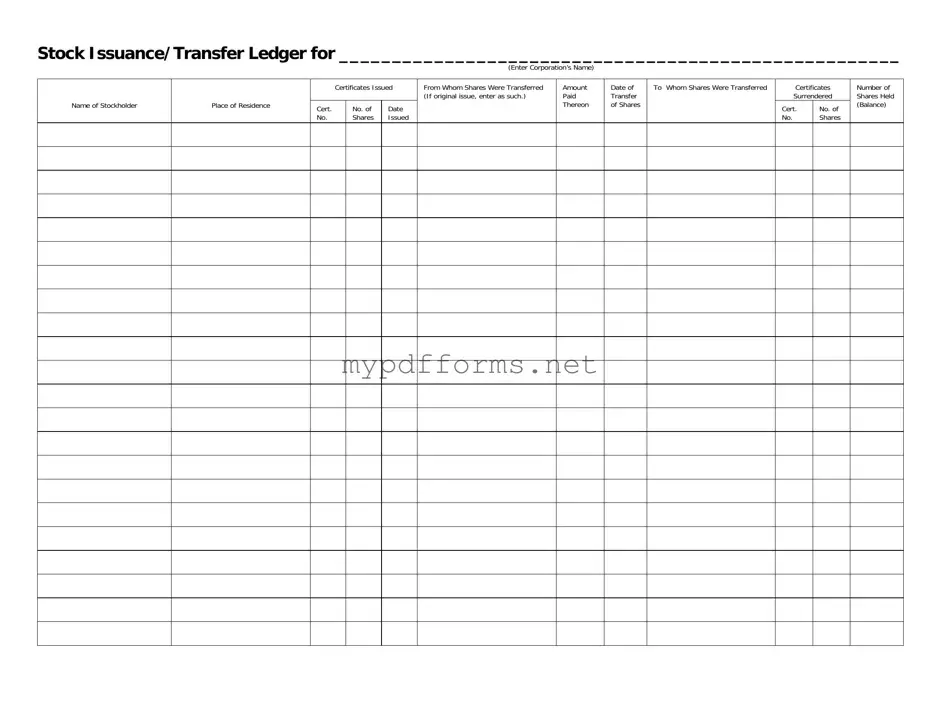

The Stock Transfer Ledger form closely resembles the Shareholder Register, which serves as an official record of all shareholders in a corporation. This document lists the names of shareholders, their addresses, and the number of shares they own. Like the Stock Transfer Ledger, the Shareholder Register keeps track of changes in ownership and is essential for maintaining accurate corporate records. Both documents ensure that the corporation can identify its owners and manage voting rights effectively.

Another similar document is the Stock Certificate, which represents ownership of shares in a corporation. Each stock certificate contains specific details, such as the shareholder's name, the number of shares owned, and the corporation's name. While the Stock Transfer Ledger records transactions and transfers, the Stock Certificate serves as tangible proof of ownership. Both documents are crucial for verifying who holds shares and for facilitating the transfer process when ownership changes hands.

The Corporate Bylaws also share similarities with the Stock Transfer Ledger in that they outline the rules governing the corporation's operations, including how shares are issued and transferred. Bylaws typically specify the procedures for transferring shares, including any restrictions or requirements. This document helps ensure that all transfers are conducted in compliance with corporate policies, just as the Stock Transfer Ledger tracks each transaction to maintain accurate records.

In addition to these essential corporate documents, individuals should consider creating a plan for their personal asset distribution as well. A comprehensive estate plan often includes vital legal documents such as a Last Will, which dictates how an individual wishes to have their assets allocated after passing, ensuring that their intentions are honored and legal formalities are observed.

The Subscription Agreement is another related document, as it outlines the terms under which an investor agrees to purchase shares in a corporation. This agreement typically includes details about the number of shares, the purchase price, and payment terms. Similar to the Stock Transfer Ledger, it plays a vital role in documenting the initial issuance of shares and ensuring that both parties understand their obligations during the transaction.

The Stockholder Agreement can also be compared to the Stock Transfer Ledger, as it governs the relationship between shareholders and the corporation. This document often includes provisions regarding the transfer of shares, including rights of first refusal and other restrictions. Like the Stock Transfer Ledger, it helps protect the interests of existing shareholders by regulating how shares can be transferred and ensuring that all transactions are documented.

Lastly, the Annual Report may bear resemblance to the Stock Transfer Ledger, as it provides a comprehensive overview of a corporation's financial performance and shareholder information. While the Stock Transfer Ledger focuses specifically on ownership and transfers, the Annual Report includes data on the total number of shares outstanding and may summarize changes in ownership throughout the year. Both documents serve to inform stakeholders about the corporation's status and ensure transparency in ownership and financial matters.