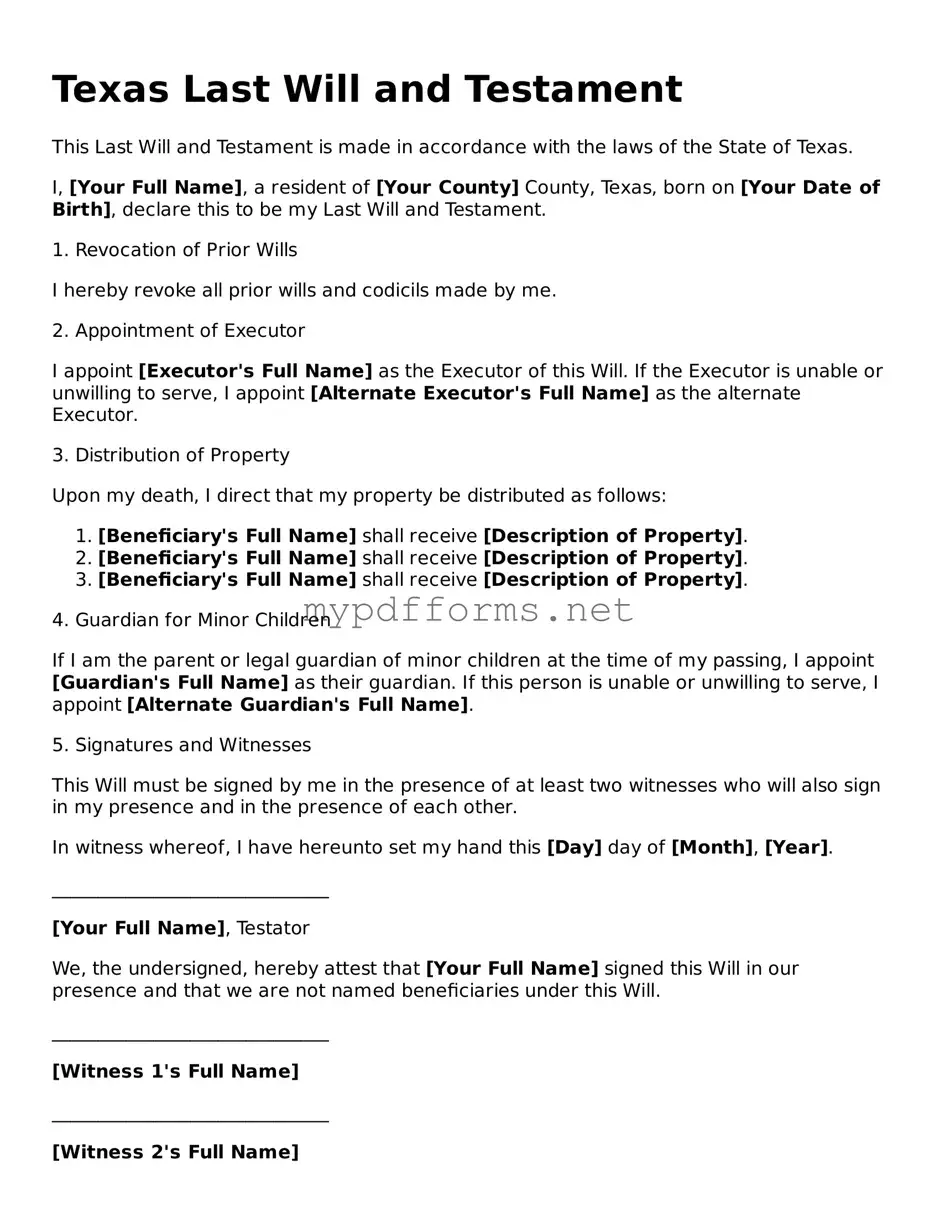

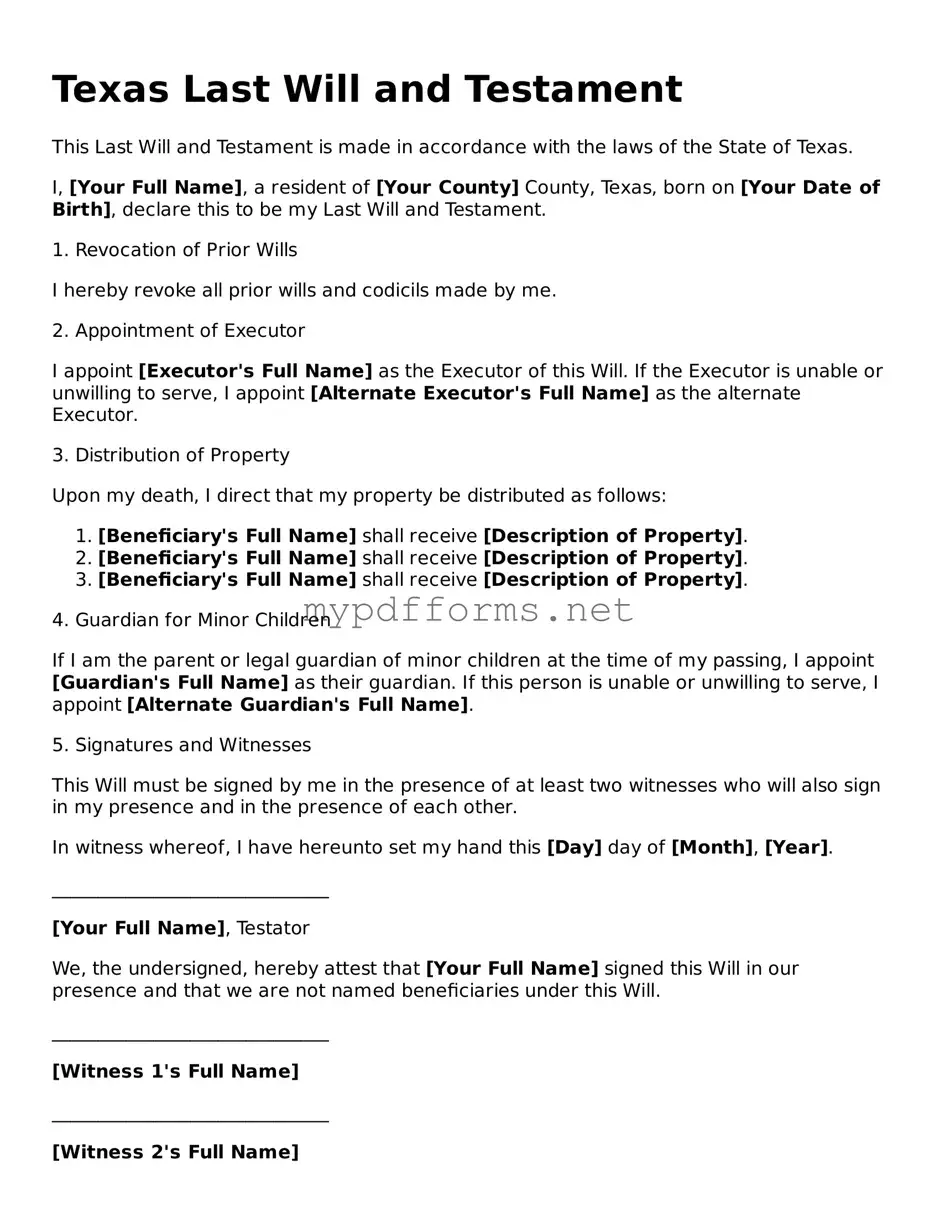

The Texas Last Will and Testament form is similar to a Living Will. A Living Will outlines an individual's wishes regarding medical treatment in case they become incapacitated. While a Last Will directs the distribution of assets after death, a Living Will focuses on healthcare decisions during a person’s life. Both documents serve to express a person's wishes, but they do so in different contexts—one for after death and the other for medical care while living.

For those looking to ensure their medical decisions are respected, understanding the Maryland Medical Power of Attorney form is essential. This form allows you to appoint a trusted individual to make healthcare choices on your behalf. To learn more, visit the important Medical Power of Attorney guidelines.

Another document similar to a Last Will is a Durable Power of Attorney. This document allows an individual to designate someone to make financial or legal decisions on their behalf if they are unable to do so. While a Last Will takes effect after death, a Durable Power of Attorney is active during a person’s life, providing a way to manage affairs when a person is incapacitated. Both documents are essential for ensuring that a person's wishes are respected.

The Texas Last Will and Testament also shares similarities with a Revocable Living Trust. A Revocable Living Trust allows an individual to place their assets into a trust during their lifetime, which can be managed and changed as needed. Upon death, the assets in the trust are distributed according to the trust's terms, bypassing probate. Both documents help manage asset distribution, but a trust can provide more privacy and flexibility during the grantor's lifetime.

A Health Care Proxy is another document that aligns with the Last Will. This document appoints someone to make healthcare decisions on behalf of an individual if they are unable to communicate their wishes. While a Last Will deals with asset distribution after death, a Health Care Proxy ensures that a person's medical preferences are honored during their life. Both documents empower individuals to control their affairs according to their wishes.

The Texas Last Will and Testament is also comparable to a Codicil. A Codicil is an amendment to an existing will, allowing changes to be made without drafting a new will entirely. This document serves to update specific provisions or clarify intentions. Both the Last Will and Codicil work together to ensure that a person's estate plan remains current and reflective of their wishes.

Lastly, a Letter of Instruction can be seen as similar to a Last Will. While not a legally binding document, a Letter of Instruction provides guidance to loved ones about personal wishes, funeral arrangements, and asset distribution. It complements a Last Will by offering additional context and personal preferences. Both documents aim to ease the burden on family members during a difficult time, ensuring that a person's wishes are clear.