The IRS Form 2848, known as the Power of Attorney and Declaration of Representative, is similar to the Tax POA DR 835 form in its purpose. Both documents allow individuals to authorize representatives to act on their behalf regarding tax matters. The IRS Form 2848 is specifically used for federal tax issues, while the Tax POA DR 835 may pertain to state tax matters. Each form requires the taxpayer's signature, ensuring that the representative has the authority to receive confidential information and represent the taxpayer before the tax authority.

The Illinois Motorcycle Bill of Sale form is a crucial legal document that facilitates the transfer of motorcycle ownership, ensuring both the buyer's and seller's rights are protected during the process. For those interested in obtaining this document, you can open the document to begin the registration and titling process in Illinois.

The IRS Form 8821, which is the Tax Information Authorization form, shares similarities with the Tax POA DR 835 form. While both documents permit individuals to designate a representative, the key difference lies in their scope. Form 8821 allows the representative to receive information about the taxpayer's tax matters but does not grant them the authority to act on the taxpayer's behalf. This makes Form 8821 useful for those who want their representative to have access to information without the ability to make decisions or sign documents.

The California Form 3520, also known as the Power of Attorney, resembles the Tax POA DR 835 form in that it allows individuals to appoint someone to represent them in tax matters specific to California. Like the Tax POA DR 835, it requires the taxpayer's consent and signature. However, Form 3520 is tailored to California's tax regulations and may include specific provisions relevant to state tax issues, reflecting the nuances of local tax law.

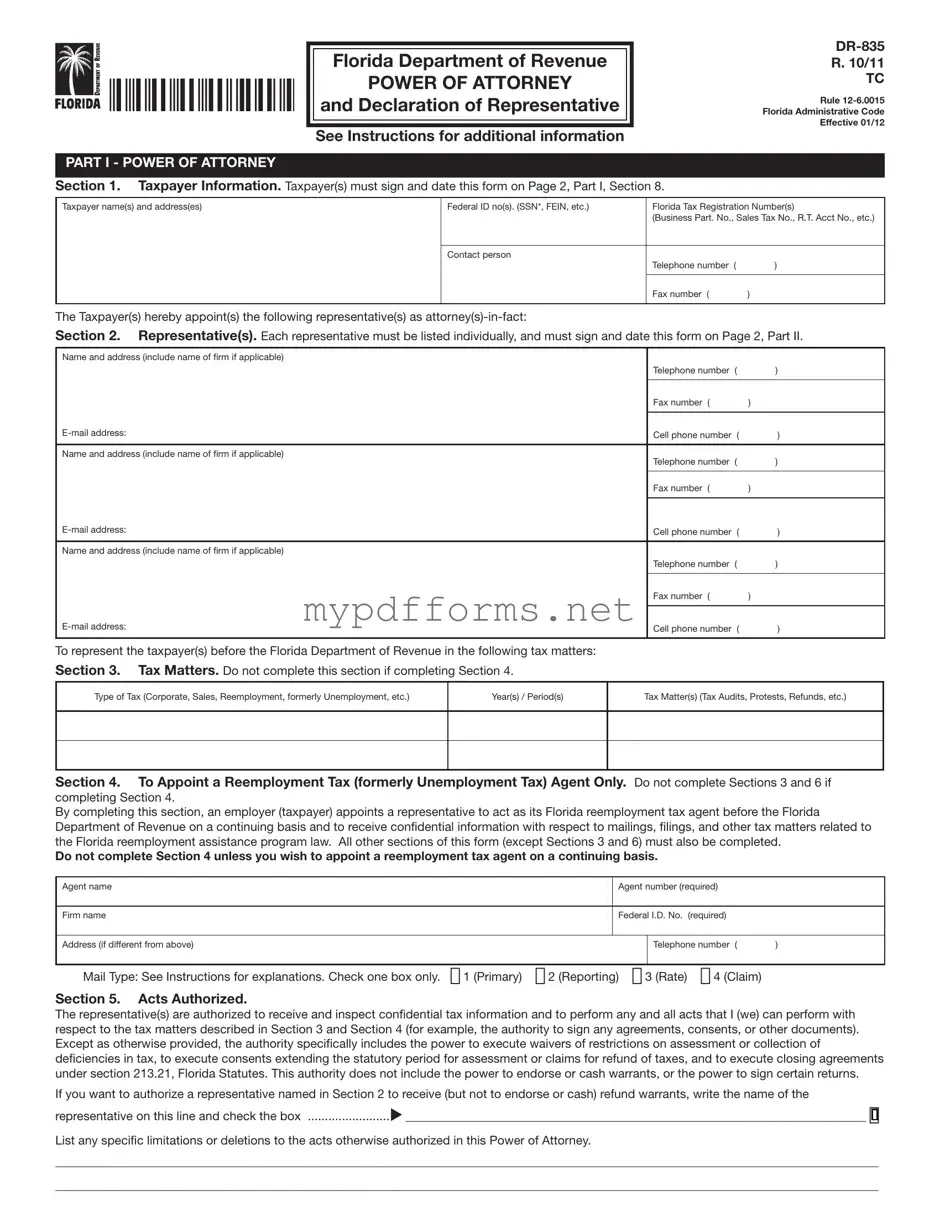

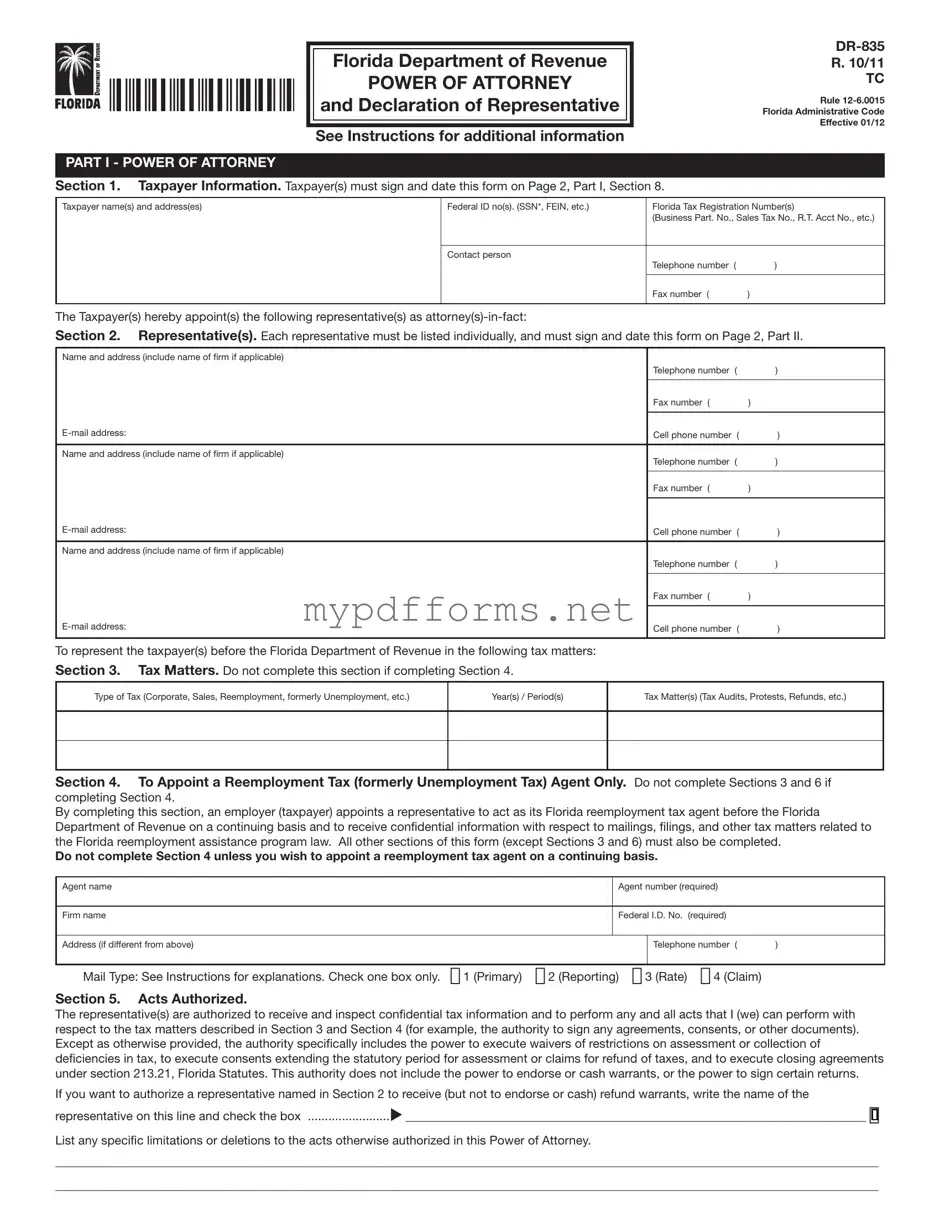

The Florida Department of Revenue's Form DR-835 is another document that aligns closely with the Tax POA DR 835 form. This form is used to appoint a representative for state tax matters in Florida. Similar to the Tax POA DR 835, it requires the taxpayer's signature and outlines the powers granted to the representative. Both forms serve to facilitate communication between taxpayers and tax authorities, ensuring that representatives can act effectively on behalf of the taxpayers they represent.