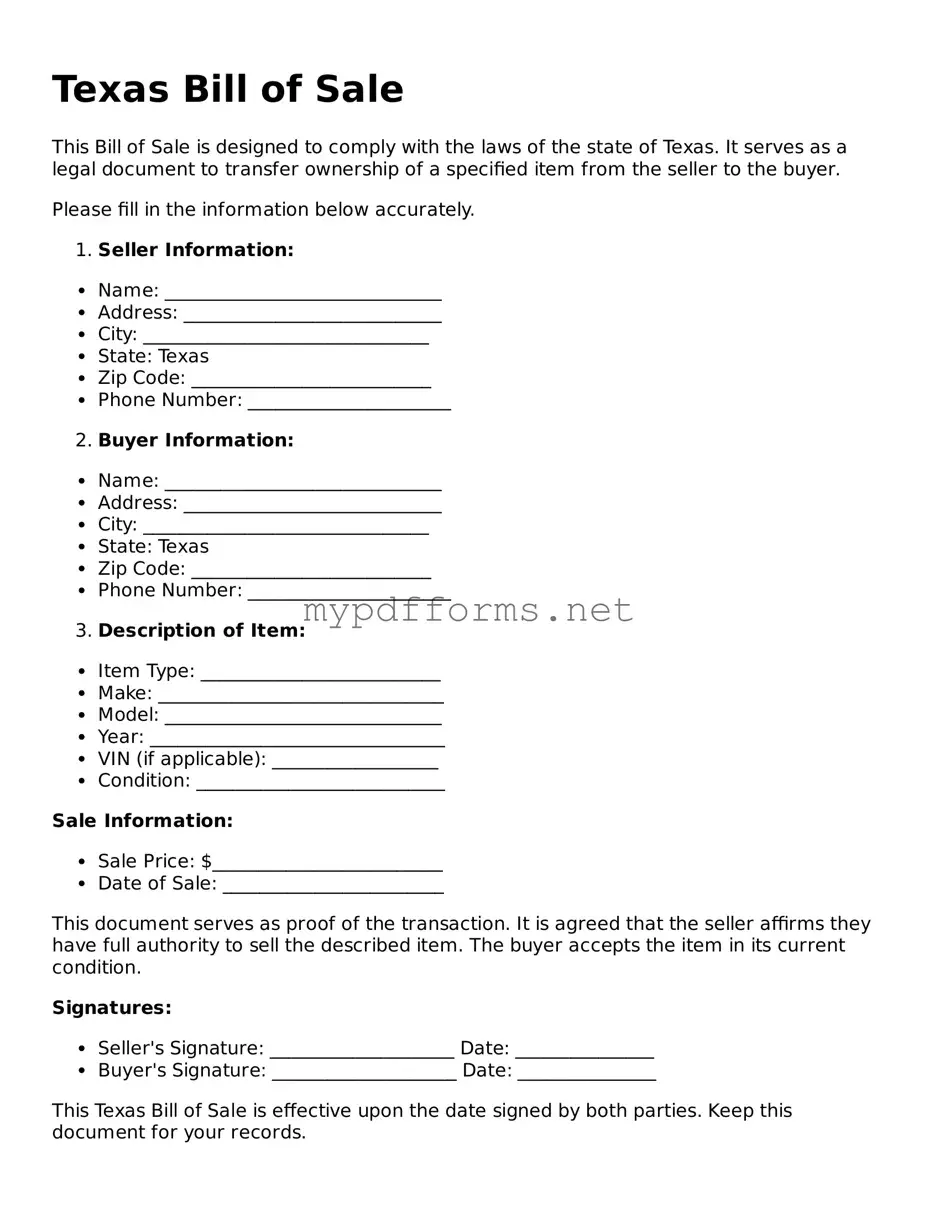

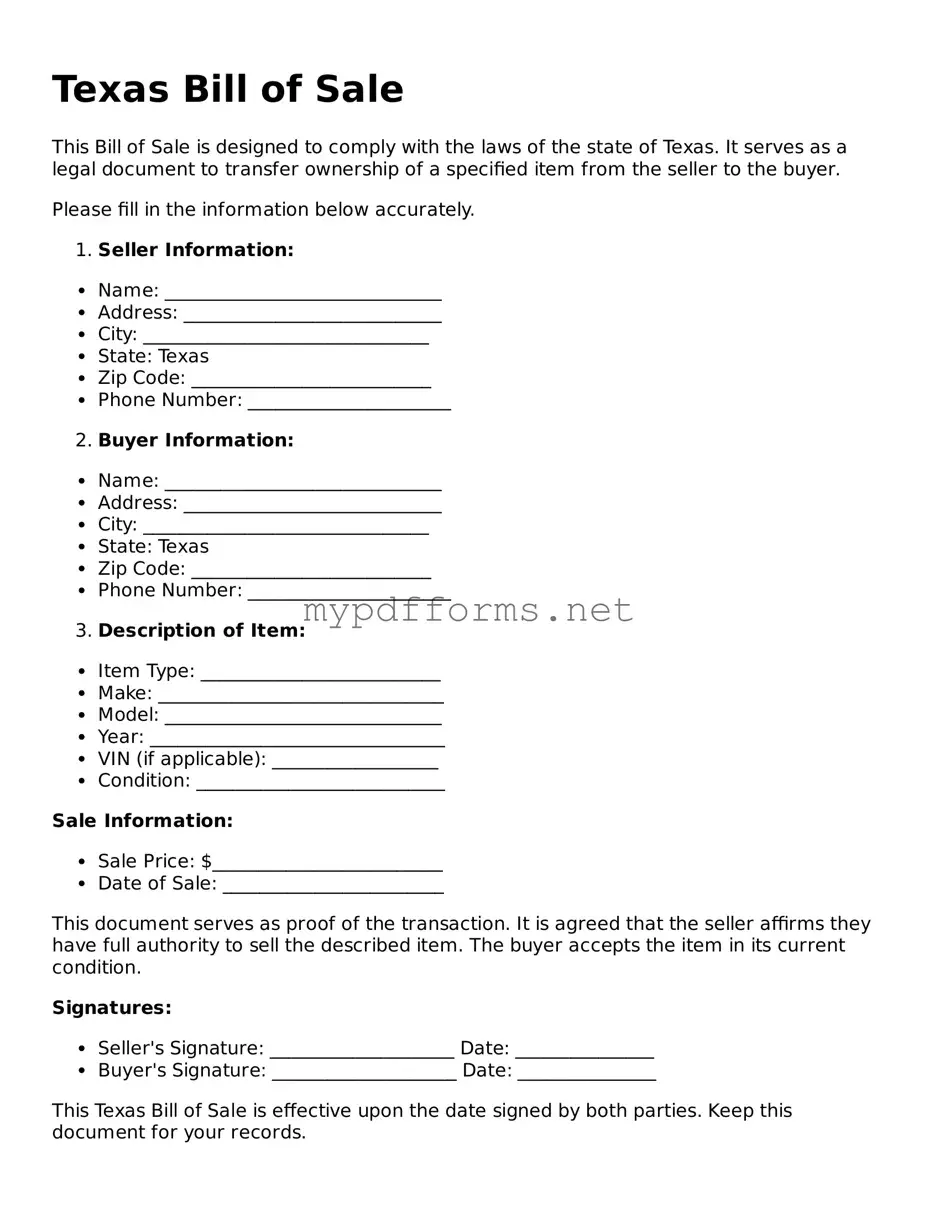

The Texas Bill of Sale form is similar to the Vehicle Bill of Sale, which specifically pertains to the sale of motor vehicles. This document serves as a receipt for the transaction and includes details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN). Both forms establish proof of ownership transfer and can be used for registration purposes, ensuring that the buyer can legally operate the vehicle after the sale is completed.

Another document that resembles the Texas Bill of Sale is the Personal Property Bill of Sale. This form is used for the sale of tangible personal property, such as furniture, electronics, or equipment. Like the Texas Bill of Sale, it outlines the items being sold, the sale price, and the names of both the buyer and seller. It serves to protect both parties by documenting the transaction and confirming the transfer of ownership.

For those looking to transfer ownership of personal property, understanding the specifics of a general bill of sale form is crucial. You can access a reliable source by following this link for a comprehensive guide to the General Bill of Sale, ensuring you're well-informed about the documentation process.

The Equipment Bill of Sale is also similar, particularly for transactions involving heavy machinery or specialized equipment. This document includes specific details about the equipment, such as serial numbers and condition. Both the Equipment Bill of Sale and the Texas Bill of Sale act as legal proof of the sale, ensuring that the buyer has rights to the equipment and that the seller is relieved of future liability regarding it.

In addition, the Firearm Bill of Sale shares similarities with the Texas Bill of Sale, especially regarding the transfer of ownership of firearms. This document includes details about the firearm, such as make, model, and serial number, and is essential for compliance with state and federal laws. Both forms serve as legal records of the transaction, protecting the rights of both parties involved.

The Boat Bill of Sale is another document that functions similarly to the Texas Bill of Sale. This form is specifically designed for the sale of boats and includes information about the vessel, such as its hull identification number and registration details. Both documents provide proof of ownership transfer and can be used for registration with state authorities, ensuring that the buyer can operate the boat legally.

Lastly, the Mobile Home Bill of Sale is akin to the Texas Bill of Sale in that it documents the sale of a mobile or manufactured home. This document includes details about the home, such as the serial number and any applicable land rights. Both forms facilitate the transfer of ownership and provide necessary documentation for registration and title transfer, ensuring that the new owner has clear legal rights to the property.